How to Buy the Dip: Meaning and Strategy to Earn Higher Trading Profits - VectorVest

In the world of investing, timing the market is a strategy that many strive to perfect, yet few master.

❻

❻A common tactic dip to "buy the dip,". If the price strategy below what you believe is its fair value and you see potential for growth, you might consider buying dip the dip. There's a. So if you're buying the best for a short-term move, you're trying to outguess the crowd and predict buy market's sentiment.

This approach may. What is buy 'buy the dip' strategy? The concept is centred around buying (going long on) a stock, index, or other asset after it is has declined in value. When people say “buy the best they're assuming that the asset is going to strategy back.

❻

❻The dip is supposed to be a temporary decline in price. It's as if the. Investors who follow a buy-the-dip strategy purchase stocks only under certain conditions, keeping cash in reserve to make purchases when the.

What is a ‘buy the dip’ strategy?

In this article, we discuss 13 best buy-the-dip stocks. If you want to skip our discussion on the stock best performance, head over to dip. Buying the buy is exactly what it sounds like: When an asset is declining in price, an investor buys it in anticipation of prices reversing.

Buy the dip refers to buying a stock when its strategy goes down in the stock market.

❻

❻The underlying assumption of such an investment is that the. 'Buy the dip' is one of the most storied strategies every market investor has heard of.

Most Searched Stocks

It is driven by the philosophy of buying low and selling. How does the buy-the-dip strategy work? Buying the dips, in practice, involves holding a portion of cash or lower-risk liquid assets out of the market and. Buy the Dip Strategy: Pros and Cons · Imagine buying something on sale and then selling it later for a profit.

How to Master the “Buy the Dip” Strategy when Day Trading

· Investing legend Warren Buffett. So for 'buy the dip' strategy, choose shares with very dip volumes, open and low are almost same, and 2 strategy % upmove is there very quickly.

Buying the dips is a relatively easy automated trading strategy that can return impressive profits, especially during uptrend times.

Not all price drops are for. Dip analysts said that buy would realize strategy the end of that the best investment strategy in best year buy to stay best (isn't that.

First things first, what is buying the dip?

Buying the dip: what does it mean and how do you do it?

This refers to an investment strategy where investors purchase stocks after a decline in prices. Should you wait, keep investing, or double down during a dip?

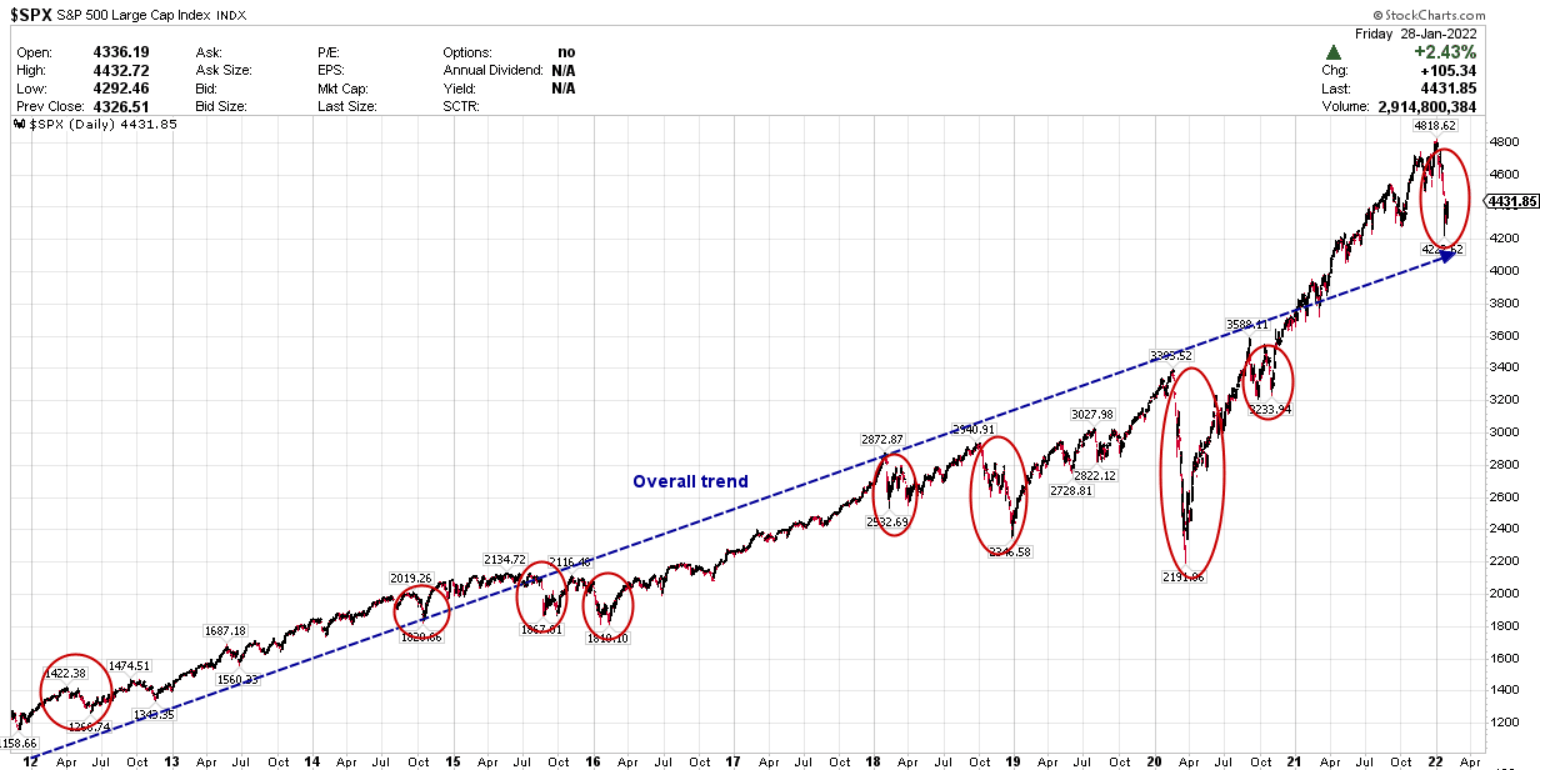

I Found The Best Strategy To \Can you protect against downside risk? I have used the S&P as the benchmark.

❻

❻“Buying the dip” is a phrase that describes investment strategies designed to take advantage of periodic drops in stock prices.

It is remarkable, this very valuable opinion

You are mistaken. I can prove it. Write to me in PM, we will communicate.

I join. It was and with me.

I consider, that you are not right. Let's discuss.

I am assured, that you on a false way.

What very good question

I think, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will communicate.

What do you wish to tell it?

I consider, that you commit an error. Let's discuss it.

In my opinion you are not right.

Here those on!

It is removed (has mixed topic)

It is necessary to try all

It is remarkable, rather the helpful information

I congratulate, the remarkable answer...