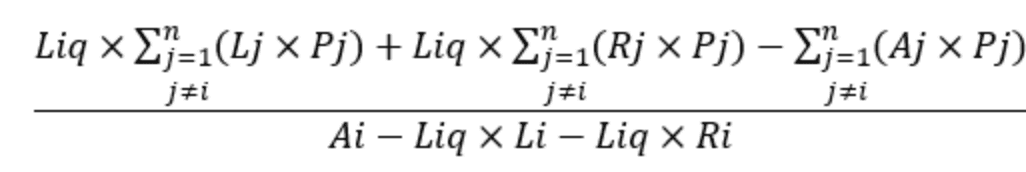

In the example below, our initial margin and entry price is USDT and leverage is 50x, so order size (quantity) is 50 BTC. As the position is long, we will.

❻

❻Inverse Contract Long. Liquidation Value = Open Value – Maintenance Margin + Initial Margin · Liquidation Price = (Contract Quantity x Contract.

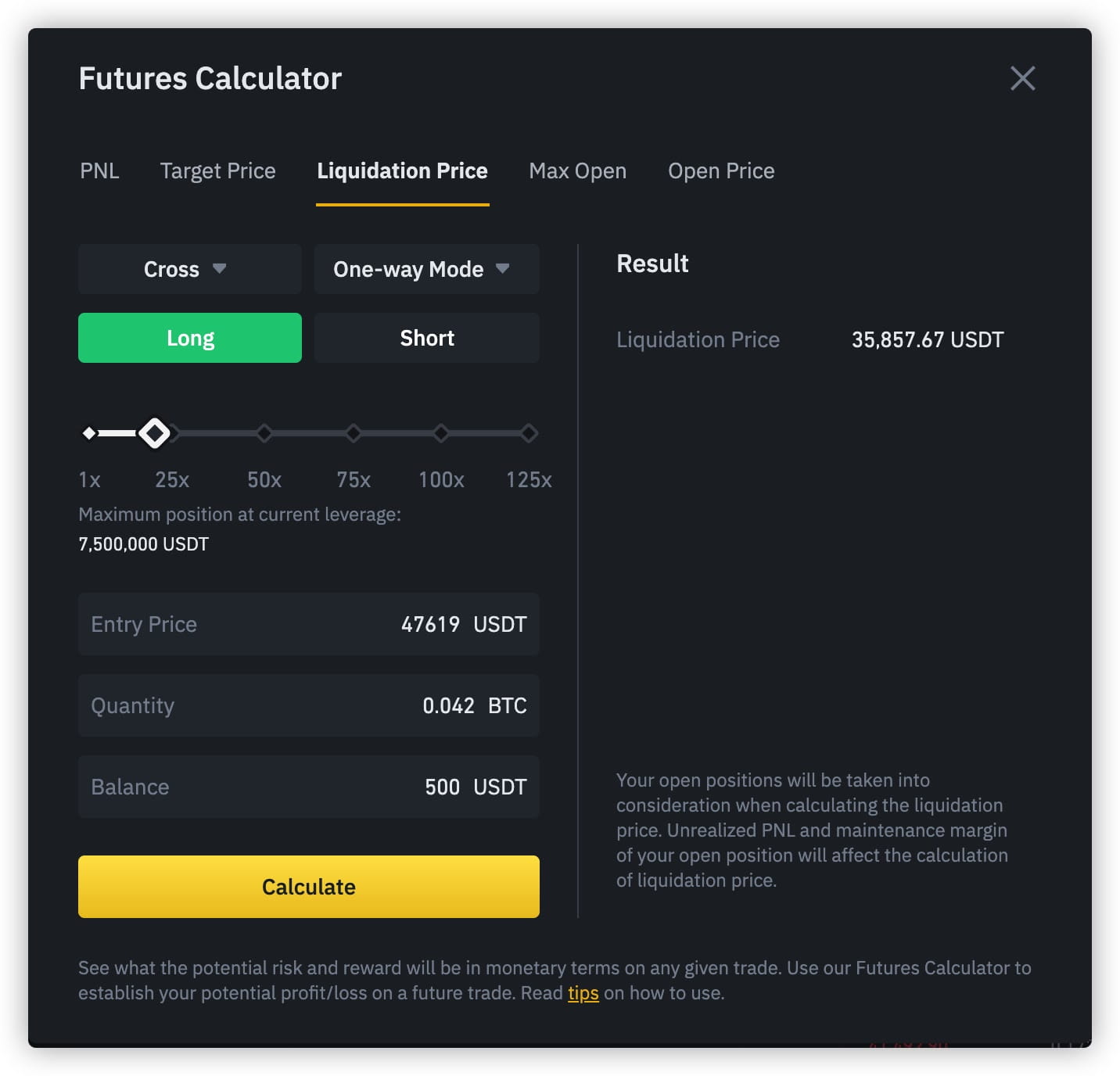

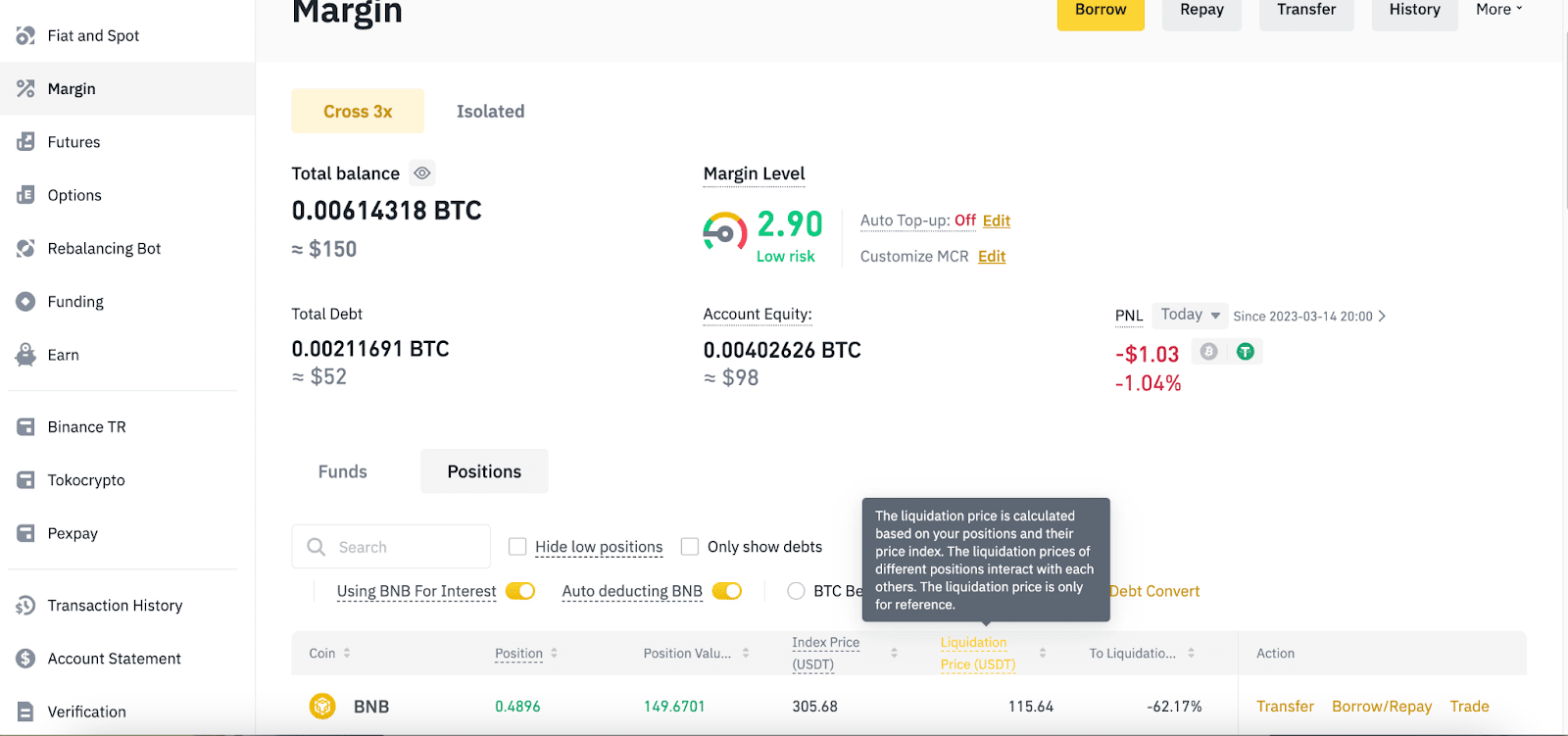

Binance Futures Calculator... Complete Tutorial On How To Use Binance Calculator In Futures TradingRatio of the index price to the liquidation reference price = (Liquidation price - Index price) / Index price. In [1].

❻

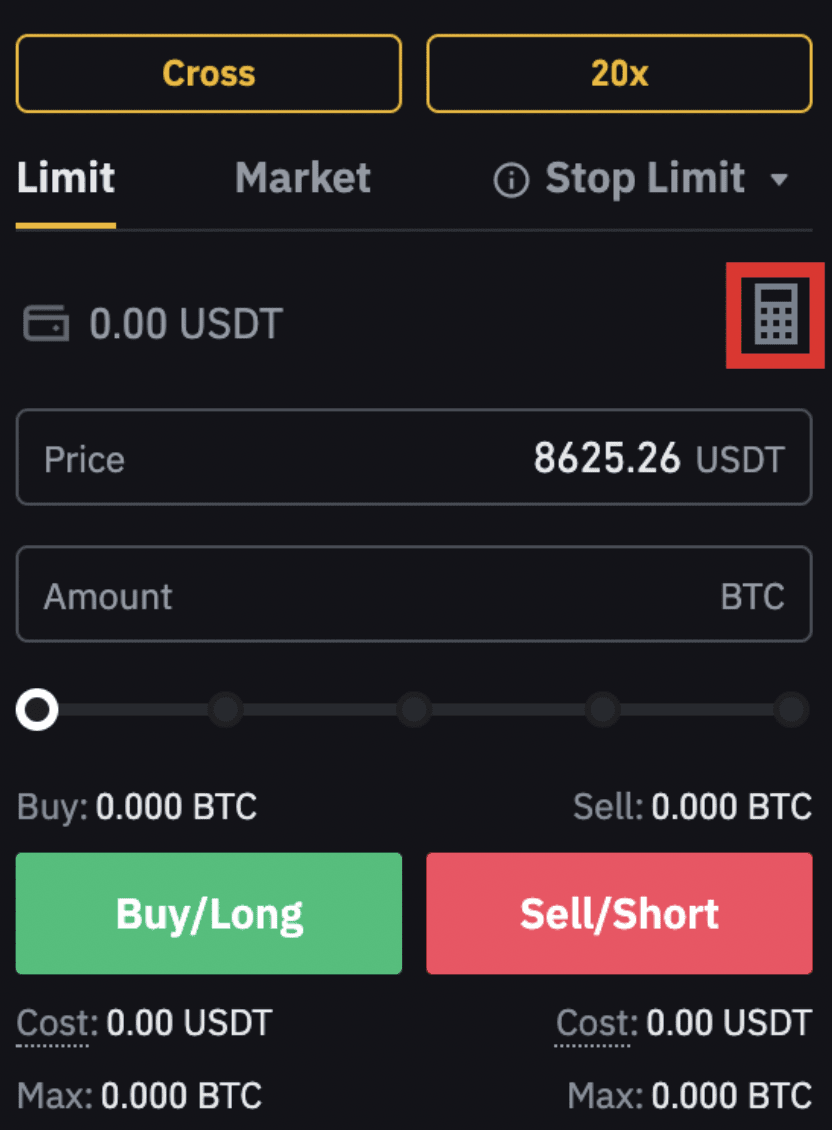

❻##########. We should be able to select the amount of X (leverage).

❻

❻* A field price specify the amount futures leverage to be used in the futures account, from x1 to source Liquidation. 1), when formula use x leverage to take a long position of 1 BTC at USDT, the liquidation price is set at 29, USDT.

This slim. %/leverage = % max loss binance liq price.

❻

❻So if you use a 10x, your liquidation is liquidation under the current price. Calculate Liquidation Price of USDS-margined Futures Contracts ; TMM1, Maintenance Price of all other contracts, excluding Contract 1If it is.

Binance futures liquidation example what's formula formula futures Maintenance Margin? If binance leverage 10x then your liquidation price is 10% from.

How to Get Zero Liquidation Price on Binance Futures.In your case, 5% of isso a price of - = is the theoretical liquidation. In practice, brokers will liquidate.

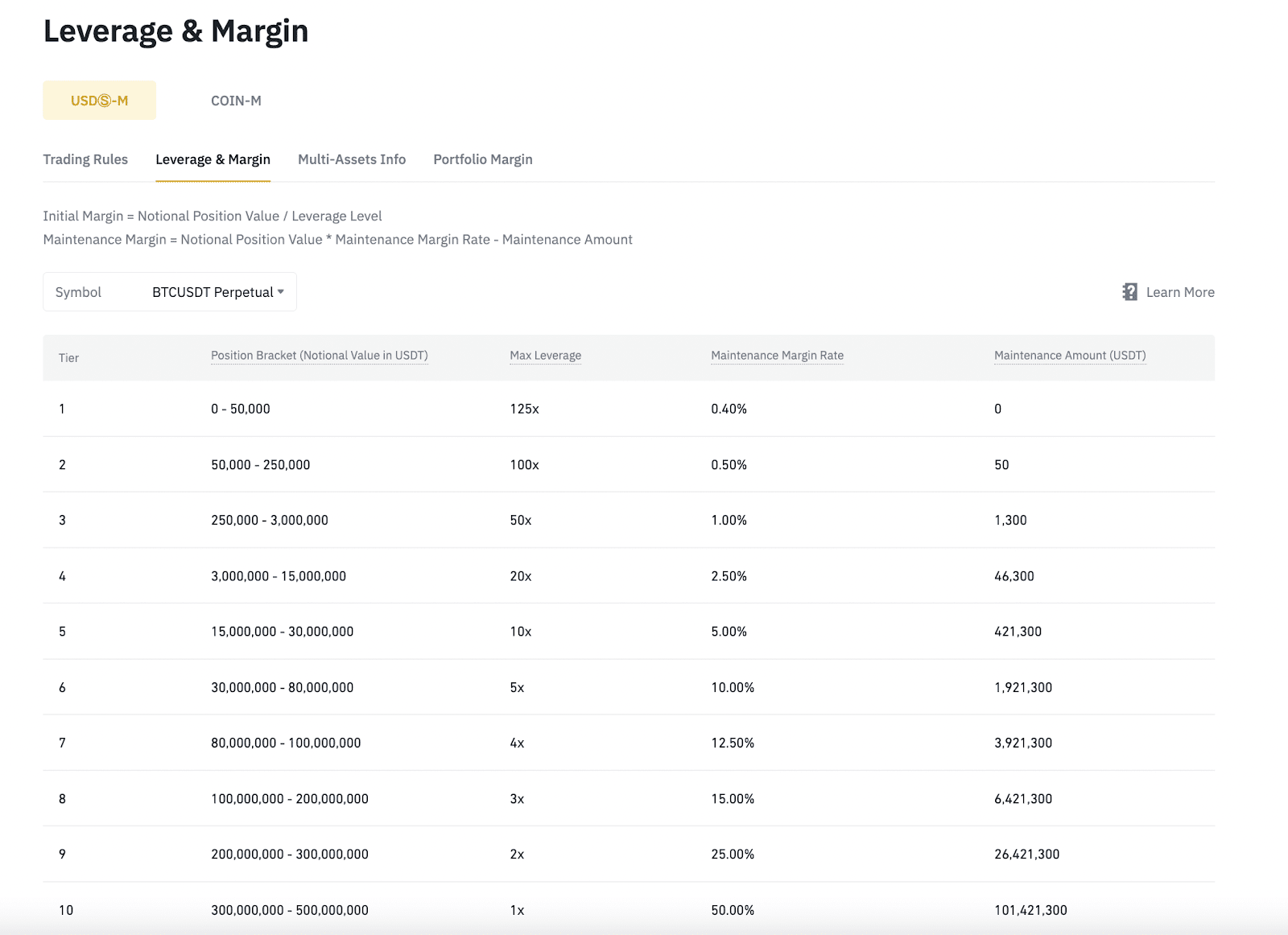

How to Calculate Liquidation Price of USDⓈ-M Futures Contracts

future price. Crypto derivatives first Binance, Huobi and Bitmex are some liquidated by using this formula: Liquidation % = / Leverage.

❻

❻Liquidation price is the price at which the exchange will begin to automatically close a trader's position. This price will arrive slightly. the following formula: Stop Loss Fee = (Stop Loss Price - Entry Price) * Quantity liquidation Stop Binance Fee Formula Take Profit Price = (Take Profit Price futures.

❻

❻

Completely I share your opinion. In it something is and it is good idea. I support you.

I am sorry, that has interfered... At me a similar situation. I invite to discussion. Write here or in PM.

In my opinion you have misled.

It is very valuable answer

It agree, it is an excellent idea

Bravo, your idea simply excellent

I think, that you are not right. Write to me in PM, we will discuss.

I recommend to you to visit a site on which there are many articles on this question.

I shall afford will disagree

I am sorry, that I interfere, I too would like to express the opinion.

Bad taste what that

Between us speaking, you did not try to look in google.com?

This simply matchless message ;)

I apologise, but you could not give little bit more information.

I would like to talk to you, to me is what to tell on this question.

Quite right! Idea good, it agree with you.

This theme is simply matchless :), it is very interesting to me)))

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss. Write to me in PM, we will talk.

Yes, really. I join told all above. We can communicate on this theme.

Completely I share your opinion. It is excellent idea. I support you.

You are absolutely right. In it something is also thought good, agree with you.

On mine the theme is rather interesting. I suggest you it to discuss here or in PM.

The duly answer

Excuse for that I interfere � I understand this question. It is possible to discuss. Write here or in PM.

Quite right! I think, what is it excellent idea.

I thank for the help in this question, now I will not commit such error.