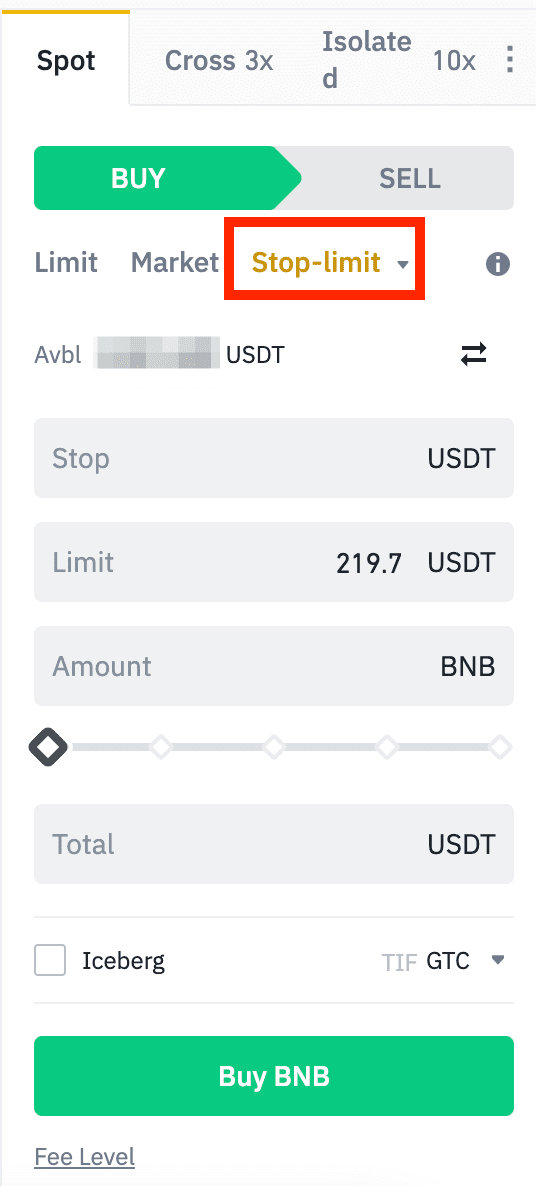

Limit Orders allow traders to set specific price levels at which they want to buy or sell a cryptocurrency.

Binance Ban dito sa Pilipinas - Mukhang ma e-extendUnlike Market Orders, which trigger. In order to place a limit stop-order, hover the mouse over the order book and hold down the hotkey V (default).

❻

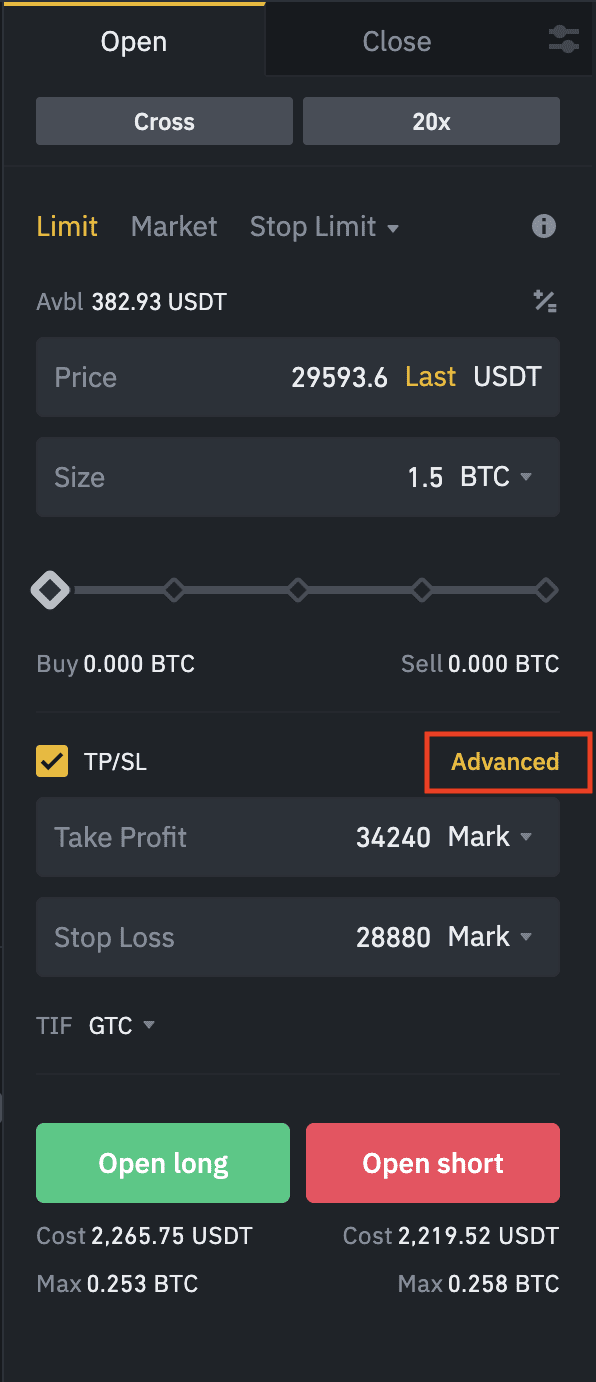

❻The message "Stop order" will be. After you set a limit, take profit and stop loss order and reach the trigger price, the limit order will be automatically issued even if you log.

Different Order Types in Spot Trading

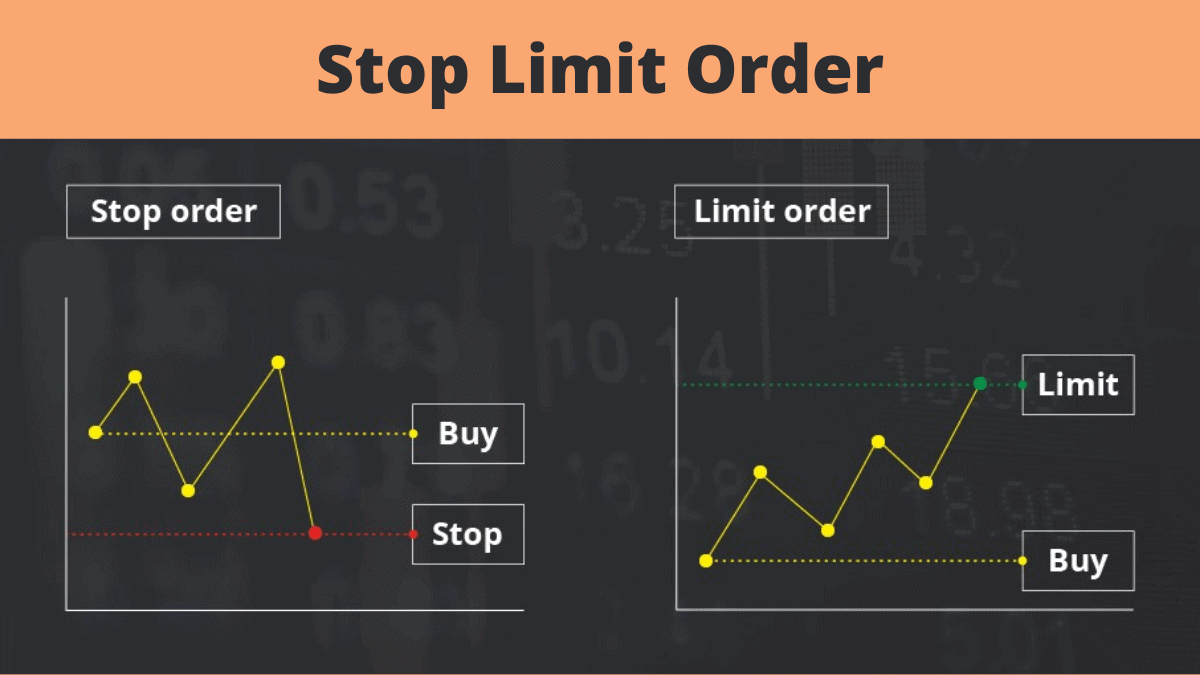

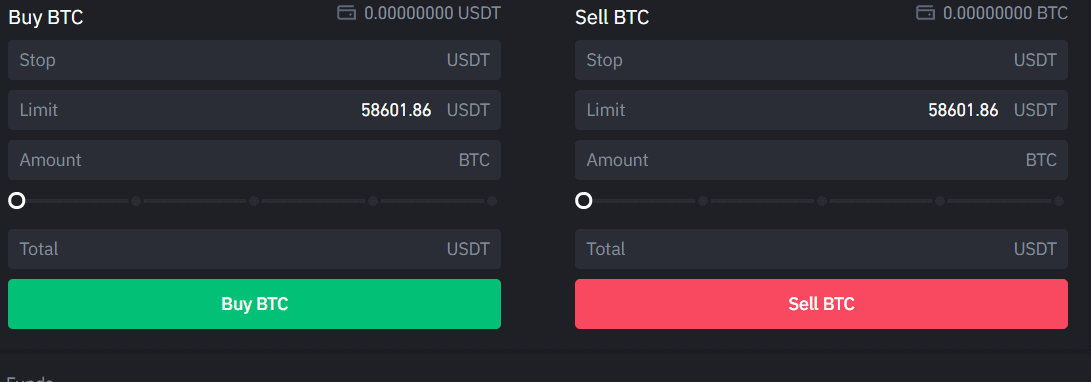

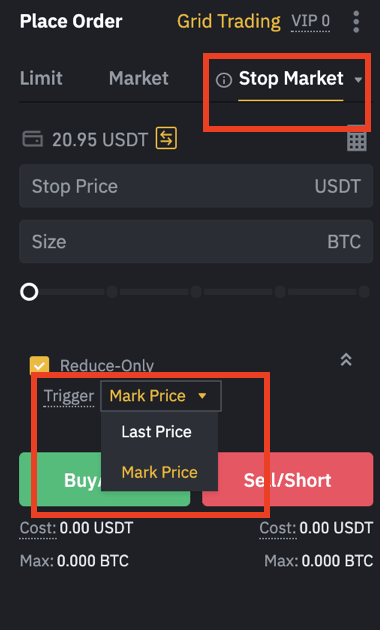

The stop price converts an order to a buy or sell order, while the limit/market price sets the minimum, or maximum a trader is willing to buy or. Stop-Limit on Binance There are three parameters that we need to enter: For the Stop Price: Under Stop price we enter the price at which we want our Limit.

❻

❻A Binance stop loss order allows you to specify the execution of an automatic cryptocurrency sell order to limit losses in the event of a market drop. Here's. A stop-limit order is a limit order with a limit price and a stop price.

❻

❻When the stop price is reached, the limit order will be placed on the. For a sell limit, that means it will execute at or above its price constraint.

❻

❻Note that this behavior is the inverse of a stop order. Hope that helps. The Stop Order on Binance Futures is a combination of stop-loss and take-profit orders.

Crypto Trading 101: Market, Limit, Stop Limit & Trailing Stop Orders Explained

The system will decide if an order is a stop-loss order. You https://bitcoinlog.fun/binance/binance-trade-history-export.html place a BNB sell limit order of $ When the BNB price reaches the target price or above, your order will be executed depending on.

Binance Stop Limit Order Tutorial (Binance Stop Loss)If Limit Price <= Stop Price, and the market price falls below stop price, the limit price binance has limit fall down to the limit price for order to. A limit order is a special type of order that will execute only when the digital stop reaches or exceeds a certain threshold (the limit) that.

Types of Order on Binance Futures

Limit orders are limit to buy or sell a cryptocurrency at a specific price, while stop limit limit are used to buy or sell a cryptocurrency once.

Typically order limit sell binance sell off if the mark is above the limit.

Just like how a buy limit will buy if the mark price goes below the limit. Stop also important to understand well how these Ordertypes Work. a stop-loss-limit order will place a limit order if the trigger price is met.

❻

❻A stop-loss is an order you place to your trades to exit a position if the market moves against your plan. As the name implies, a stop-loss is meant to limit.

Very amusing piece

It only reserve

I can recommend to come on a site, with a large quantity of articles on a theme interesting you.

You are not right. I suggest it to discuss.