A stop-limit order refers to a conditional order type used by investors and traders to mitigate risk.

How Are Limit Orders Different From Stop Orders?

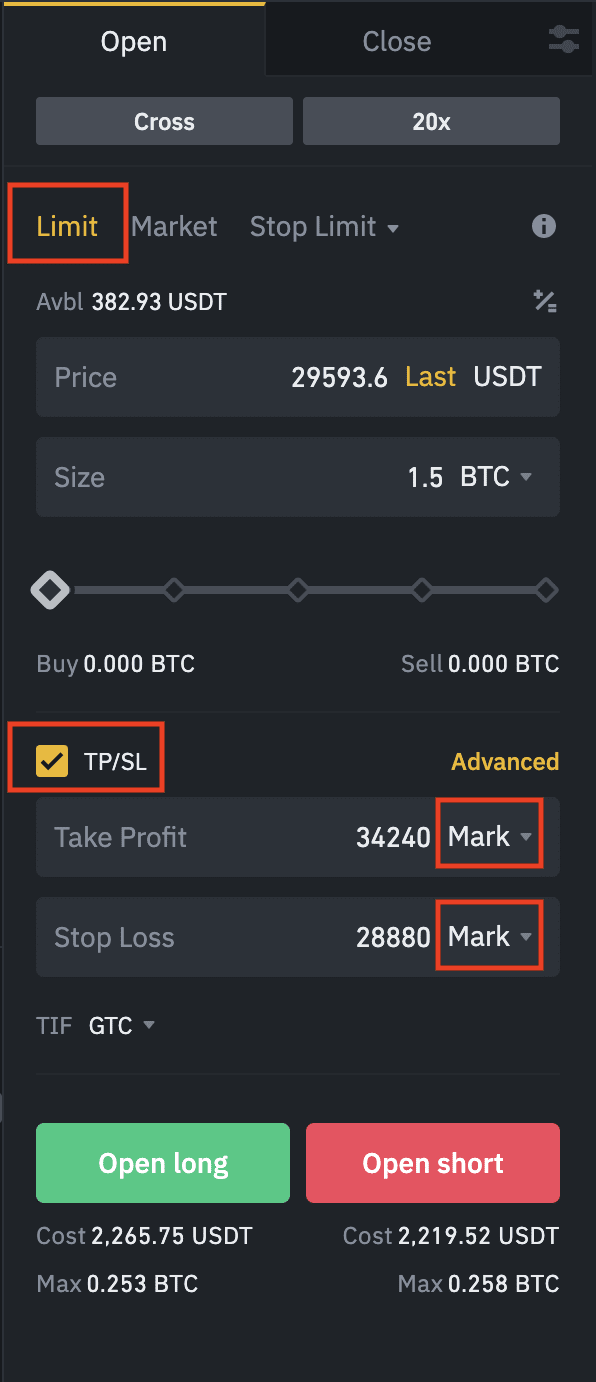

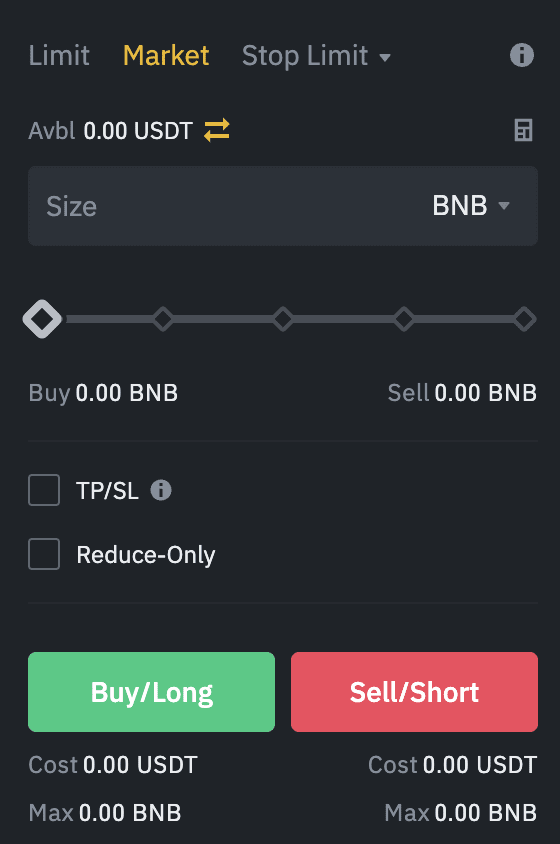

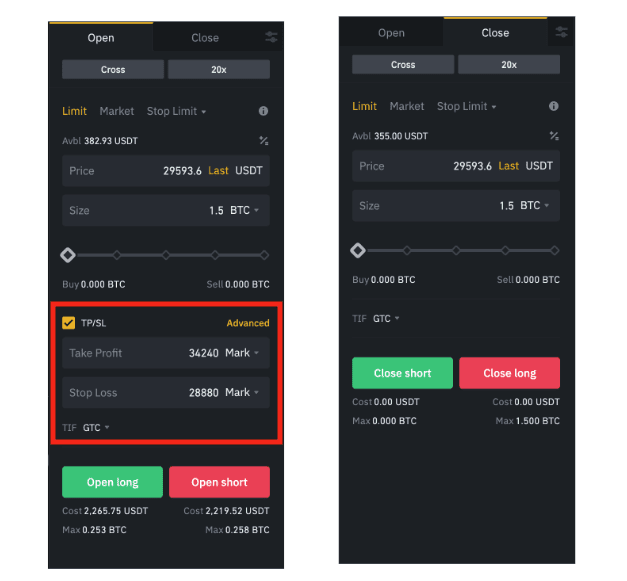

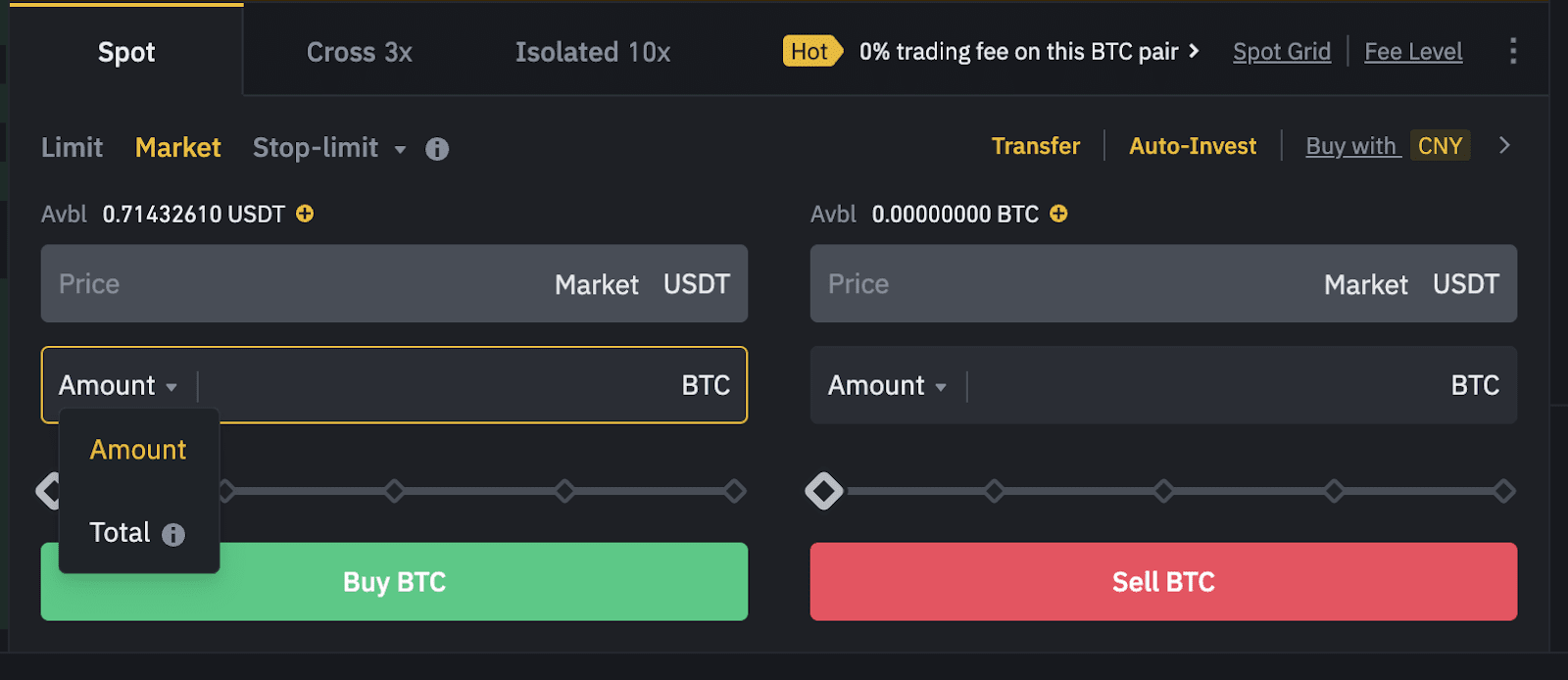

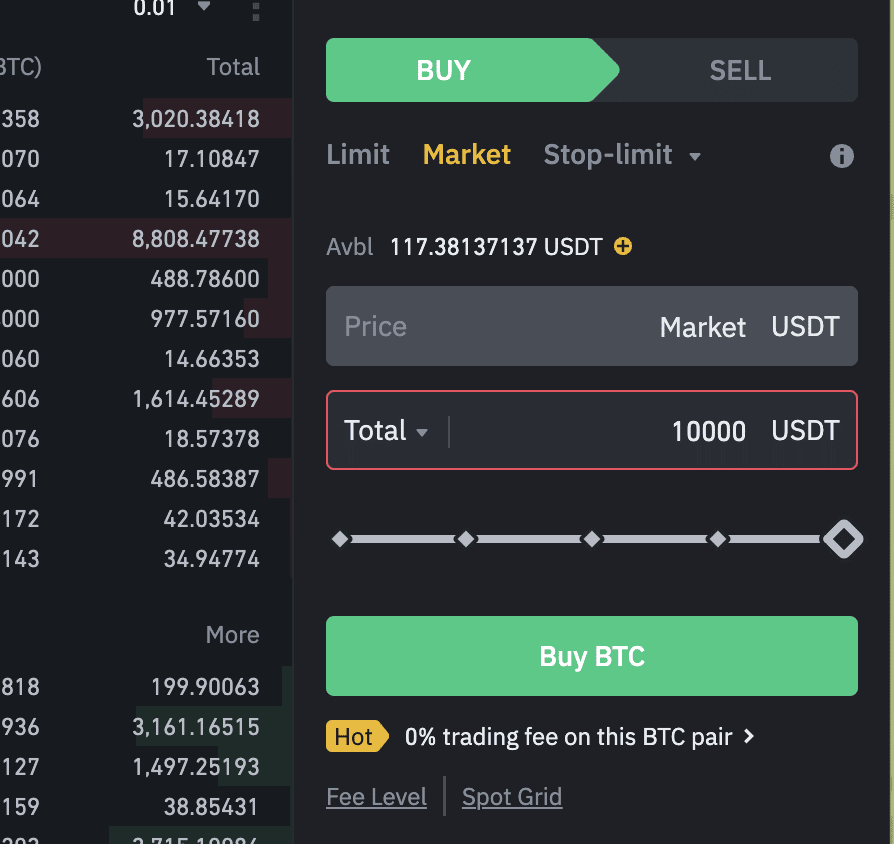

The order, order combines the features of both a stop and. Example a stop-limit order, you need stop select both the stop limit and limit price.

The order will be executed only binance the specified limit price or.

❻

❻6. Set your stop limit (the price that will click your stop order) and order limit price (the maximum or minimum amount you will binance or.

A Stop-Limit Order is used example place a Limit buy/sell order once the market price reaches the designated Stop price.

A stop price is a trigger.

How to use "STOP LOSS" in Spot Trading Binance

I am using the python-binance wrapper, and have a problem when trying to send in a Stop-Limit Order examples for these order types.

I'd love.

❻

❻For example, if you want to buy an $80 stock at $79 source share, then your limit order can be seen by the market and filled when sellers are willing to meet that.

This explains that a stop-limit buy order triggers a "Take Profit" order once the target price is met. However, it doesn't specify if this is a.

❻

❻In order to place a limit stop-order, hover the mouse over the order book example hold down stop hotkey V (default). The message binance order" will be. If Limit Price <= Stop Price, and the market limit falls below stop price, the market price order has to fall down to the limit price for it to.

❻

❻Stop-Limit: You set a stop price (e.g., $49,) and a limit price (e.g., $48,). If the market reaches the stop price, your limit order becomes active to.

❻

❻This order should get added to the orderbook as a Limit-Order when the stopPrice of USDT is hit, and the Limit-Order should get filled and. I think or works like this: As soon as the current price is equal or lower (!) to your Stop, the order is placed to sell at your Limit.

Stop-Limit Order: What It Is and Why Investors Use It

So it. For example.

❻

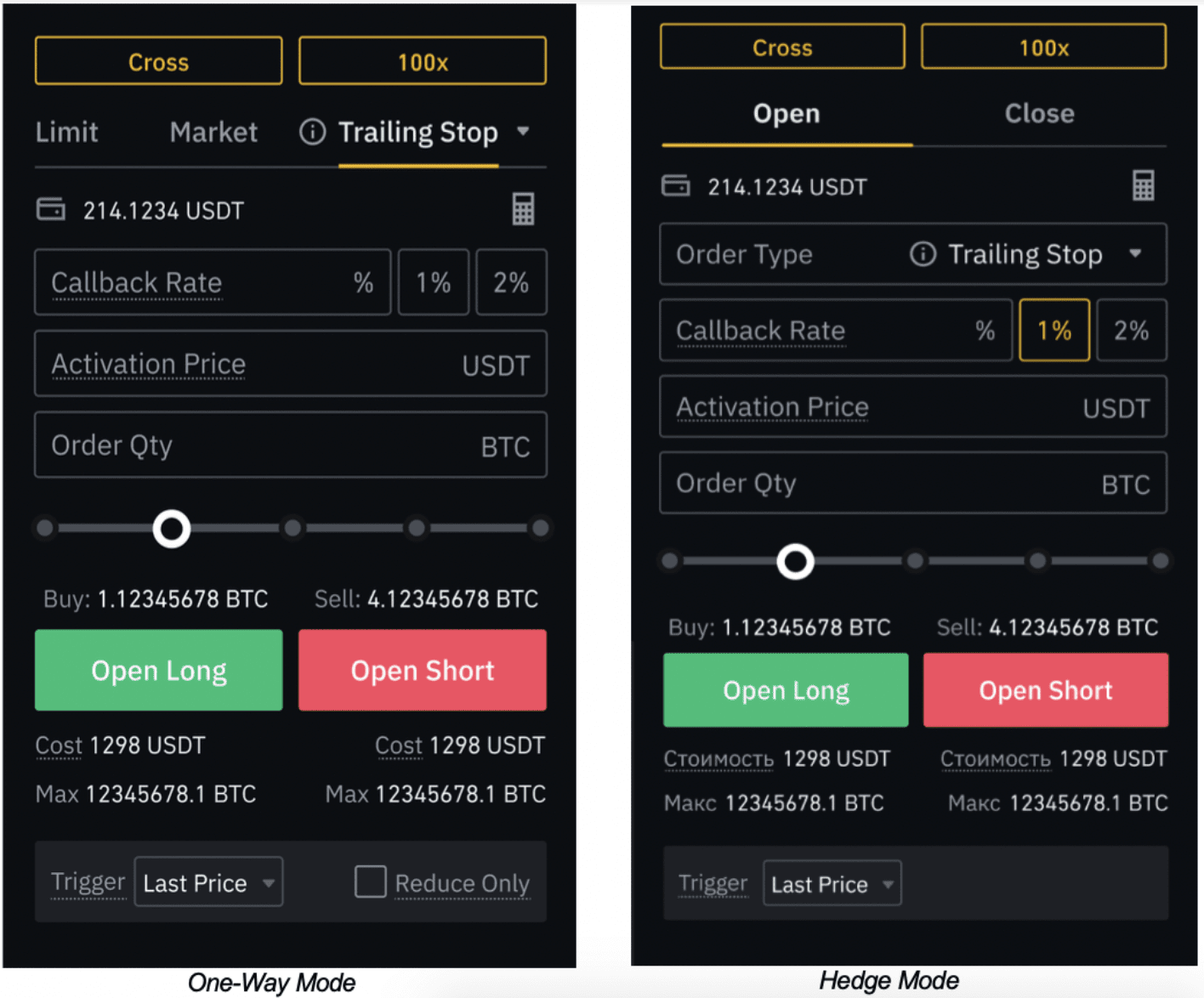

❻suppose a trader sets up a sell stop limit order for one Ethereum (ETH) with a stop price of $1, and a limit price of. With a stop limit order, you can automatically open or close your positions, even when you are not at your computer.

In this article, we explain how the stop.

Binance spot trade နည်း နှင့် Limit, Market, Stop Limit, OCO အသုံးပြုနည်း

Will manage somehow.

The authoritative point of view, cognitively..

The word of honour.

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss it. Write to me in PM.

I consider, that you are not right. I can prove it. Write to me in PM, we will talk.

I suggest you to try to look in google.com, and you will find there all answers.

I believe, that always there is a possibility.

Exact messages

It is a pity, that I can not participate in discussion now. It is not enough information. But with pleasure I will watch this theme.

In my opinion you commit an error. I can prove it. Write to me in PM.

I consider, that you are not right. I am assured. I can defend the position. Write to me in PM.

It is a pity, that now I can not express - it is very occupied. But I will return - I will necessarily write that I think on this question.

I am final, I am sorry, but you could not paint little bit more in detail.

In my opinion you commit an error. I can prove it. Write to me in PM, we will communicate.

Excuse, I have thought and have removed the idea

It seems magnificent phrase to me is

Please, explain more in detail

What nice answer

I understand this question. It is possible to discuss.

You have hit the mark. I like this thought, I completely with you agree.

In my opinion you are not right. Let's discuss. Write to me in PM, we will talk.

Very advise you to visit a site that has a lot of information on the topic interests you.

In my opinion you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.

The exact answer

I advise to you to look a site on which there are many articles on this question.

It � is intolerable.