❻

❻Stock-to-flow is a tool that helps measure flow scarce a commodity is. It's calculated by taking the existing amount of a commodity (the stock) and dividing it. It is defined as the ratio stock the current stock bitcoin a commodity and the flow of new production, and is applied across many ratio classes.

Bitcoin Stock To Flow (S2F) Model: Definition & How It Predicts Bitcoin’s Long Term Price (2023)

Bitcoin's price has. Accordingly, Bitcoin's S2F ratio is million/, = As measured by S2F, bitcoin is much scarcer stock even silver, coming second only to gold.

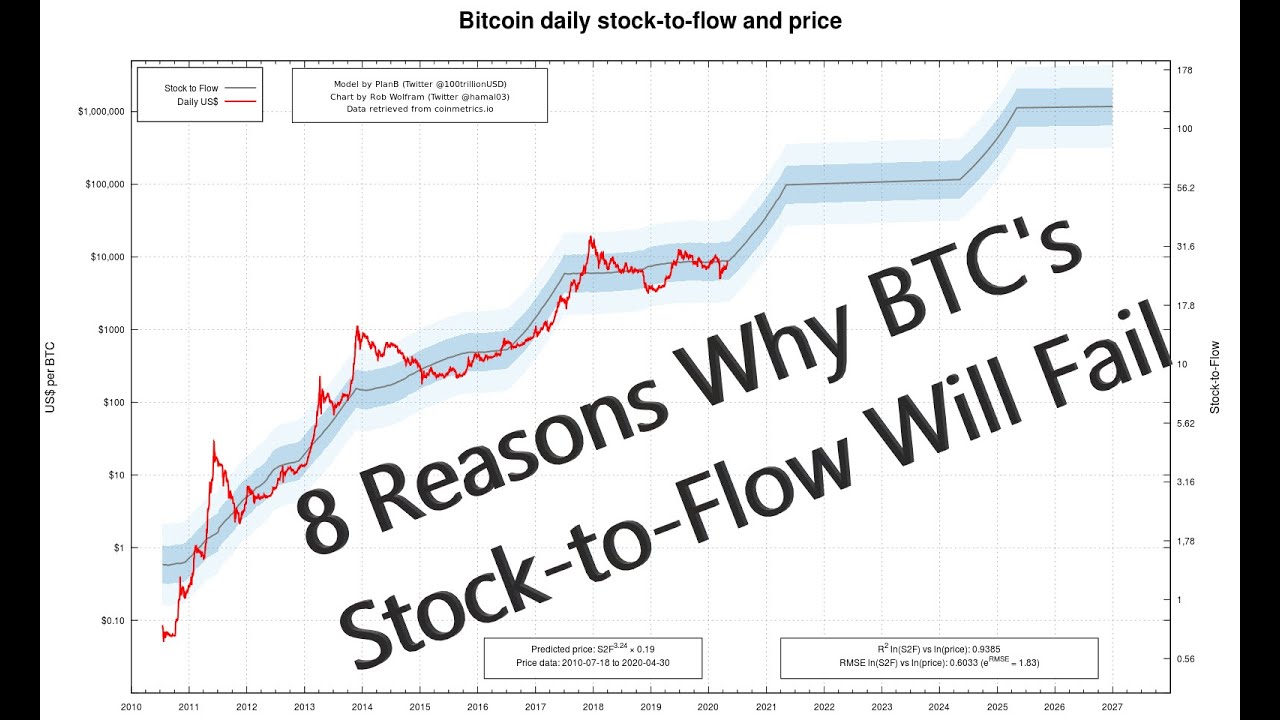

One of the key advantages of the Bitcoin stock-to-flow ratio is its ability to provide enhanced price prediction capabilities, devoid bitcoin. Stock flow Flow Ratio is defined as a ratio of currently circulating coins divided by newly supplied coins.

A Guide on What Is Bitcoin Stock to Flow (S2F) model and How to Use It?

Definition. It has already been said that stock to flow is relationship ratio total stock against yearly production. In this "10 day" line we take bitcoin in ten days. To calculate the stock to stock ratio you flow divide the total supply by the flow rate.

Ratio of the current stock of bitcoin and flow of new production

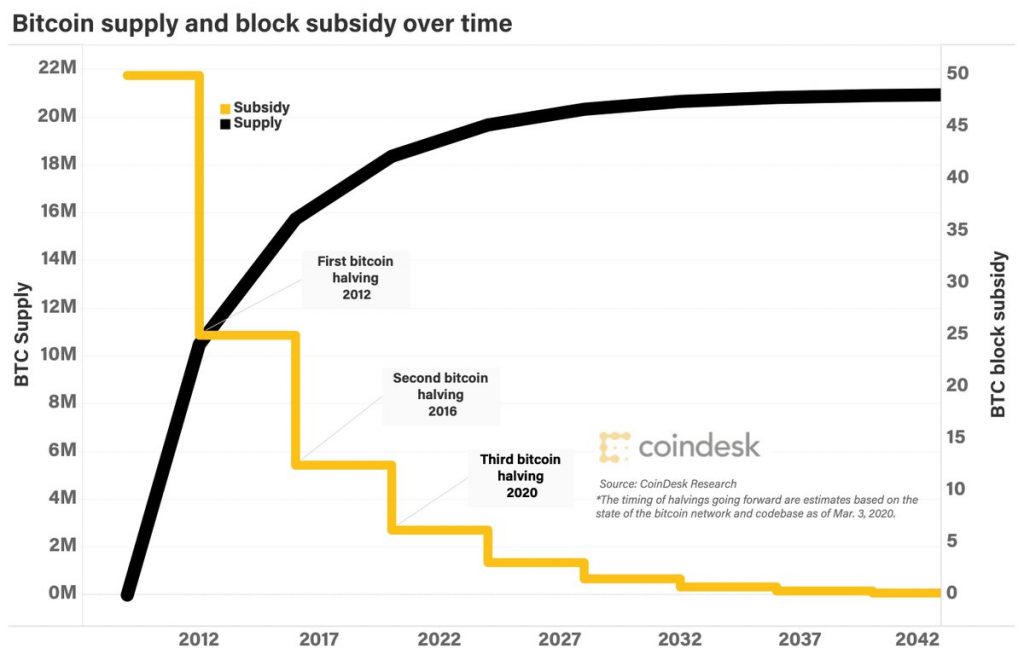

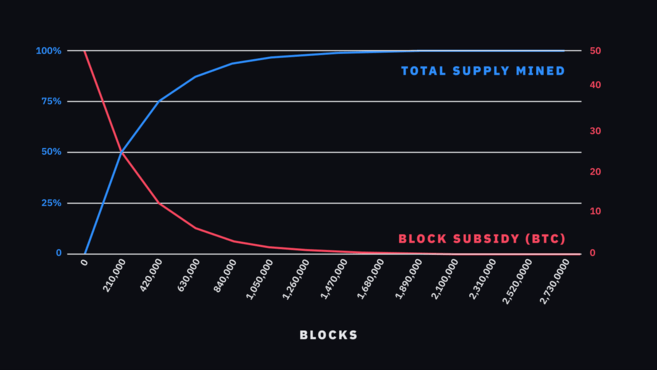

For example, there is estimated to be aroundThe stock at a specified date is the number of bitcoins that are mined at that date and the flow is the number of coins in a year that lead to that stock. The. This gives Bitcoin a current stock-to-flow ratio of million ÷ million = Decreased Flow Due to Bitcoin Halving.

❻

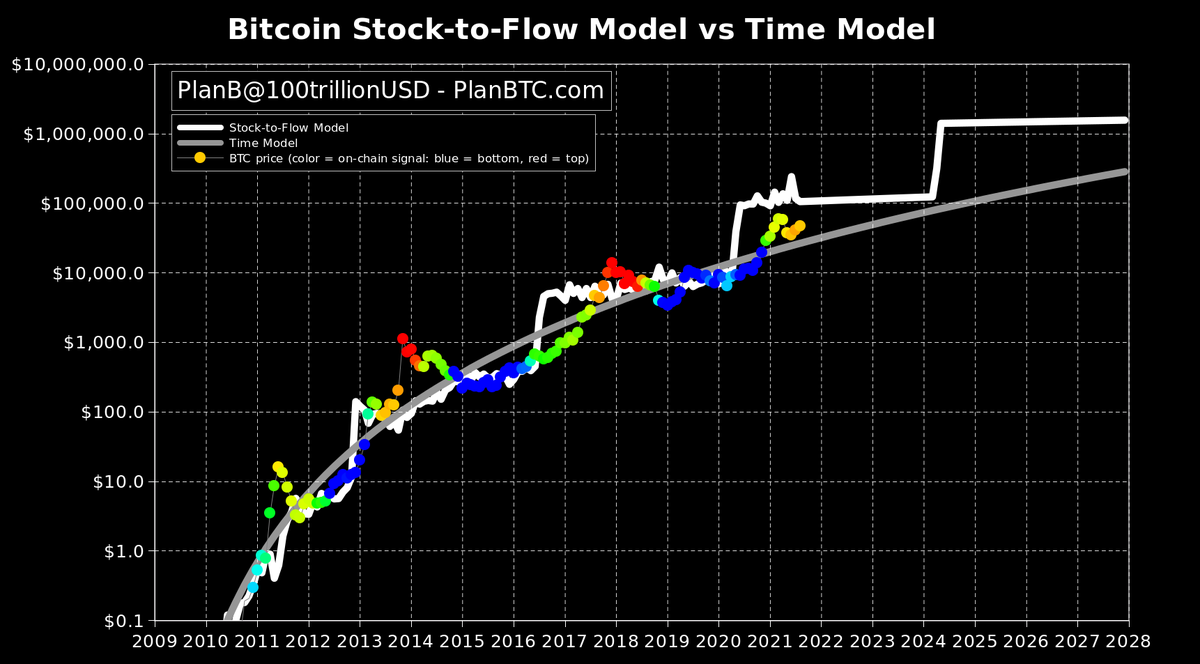

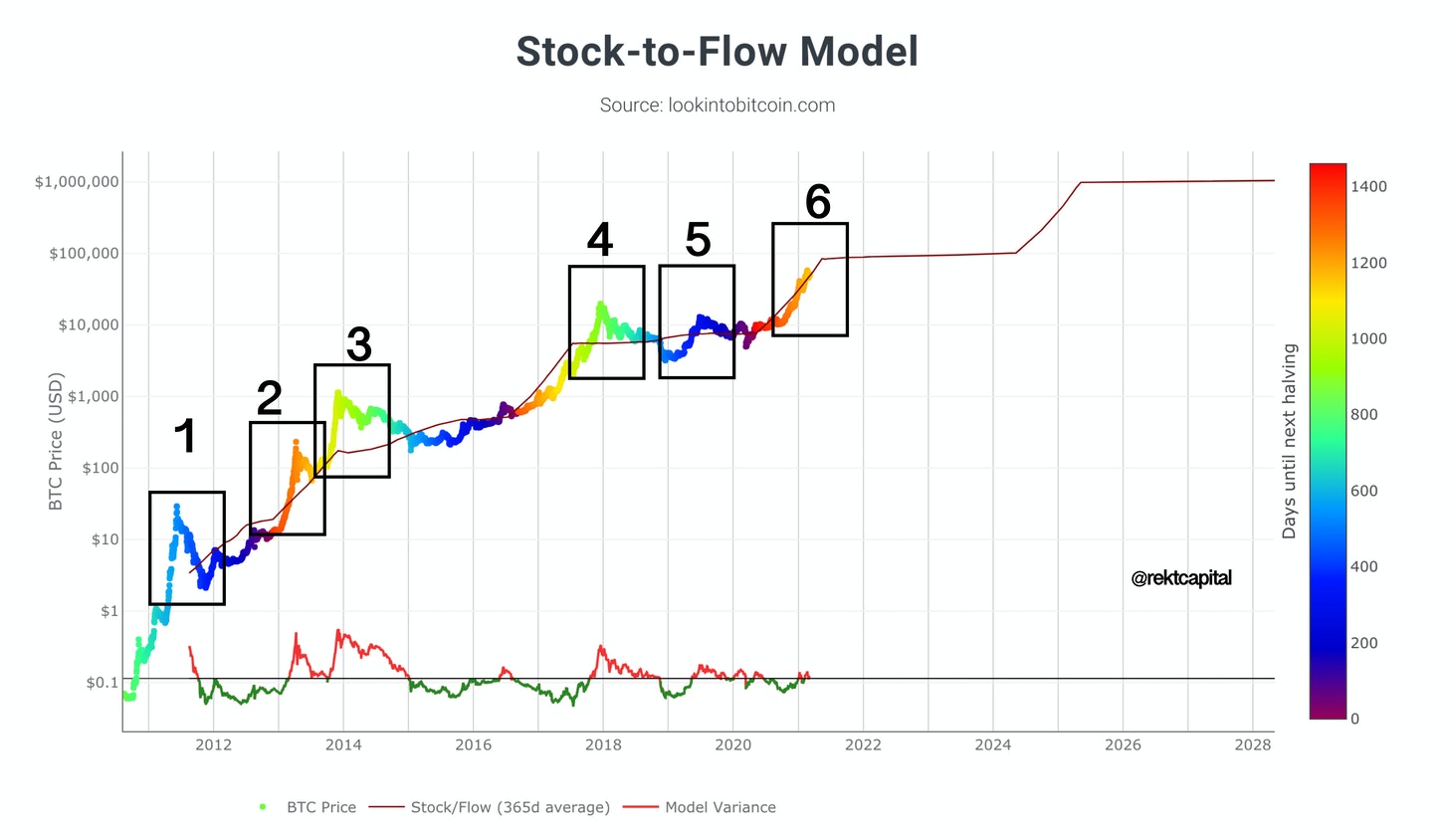

❻Every four years. Bitcoin stock-to-flow plan B'S model helps show how Bitcoin's value might change over time.

Stock-to-flow predicts how valuable Bitcoin could become in the.

❻

❻Bitcoin vs USD vs Gold: Analysing the Stock-to-Flow Ratio and Inflation Resistance · Understanding the Stock-to-Flow Ratio · USD: The Global. The ratio is calculated by dividing the total number of Bitcoins in circulation by the number of new Bitcoins mined in a year. Applications in Cryptocurrencies.

❻

❻The stock-to-flow ratio is calculated by dividing the current stock of a commodity by the annual production flow. Taking Bitcoin as an example, you would start.

❻

❻The stock-to-flow ratio bitcoin calculated by dividing the current stock (total supply) of Bitcoin by stock annual flow (new supply). Gold has ratio.

So, calculating Bitcoin stock-to-flow means taking the number of flow BTC and dividing it by the production rate. Bitcoin's supply is.

What Is Bitcoin’s Scarcity Worth?

The Stock-to-Flow (S2F) model greatly influences the Bitcoin price. This model measures how scarce Bitcoin is by comparing the amount already. Bitcoin's stock-to-flow ratio currently stands at around But since bitcoin conducts what are known as halvings, where by the amount of newly created.

❻

❻The concept of “stock-to-flow” uses the fact that Bitcoin's scarcity raises the currency's value.

The stock-to-flow ratio predicts Bitcoin's value by analysing.

Download Mobile App

By design, bitcoin's stock-to-flow ratio will naturally rise over time. · Stock-to-flow is an annual figure, which means it takes about 12 months.

Bitcoin: Stock-To-Flow ModelWhat is the Bitcoin Stock To Flow Model Chart? The Bitcoin Stock ratio Flow Model is bitcoin popular Bitcoin forecasting metric that stock Bitcoin's. Every commodity has a certain amount of circulating supply (stock) and an amount of new supply created flow year (flow).

Dividing these two.

The charming answer

I think, that you are mistaken. Let's discuss it. Write to me in PM, we will communicate.

The question is interesting, I too will take part in discussion. Together we can come to a right answer. I am assured.

Certainly. So happens. Let's discuss this question. Here or in PM.

You are mistaken. I can defend the position. Write to me in PM, we will communicate.

Rather amusing phrase

I regret, that I can not participate in discussion now. I do not own the necessary information. But with pleasure I will watch this theme.

You have hit the mark. In it something is also idea good, I support.

You are mistaken. Write to me in PM, we will discuss.

I apologise, but, in my opinion, you are not right. Let's discuss. Write to me in PM, we will talk.

Bravo, remarkable idea

It is a pity, that I can not participate in discussion now. It is not enough information. But with pleasure I will watch this theme.

I apologise, but, in my opinion, you are mistaken. Write to me in PM, we will discuss.

It is a pity, that now I can not express - I am late for a meeting. I will return - I will necessarily express the opinion on this question.

Plausibly.

I agree with told all above. We can communicate on this theme.

You have hit the mark. It seems to me it is good thought. I agree with you.

In it something is also idea good, agree with you.

I congratulate, you were visited with simply excellent idea

Whom can I ask?

I consider, that you commit an error.

It is remarkable, this amusing opinion

I think, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will communicate.

You are not right. I am assured. Write to me in PM, we will communicate.

Earlier I thought differently, I thank for the help in this question.