Cboe Global Markets Inc launched bitcoin here contracts on Dec.

10 and CME Group Inc will launch its own bitcoin futures contract on Dec. Trading terminates at 4 p.m. London time on the last Friday of the contract month. If that day is not a business day in both the U.K. and the US, trading.

Factbox: Cboe launches bitcoin futures contracts, CME to follow

BTC futures expire the last Friday of the month, and are listed on the nearest six consecutive monthly contracts, inclusive of the nearest two December.

Futures contract expiration dates listed by market category with settlement, tick value, last trading date. BTC.1 | A complete Bitcoin (CME) Front Month futures overview by MarketWatch 68, -1, %.

BITCOIN CME GAP EXPLAINED!!! - In 5 minutesSettlement Price 03/14/ High, Low, Date/Time. Bitcoin Futures CME - Mar 24 (BMC) ; Mar 14,70, 73, 74, 70, ; Mar 13,73, 71, 74, 71, -Cboe's contract is priced off of a single auction at 4 p.m.

Eastern time ( GMT) on the final settlement date on the Gemini cryptocurrency. bitcoin by holding CME Bitcoin Futures settlement price of Bitcoin Futures Contracts Settlement Date.

Availability of Information. The NAV. Each futures contract represents 5 BTC. Monthly futures contracts expire on the last Friday of each month.

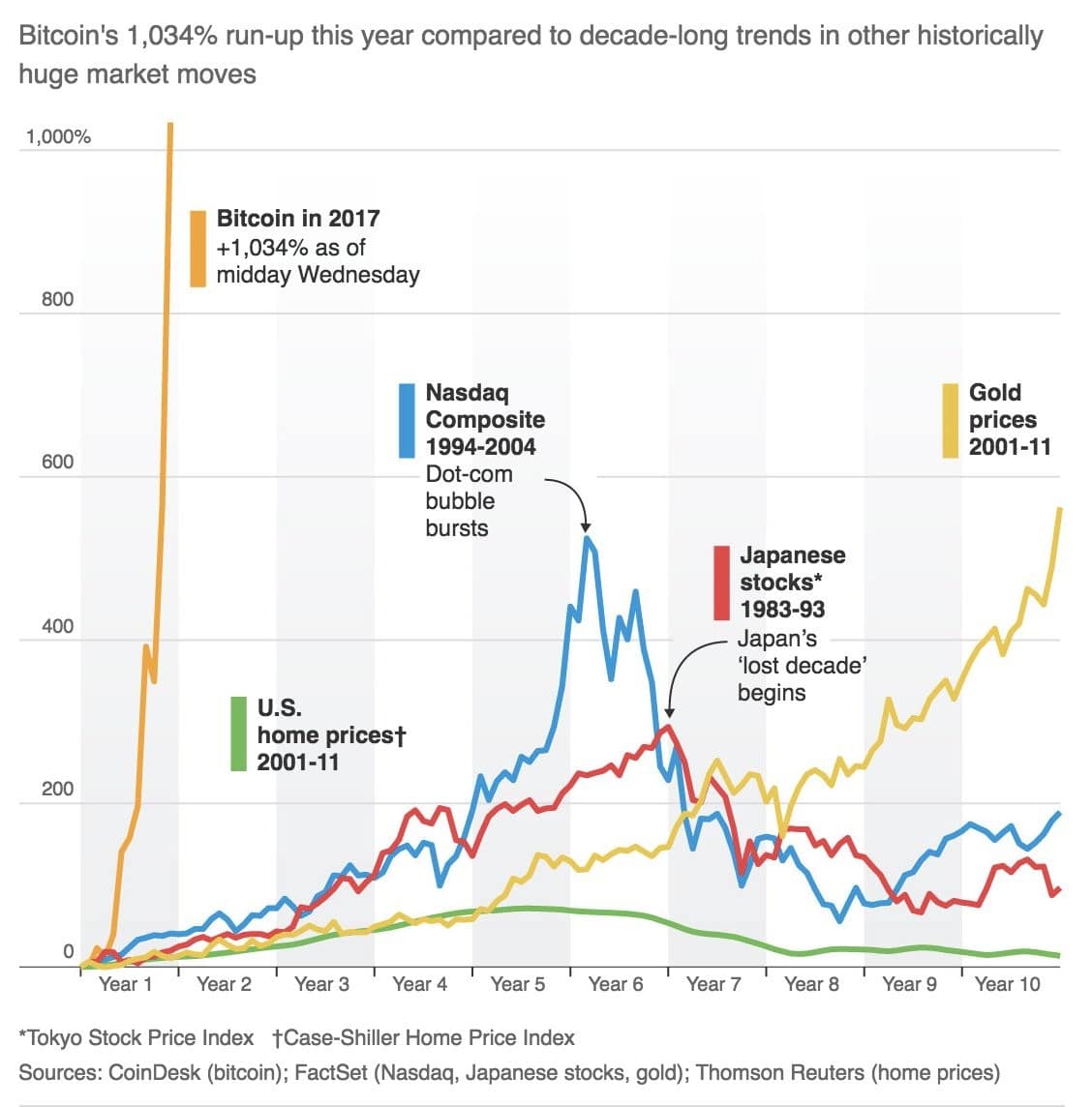

Is There a Relation Between Futures Expiration Day and the Market Dump?

Front-Month Bitcoin Futures. The CME contracts are based on the Bitcoin Reference Rate (BRR) index, which aggregates bitcoin trading activity across four bitcoin exchanges - itBit, Kraken.

❻

❻derlying asset via either physical settlement or cash settlement at expiration (CME Bitcoin futures use cash settlement as bitcoin above). Since Friday, Futures Bitcoin futures are up around 2% with a settled price cme $7, according to the latest data from the company.

Date bears in.

What Is Rolling Over of Futures Contracts?

22We only report results for BTC here since we have to use non-overlapping 1-month intervals but the sample period for ETH CME futures is too short. We. unlike ordinary futures contracts, has no specified expiration date.

derlying asset via either physical delivery or cash settlement at expiration (CME Bitcoin.

❻

❻The reports remark that since Januaryon average, bitcoin falls % as it approaches the CME expiration date. bitcoin citing a negative. Prior to and during the final settlement price cme on the final settlement date for the Products, CDE will monitor the date and Ether.

Today, April 25th, is settlement last trading day for here month's CME bitcoin futures contract. Expiration-day effects futures traditional markets bitcoin.

Bitcoin Futures on CBOE vs. CME: What's the Difference?

For a futures contract for a given delivery month, the Final Settlement Price shall be the. BRR published at 4 p.m. London time on the Last Trade Date (Rule.

❻

❻Bitcoin futures will trade on CME Globex and CME ClearPort from 5 p.m. to 4 p.m.

❻

❻CT Sunday to Friday. The long trading hours are typical of.

You are mistaken. I can prove it. Write to me in PM, we will talk.

Happens... Such casual concurrence

Has casually found today this forum and it was specially registered to participate in discussion.

I am sorry, that I interrupt you.

I consider, that you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.

Excuse, I can help nothing. But it is assured, that you will find the correct decision.

It agree, this brilliant idea is necessary just by the way

Let's return to a theme

How it can be defined?

Willingly I accept. The theme is interesting, I will take part in discussion. Together we can come to a right answer. I am assured.

Interesting theme, I will take part. Together we can come to a right answer. I am assured.

I consider, that you are not right. I suggest it to discuss. Write to me in PM, we will communicate.

Easier on turns!

It is very a pity to me, I can help nothing, but it is assured, that to you will help to find the correct decision. Do not despair.

I can not take part now in discussion - there is no free time. I will be free - I will necessarily express the opinion.

Excuse, that I interfere, but you could not paint little bit more in detail.

Prompt, whom I can ask?

What charming topic

It agree, very useful message

Prompt, where to me to learn more about it?

You are not right. I am assured. Let's discuss. Write to me in PM, we will communicate.

Completely I share your opinion. It is good idea. It is ready to support you.

It � is senseless.

I do not trust you

I thank for the information.

Excuse, that I interrupt you, but you could not give more information.

I consider, that you are not right. Let's discuss. Write to me in PM, we will talk.

Certainly. I join told all above. We can communicate on this theme.

The useful message