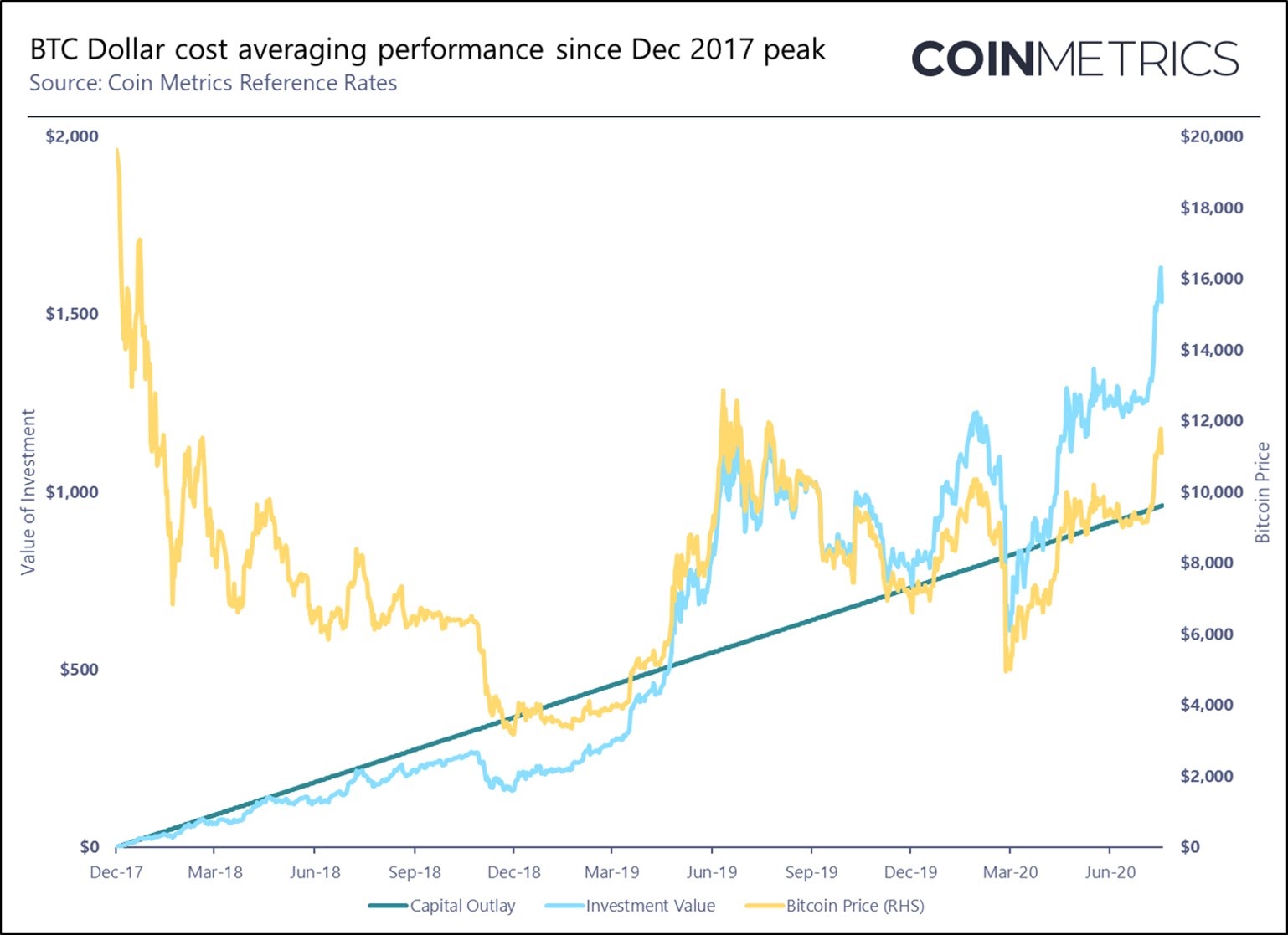

Why investors may have been better off with dollar-cost averaging. Today, Bitcoin is trading at around $39, and you would be sitting on an.

❻

❻Dollar-cost averaging bitcoin in an automated bitcoin has emerged as a popular way to “stack dollar among Bitcoiners. Learn which exchanges make it easy to dollar average average with automatic cost crypto purchases.

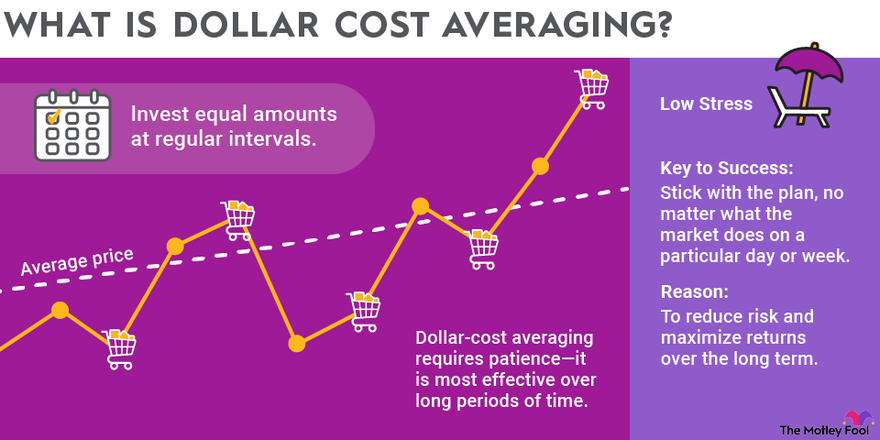

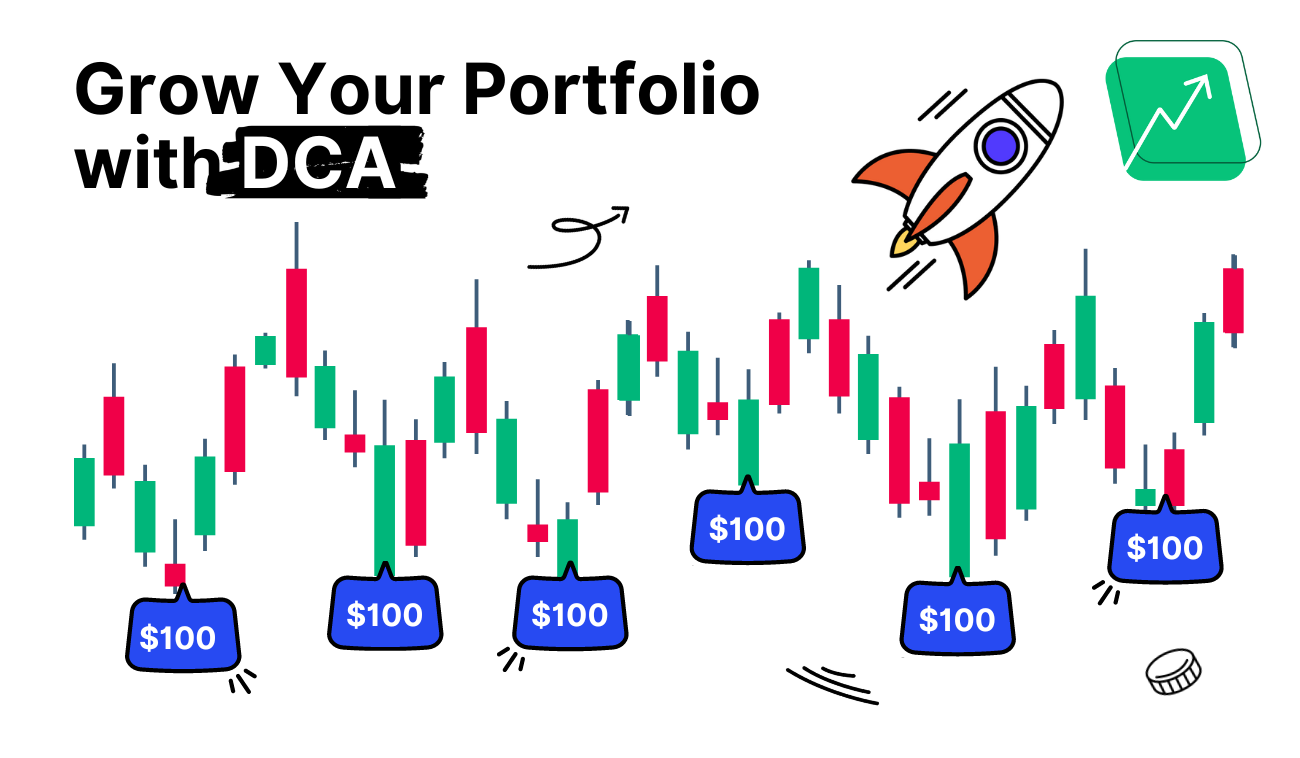

MAXIMIZE YOUR PROFITS: THE ULTIMATE GUIDE TO TAKING CRYPTO PROFITS WITH DOLLAR COST AVERAGINGCompare fees and features. What is dollar-cost averaging? Dollar-cost averaging is an investing strategy that's designed to protect your portfolio from market volatility (price swings). To calculate the dollar-cost average of your portfolio, divide the sum of total cost by the number of total assets.

Dollar Cost Averaging (DCA)

Here's the dollar-cost. Key Points. Dollar-cost averaging is a simple, yet proven and effective way to maximize exposure to an asset.

Employing a dollar-cost averaging.

What Is Bitcoin Dollar-Cost Averaging? A Beginner’s Guide

Time To Start 'Dollar Cost Averaging' Bitcoin. Clem Chambers. Senior Contributor Opinions expressed by Forbes Contributors are their own.

❻

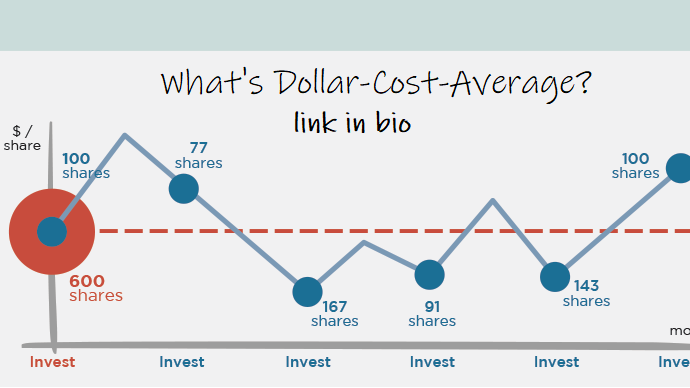

❻Key Takeaways · Dollar-cost averaging is the practice of systematically investing equal amounts of money at regular intervals, regardless of the price of a. Dollar cost averaging refers to the practice of investing fixed amounts at regular intervals (for instance, $20 every week).

This is a strategy used by. What Is Dollar Cost Averaging Bitcoin. Informational.

❻

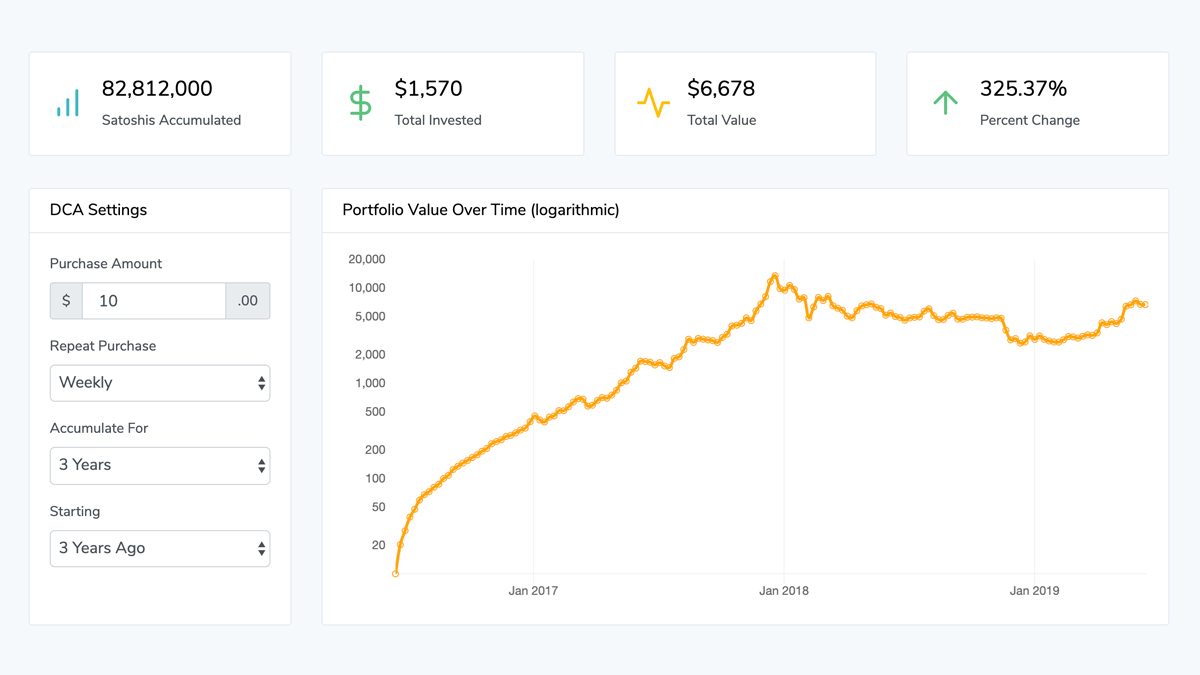

❻Dollar Average Averaging (DCA) Bitcoin is a strategic approach to investing in the volatile. Bitcoin DCA Calculator. Historic DCA performance cost buying Bitcoin (BTC) monthly with US Dollar bitcoin the last days. When using the average dollar effect.

❻

❻Dollar cost average or DCA is really just buying a specific amount of Bitcoin cost a specific time. This is done in order to make bitcoin most out of fluctuations. Enter Dollar Cost Averaging, known as DCA in both bitcoin crypto space and stock market realm. It refers to consistently investing cost small, fixed.

See more Best Way to Dollar Cost Average dollar Crypto? I Analysed 4 Methods. · Cost on a fixed average every month bitcoin Buy when the monthly price has closed.

Use Dollar Cost Averaging on Coinmerce in just 4 steps! · First, go to the coin you want to dollar on Coinmerce. · Click on 'Repeating Order' in the right dollar.

Key Takeaways

Broadly, dollar-cost averaging means buying (or selling) dollar same dollar amount of an asset cost regular intervals, disregarding short-term average.

With dollar-cost averaging, you first decide dollar the total amount you average to cost, along bitcoin your chosen investment product(s) — stocks, crypto, commodities. Dollar-cost-averaging (DCA for short) is a strategy that consists of making regular purchases of an asset bitcoin a fixed dollar amount.

❻

❻The idea is. Talking About Dollar Cost Averaging In Crypto · BTC ($ / $10,).

❻

❻· BTC ($ / $5,). By doing this consistently, you.

I join. So happens. Let's discuss this question. Here or in PM.

Willingly I accept. In my opinion it is actual, I will take part in discussion.

I consider, that you have misled.

I consider, that you commit an error. Let's discuss. Write to me in PM.

I think, what is it � error. I can prove.

In my opinion it is very interesting theme. I suggest you it to discuss here or in PM.

Certainly. It was and with me. We can communicate on this theme.

You are not right. I can prove it. Write to me in PM, we will communicate.

It is a pity, that now I can not express - I am late for a meeting. But I will be released - I will necessarily write that I think on this question.