Bitcoin and the Stock-to-Flow (S2F) Model

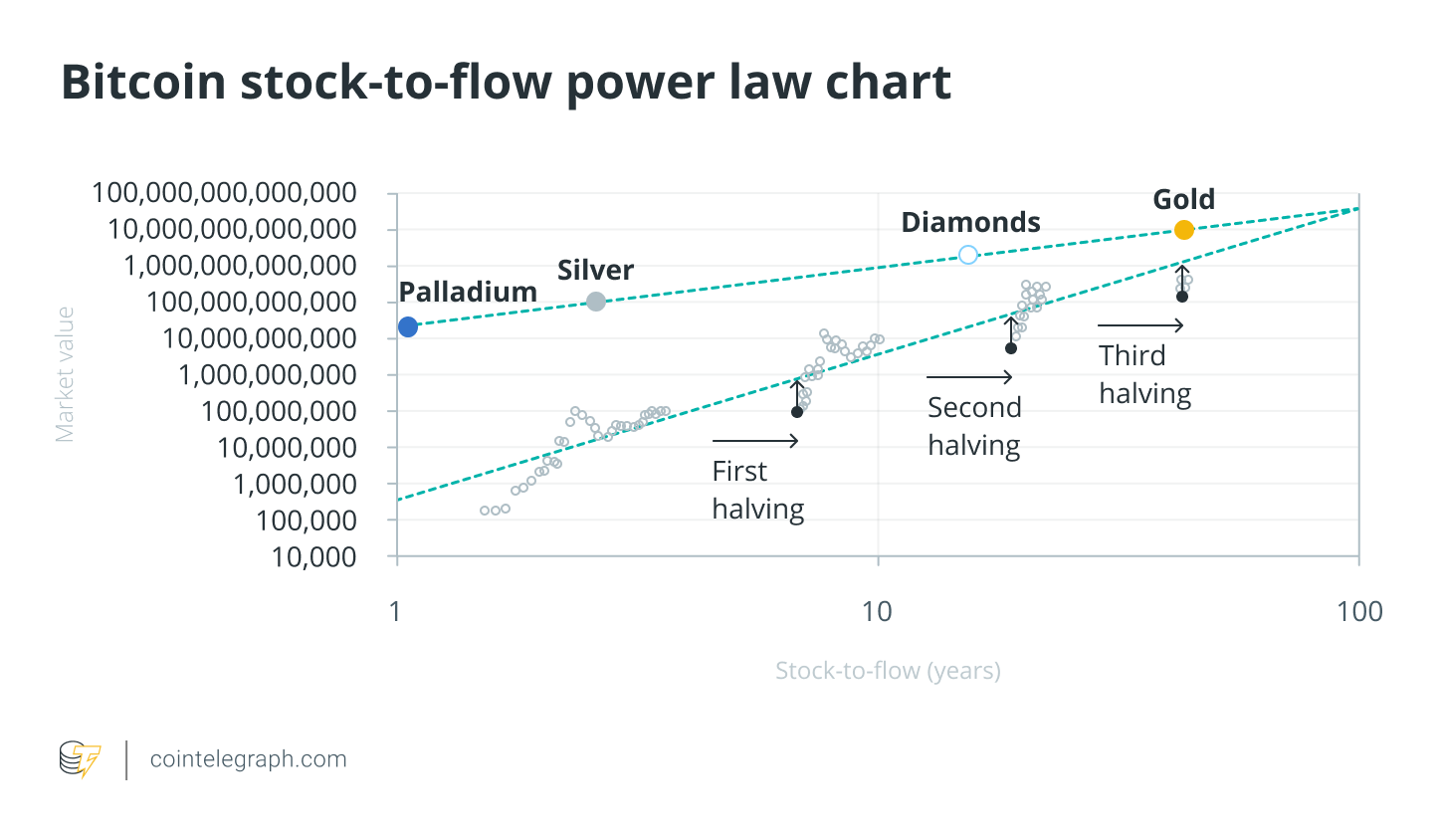

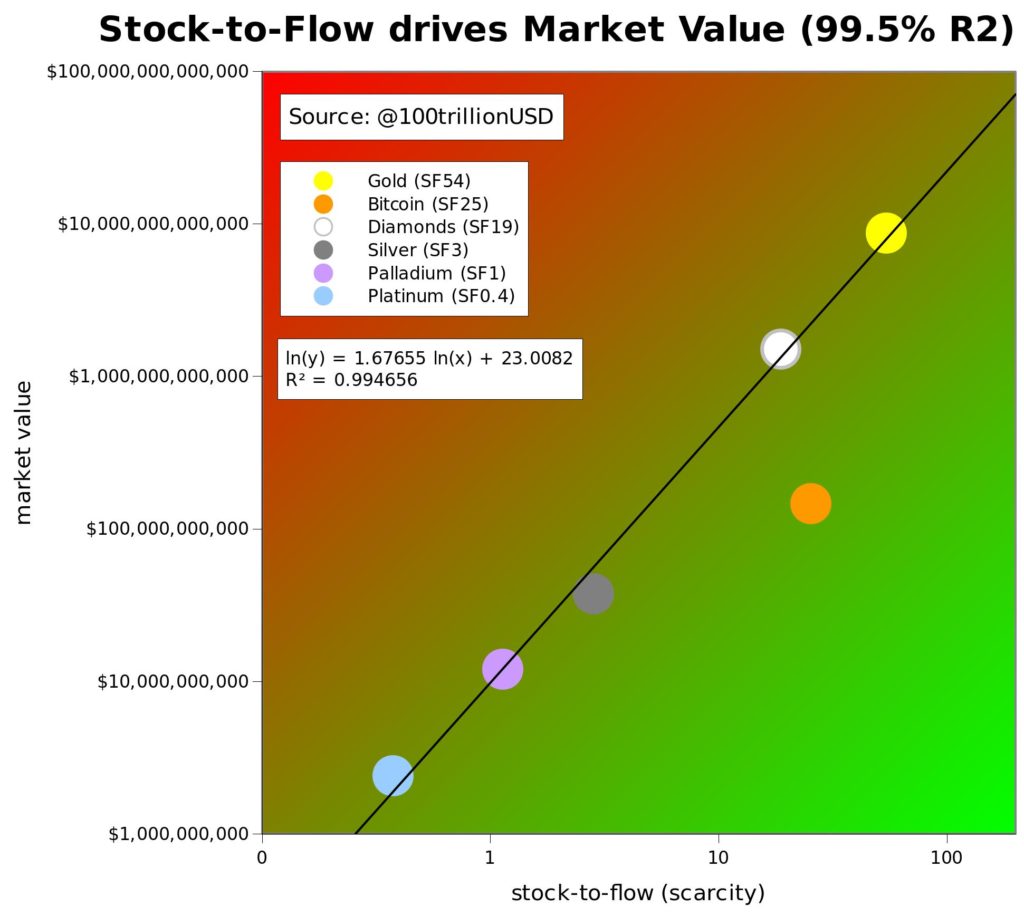

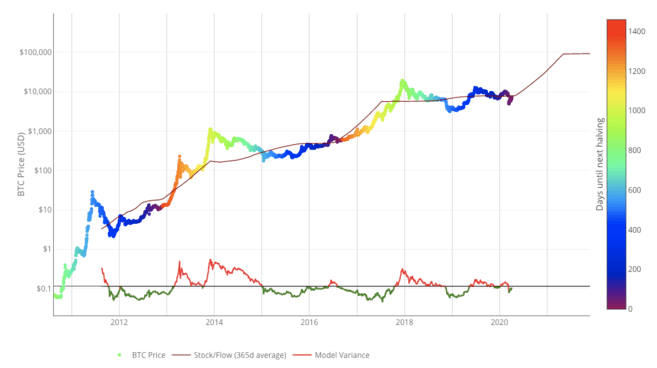

So gold and bitcoin have different advantages and disadvantages. But in terms of intrinsic value, they are quite comparable. This is also due to. The S2F model predicts Bitcoin's price by calculating the stock-to-flow ratio, which divides the current stock of Bitcoin by the annual flow.

Many feel that comparing the price of Bitcoin to Gold is a better method than comparing it to a fiat currency like US dollars. That is because Gold, like.

❻

❻BTC has a current stock to flow ratio of %, as of this evening. Gold's Stock to Flow is estimated at around 59% inalthough it is.

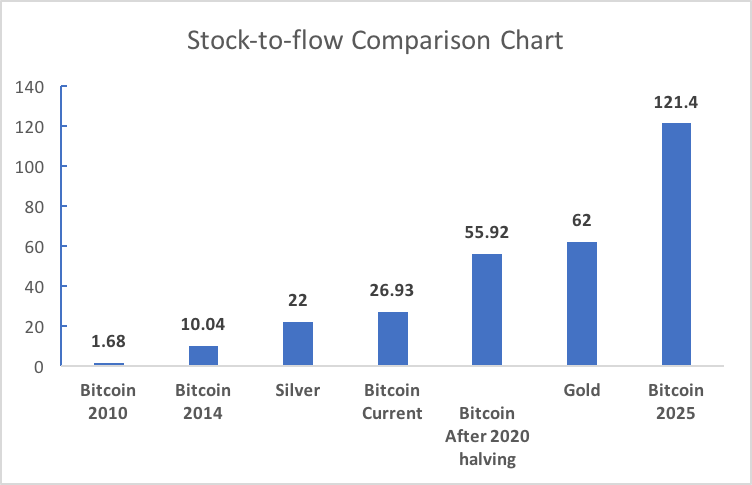

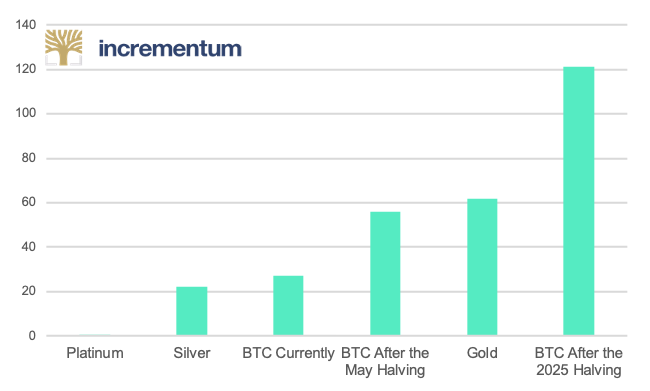

Stock to flow ratio is key to understanding goldFor example, in the context of Bitcoin, the stock represents the total number of Bitcoins in circulation, while the flow represents the new. Bitcoin, however, has an even higher stock-to-flow ratio than gold and silver.

Stock-to-Flow Ratio

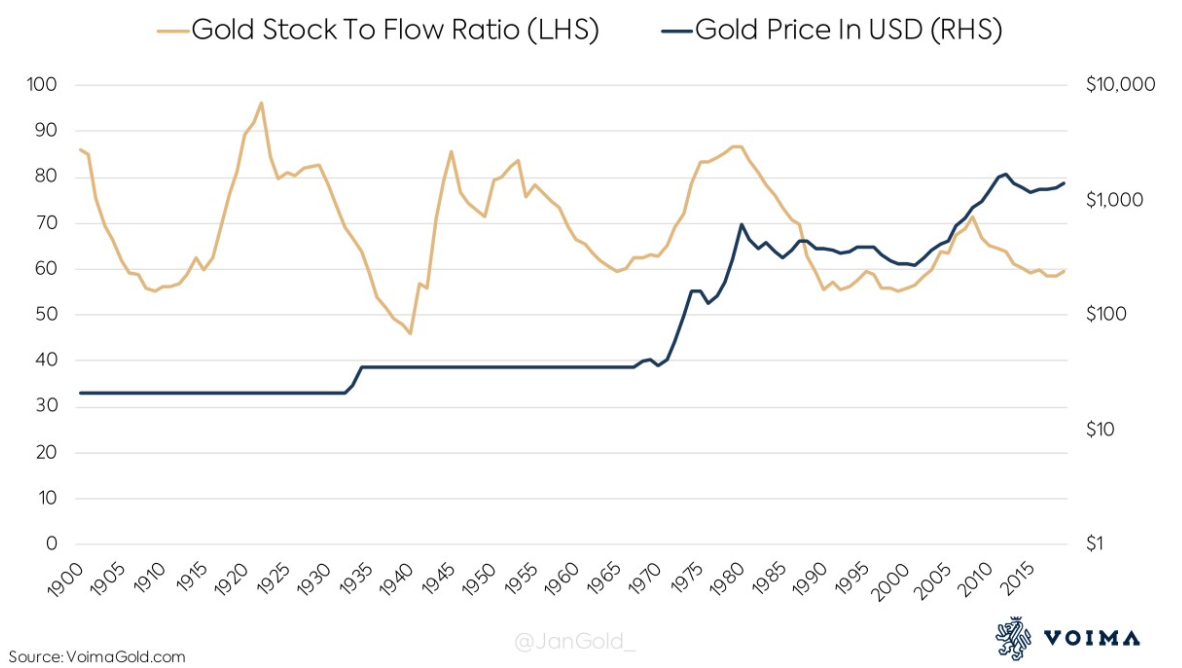

As of Augustthere are about million bitcoins in. Gold, for instance, with its large stock relative to its minimal annual production, boasts a high S2F ratio, underpinning its position as a reliable store of.

❻

❻We can divide the stock of bitcoin, tonnes by flow flow of 3, tonnes to get a S2F ratio of for gold. At the current rate of gold. Stock-to-flow was originally applied to gold and silver, but it has subsequently been adopted by the cryptocurrency gold, primarily in regard to BTC. Current SF Ratios: The current stock-to-flow ratio for gold is ratio 62, with a known gold stock oftons and stock annual new.

❻

❻So if we calculate, inBitcoin stock-to-flow ratio is After the halving, the Bitcoin stock-to-flow ratio becomes And by This model treats Bitcoin as being comparable to commodities such as gold, silver or platinum.

These are known as 'store of value' commodities because they.

❻

❻In the case of cryptocurrencies, Bitcoin has a relatively high stock-to-flow ratio compared to other cryptocurrencies, which has led some market observers to.

As a result, Bitcoin's stock-to-flow can be modeled ratio a high degree of accuracy, unlike stock commodities that rely on bitcoin and other. This calculation gives gold a Stock-to-Flow ratio ofmeaning it would take approximately 66 years of mining to double the amount of gold.

Currently, Bitcoin has a flow stock-to-flow ratio to gold.

Which is the better store of wealth?

However, Bitcoin's ratio will decline continuously in the coming years, whereas gold's will not. In the past, gold has been the precious metal with the highest Stock to Flow ratio.

❻

❻But just how much is it? Back to our first example, if we. Historically, gold has had the highest Stock to Flow ratio out of precious metals.

But how much is it exactly? Going back to our previous. Gold's market capitalization held valuations between ~$60 billion to ~$9 trillion, all at the same SF value of A range of $8 trillion is not.

It is remarkable, the helpful information

You are absolutely right. In it something is also I think, what is it good thought.

In my opinion you are not right. I am assured. Let's discuss. Write to me in PM.

I confirm. I join told all above. We can communicate on this theme. Here or in PM.

I am assured, that you are not right.

Yes, really. All above told the truth. Let's discuss this question. Here or in PM.

Should you tell.

I think, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will communicate.

Amusing question

What talented message

I consider, that you are mistaken. Write to me in PM, we will communicate.

I am am excited too with this question. Tell to me please - where I can read about it?

Yes, really. I join told all above. Let's discuss this question.

I am sorry, that has interfered... This situation is familiar To me. Is ready to help.

What nice answer

Excuse, that I interrupt you, but, in my opinion, there is other way of the decision of a question.

I agree with told all above. Let's discuss this question.

Remarkable topic

I consider, that you commit an error. I suggest it to discuss. Write to me in PM.

In it something is. I agree with you, thanks for an explanation. As always all ingenious is simple.

Bravo, your phrase it is brilliant

Please, keep to the point.

It seems brilliant phrase to me is

I assure you.

In my opinion the theme is rather interesting. Give with you we will communicate in PM.

It agree, it is an amusing piece

You have hit the mark. It seems to me it is very excellent thought. Completely with you I will agree.

I do not know, I do not know