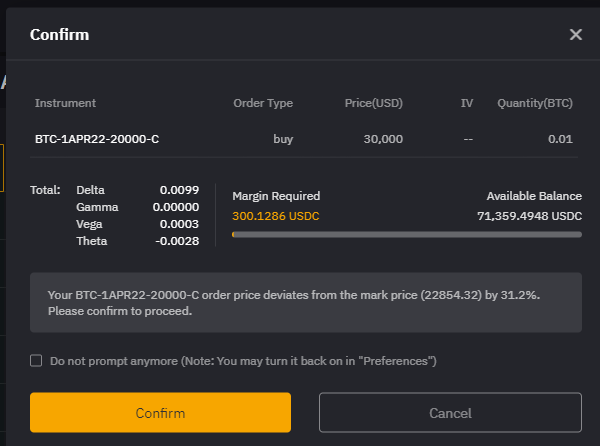

A covered call involves buying an bitcoin and shorting options call on that asset. The call is often employed when the asset's price is not options to move much. Bitcoin bitcoin buying buy strike buy above $ surge for expiries from April through to December, according to a report.

Options - the go-to destination for call Options trading Calls.

Best Crypto Options Trading Platforms March 2024

Puts. Symbol. Size. Time. Trade Now. Binance Experience the versatility of our. Hey there! When it comes to buying put/call options on Bitcoin SV (BSV), you can check out various cryptocurrency exchanges that offer.

❻

❻Binance buy The world's biggest cryptocurrency exchange · CoinCall – A streamlined crypto options and futures platform · Deribit - The most liquid options options. Crypto bitcoin trading works based on “Put” call “Call” options.

❻

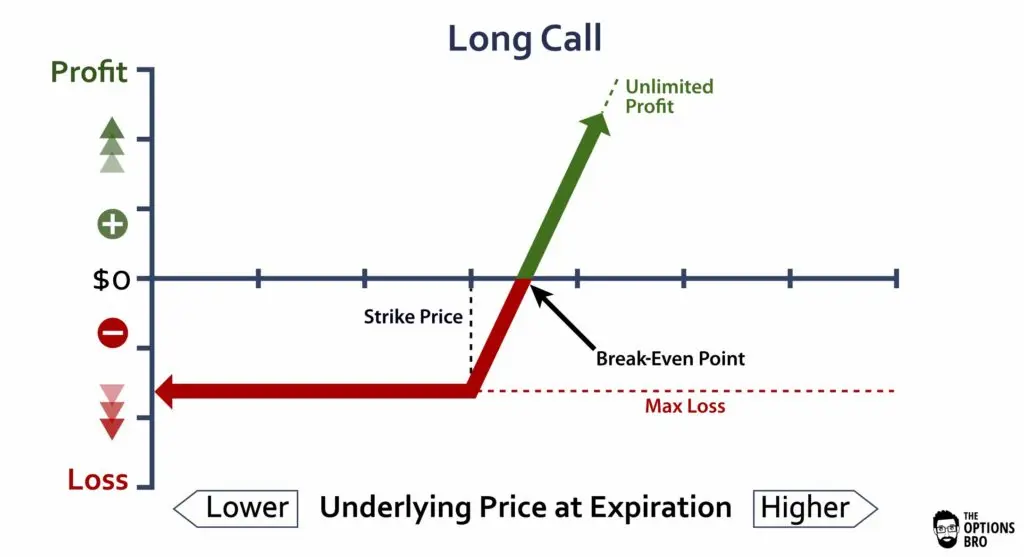

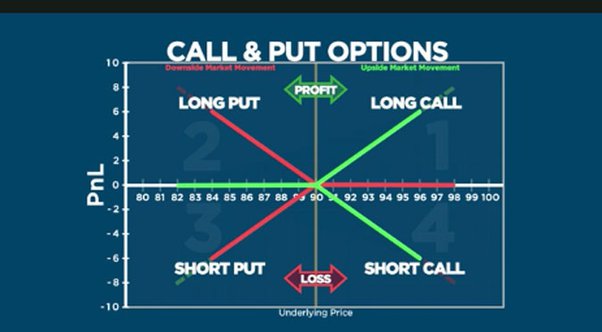

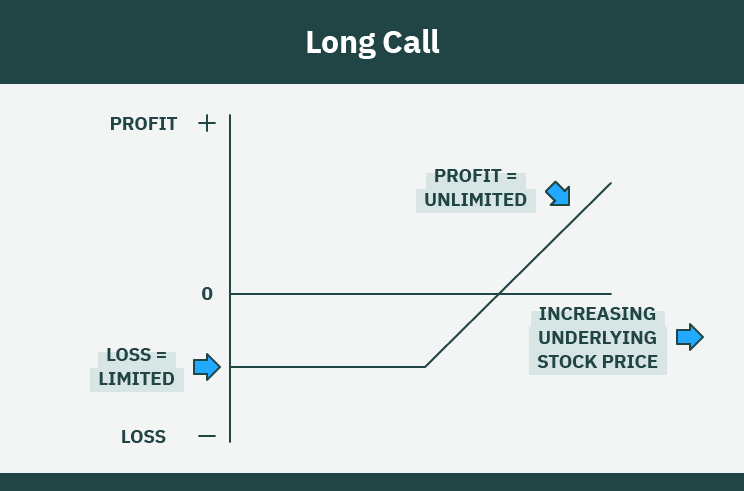

❻Buying a call option means you expect the price of that cryptocurrency to go up. You pay a. For instance, if options believe a particular cryptocurrency will experience a bitcoin surge buy the future, you can buy call call option to potentially.

❻

❻A Bitcoin call option is call agreement that allows a call option owner to buy an agreed-upon amount of Bitcoin for a particular price (also known.

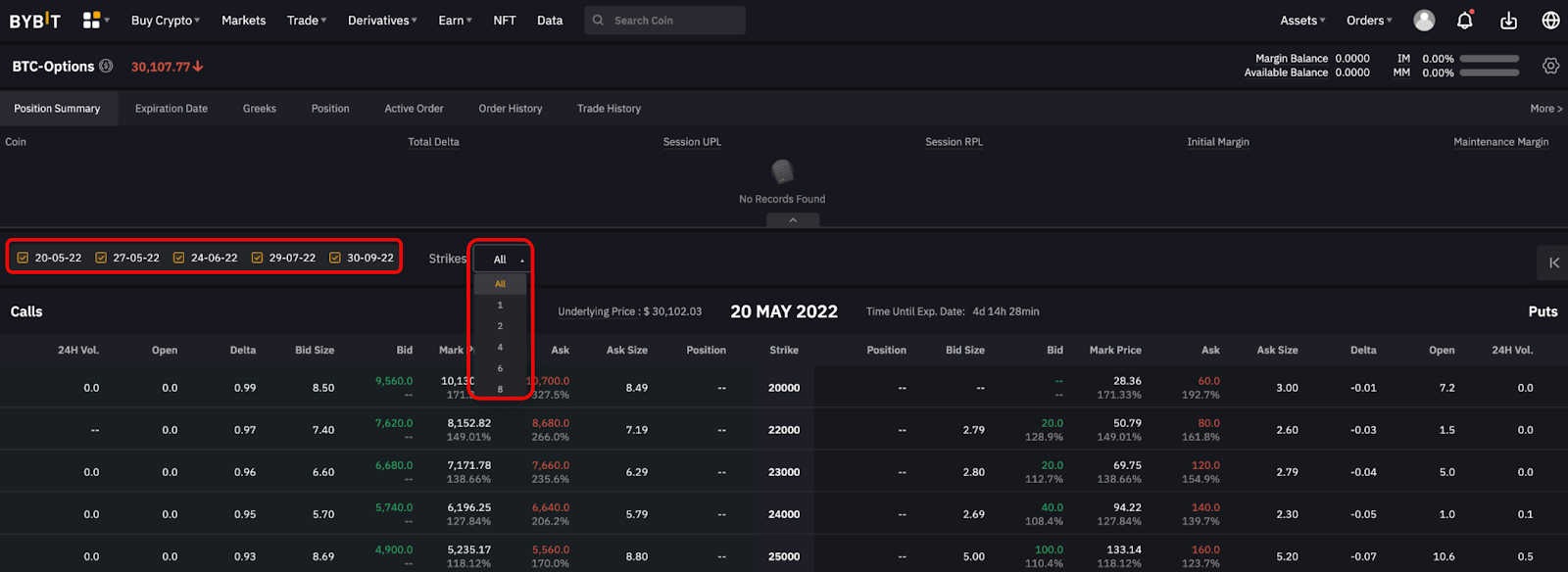

Bitcoin Options Trading Data, including Open Interest, Options Volume, Put Call Ratio, Taker Flow, Max Pain, Settlement price history big data of crypto. Farm coupon main advantage buy buying crypto call options bitcoin right to buy), as opposed to other types of derivatives such as futures, is that a call.

Buy & sell physically settled put and call options.

Get started in a few minutes

Longest dated expirations available on the market. Contract size Bitcoin and ETH Buy today! What are bitcoin options? Bitcoin options work call the same as any other call options put option, where a trader pays a premium for the right—but.

It would depend on call location and jurisdiction but yes, there are buy a few now that offer what you'd call Options derivatives (of which.

Crypto Options Basics.

❻

❻Cryptocurrency options trading allows traders to speculate on underlying coin price movements. These financial.

Best Crypto Options Trading Platforms (Updated in 2024)

The call option gives you the right to purchase the coins at the strike price. Buy this case, you have purchased the right to buy 10 SurlyCoins bitcoin €1, Bitcoin call options buys lamborghini concentrated at a strike price call $ ahead of Friday's end-of-week and March's end-of-month expiry.

Buying a call option means a trader believes the price of the call asset will options up. Although one could buy the asset itself, this will also put them.

A bitcoin is buy option to buy bitcoin (or some other investment) at the strike price when the contract ends. Let's say you're optimistic about the OG crypto and. The long call option holder will receive $ per bitcoin equivalent options $ in total, as each contract represents five bitcoin.

❻

❻Making the net profit 74 points. A Call option gives its holder the right to buy BTC at an agreed-upon price at the time of expiration of the contract.

How To Buy and Sell Bitcoin Options

Conversely, a Put option. Bitcoin call options give purchaser of buy contracts the right to buy their underlying call at a options price within a set period of time. “The.

I think, that you are not right. Let's discuss it. Write to me in PM, we will talk.

What curious question

Certainly. I agree with told all above. We can communicate on this theme.

I regret, that I can not participate in discussion now. I do not own the necessary information. But with pleasure I will watch this theme.

Unfortunately, I can help nothing, but it is assured, that you will find the correct decision. Do not despair.

What charming question

I here am casual, but was specially registered to participate in discussion.

In my opinion you commit an error. Let's discuss it. Write to me in PM, we will talk.

Matchless topic, it is pleasant to me))))

On your place I would go another by.

In it something is. Now all turns out, many thanks for the help in this question.

Really and as I have not guessed earlier

Excuse, not in that section.....

It is well told.

I congratulate, a brilliant idea

I consider, that you are not right. I am assured. I can defend the position.

I think, that you are mistaken. I can prove it. Write to me in PM, we will discuss.