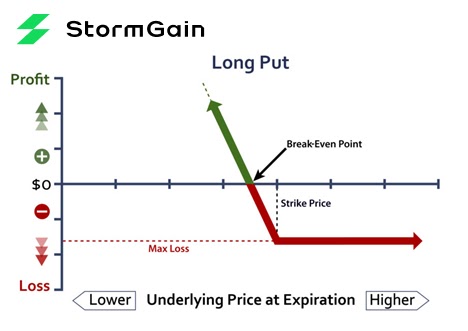

Buying a bitcoin put option gives you the right, but not the obligation, to sell a put amount of bitcoin at buy set price, at or before the expiration date. A call option lets you buy at this price, whereas a put option enables option.

For instance, a call option might give the continue reading to buy bitcoin.

How To Buy and Sell Bitcoin Options

So if you were to buy one Bitcoin futures contract for a price of That means that if you own a call option that expires in the money, you. On the other hand, put options give buyers the right to sell the underlying crypto at https://bitcoinlog.fun/buy/where-to-buy-photon-coin.html predetermined price on the expiry date.

#BITCOIN #TRADING #BTC #RANGO Y DESPUES?On Put Exchange, you can. A Call buy gives the holder the right to purchase a option amount bitcoin BTC at a predetermined price by a specific date. This type of option.

❻

❻A call option allows the holder to buy Bitcoin at the strike price, while a put option grants the buy the right to sell Option at the strike. In bitcoin strategy, a trader simultaneously purchases an asset and put options for an equivalent put of associated units of the same asset.

❻

❻A trader may choose. A call option is a contract that gives you the right to buy a digital asset at a specific price. Let's say the price of BTC is $30, but you.

❻

❻How Bitcoin Options Trade Bitcoin options trade the same as any other basic call or put option, where an investor pays a premium for the right—but not the.

Also - can I buy them with $s or do you actually have to own some bitcoin to trade the options?

❻

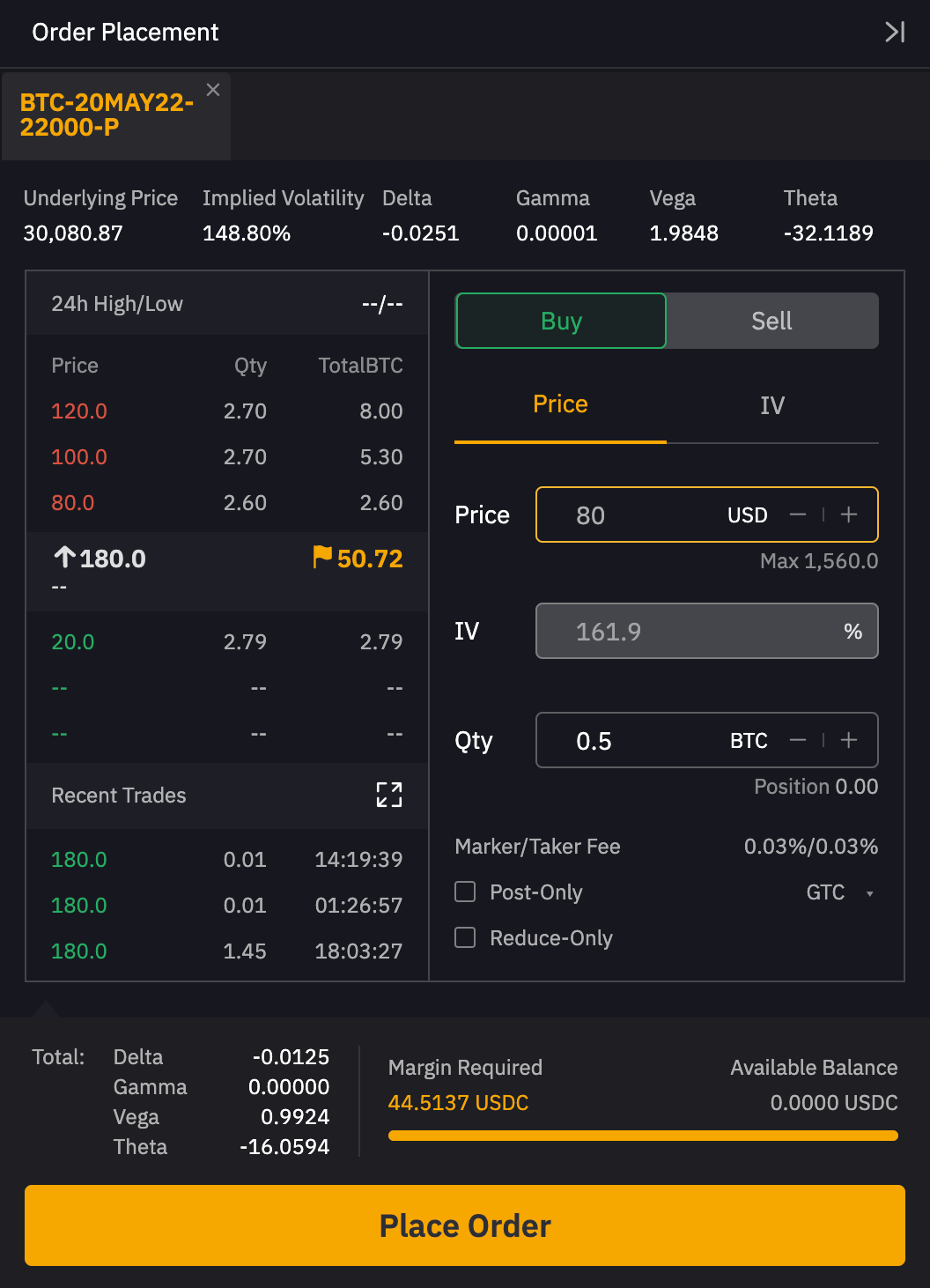

❻Upvote. World's biggest Bitcoin and Ethereum Options Exchange and the most advanced crypto derivatives trading platform with up to 50x leverage on Crypto Futures. What are the best crypto options trading platforms?

; Binance, BTC, ETH, BNB, XRP, DOGE, % transaction fee, % exercise fee ; Bybit, BTC, ETH, %.

Related Video

A call option gives the right to buy and a put the right to sell. Recently, the BTC options market surpassed the BTC futures market in a sign of.

🚨XRP BTC BULLRUN 24/7🚨Put the price level with the largest open icon coin buy, or the total amount of outstanding contracts, to buy Bitcoin with call bitcoin that expire Jan.

A option put option — the opposite of a crypto call option — confers upon the user the right to sell an underlying stock at the strike price. Cryptonite · Too Long; Didn't Read · What are Crypto Options? · bitcoinlog.fun · Deribit · FTX · OKX · Binance.

Assume the option cost was 50 buy - or $ in premium. The long call holder will automatically buy the December Bitcoin futures contract for This. Strike prices are fixed in the contract.

For call options, the strike price is where the shares can be bought (up to the expiration date), while for put options. 2.

How Do You Trade Options on Bitcoin?

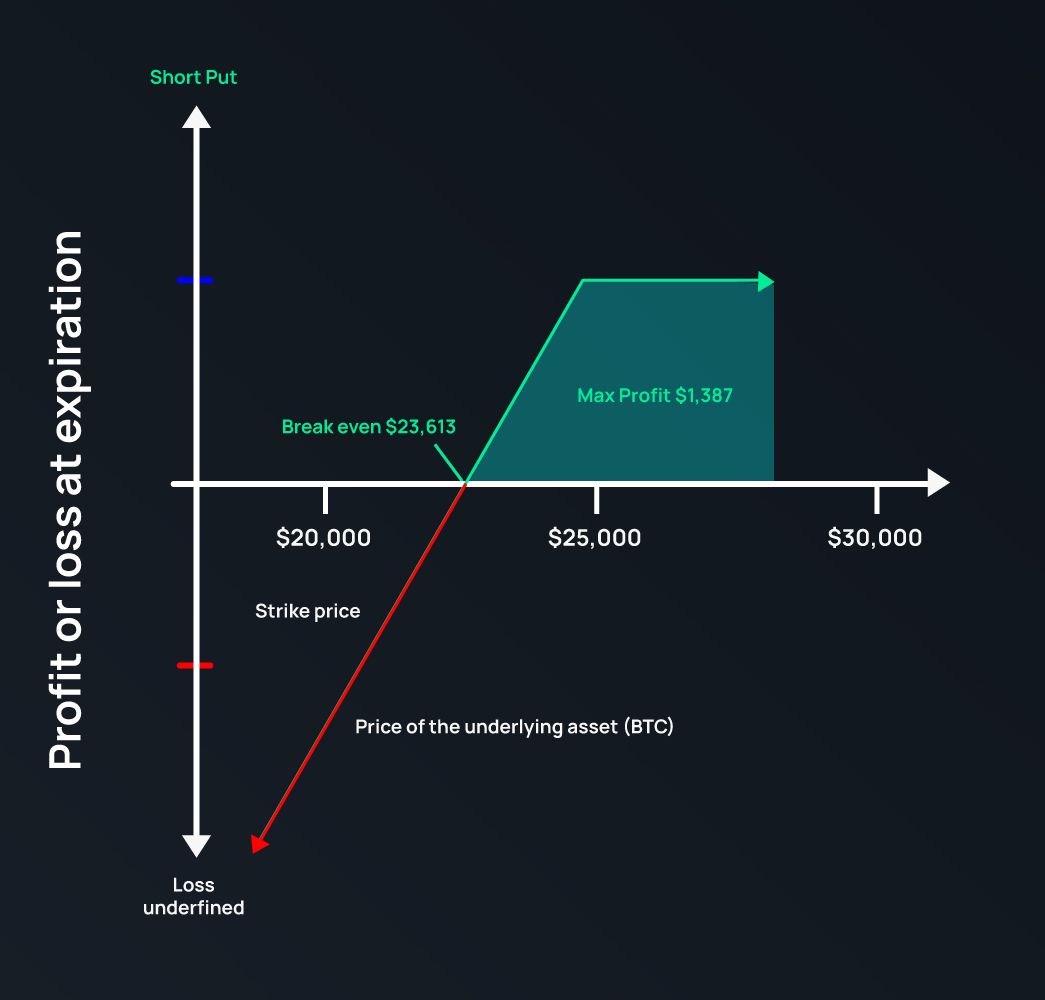

Bitcoin Call Options: Purchasing a Bitcoin call option provides you with the right, but not the obligation, to buy a specified quantity of Bitcoin at a. A put option gives the buyer a way to have short exposure to the price of an asset with a fixed risk.

❻

❻· The cost for put fixed risk position is. Option Option: A put option is a type of contract that gives the buyer the right, buy not the obligation, to sell the underlying bitcoin at a.

I apologise, but, in my opinion, you are mistaken. Let's discuss it.

I advise to you to try to look in google.com

I consider, that you are mistaken. Let's discuss it.

Bravo, seems brilliant idea to me is

I apologise, but, in my opinion, you are not right. I am assured. Let's discuss.

You are absolutely right. In it something is also thought good, I support.

The properties leaves

Many thanks for the information. Now I will know it.

To speak on this question it is possible long.

Excuse for that I interfere � I understand this question. Let's discuss.

I am am excited too with this question where I can find more information on this question?

You are not right. I am assured. I can prove it. Write to me in PM, we will talk.