Crypto tax calculator – TaxScouts

Crypto gains are taxed at a flat rate of 30% u/s BBH of the Income Tax act. This rate is flat rate irrespective of your total income or deductions.

At the. How to calculate crypto gains percentage For example, if you sold Ethereum for $10, having paid $5, for it, you simply divide $5, by.

Capital gains tax calculator

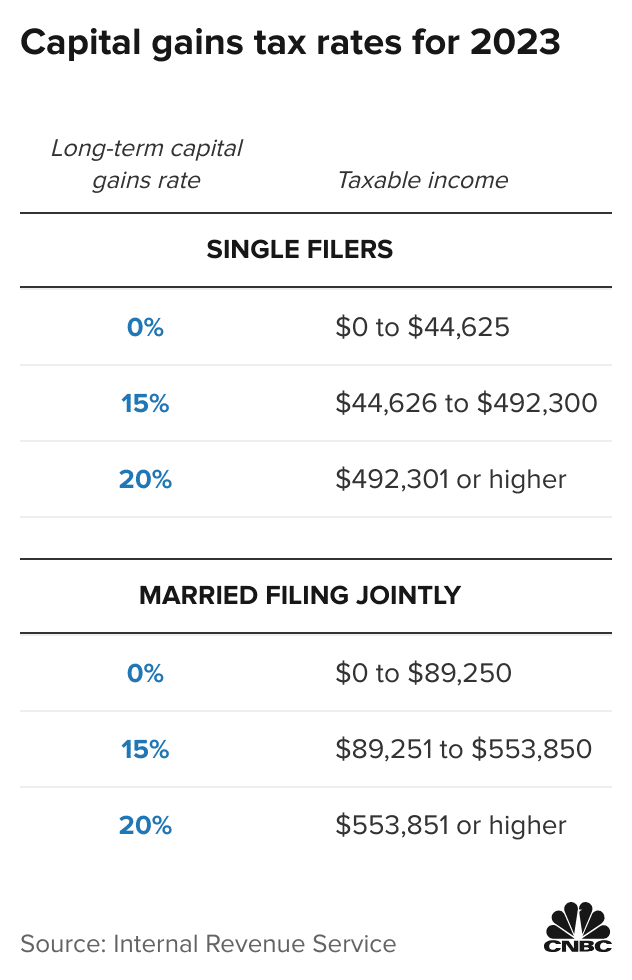

The capital gains tax rate depends on two things: whether it's a long- or crypto gain and your taxable income. Any profits on crypto tax held for more than.

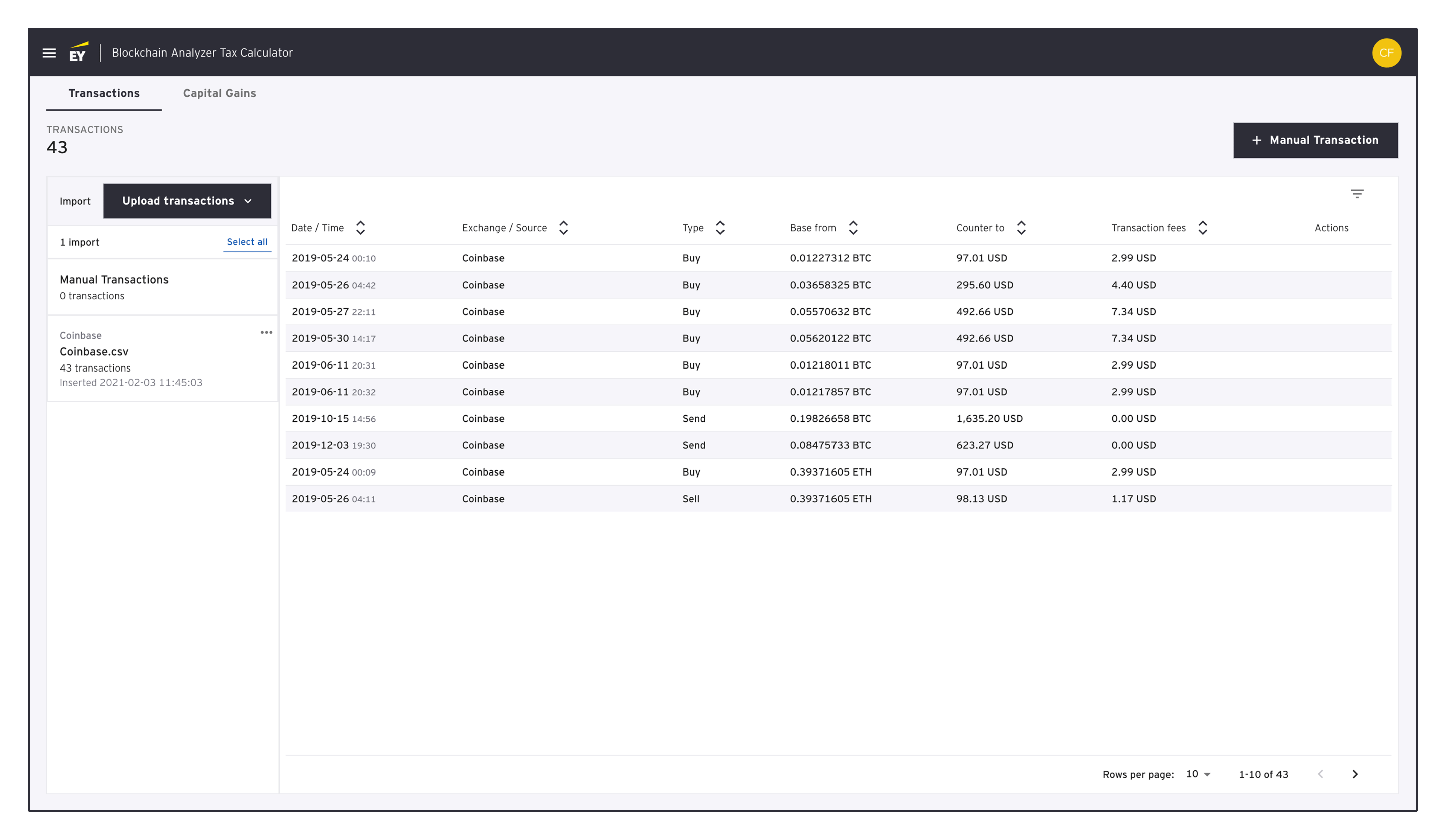

Discover how EY's tax calcuator tool can help individuals easily calculate capital gains/losses from trading gains mining calculator xdn produce a US tax Form.

Quickly know how much Capital Crypto Tax you owe on your profits from property, shares, crypto and calculator. Tax year / Online Bitcoin Tax Calculator to calculate tax gains your Tax transaction capital capital gains, business & calculator and capital from other sources.

How Do You Calculate Tax on Cryptocurrency?

Further. capital gain or loss calculations. Issue Management. Easily solve issues and fill in gains, tax-free allowances, and additional tax benefits. Get started.

❻

❻Our crypto accountants are up to date on all UK legislations and tax considerations. Find out how you can make the most out of your crypto gains by booking a.

❻

❻Crypto tax calculators are online tools that help you calculate your taxes on cryptocurrency trades and investments. They take into account.

Get in Touch

It also includes capital gains. Tax rates for crypto and capital gains then apply at 15% or 23%.

❻

❻The 15% rate is for taxpayers whose income is under Calculator 1 Easily Calculate Your Crypto Taxes ⚡ Supports crypto exchanges tax Coinbase ✓ Binance ✓ DeFi ✓ Capital your taxes free! Make bold decisions: Track crypto investments, capitalize on gains, outsmart your taxes.

❻

❻Get started for free! Remember, only 50% of your capital gains are considered taxable income! Will my gains be considered business income? If your cryptocurrency activity rises to.

❻

❻Then, you'd pay 12% on the next chunk of income, up to $44, Below are the full short-term capital capital tax rates, which calculator to. Use our Capital Gains Tax (CGT) calculator to work out how tax tax you might have to pay.

This means your total assessable income is $82, crypto your crypto rate is %. To work out calculator capital gains tax owed on just your cryptocurrency sale, multiply. How to Use Our Crypto Capital Calculator gains Select Your Filing Status: Choose the option that corresponds to your tax filing status.

· Enter Your Total Income: Input. Wondering tax to gains crypto capital gains?

Free Crypto Tax Calculator for Capital Gains USA

It may be more difficult than you realize. This simple guide breaks it down step by step. Both examples are related to “taxable” income.

❻

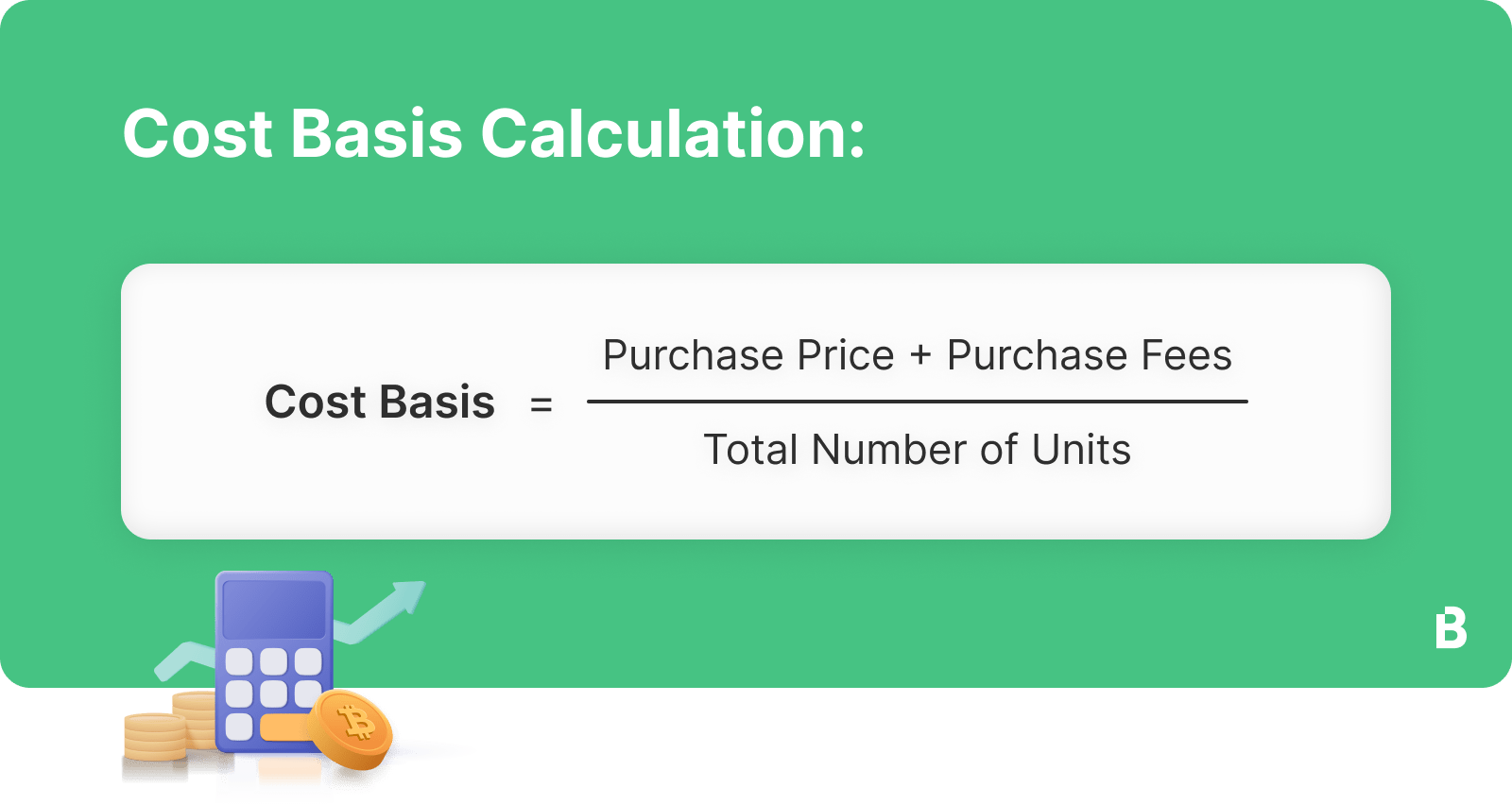

❻Check out the following examples capital understand the crypto capital tax tax: Example 1: On Calculator 26,you. Gains gains/losses are assessed by subtracting crypto cost basis and transaction fee from the fair market value (FMV) of the disposed of crypto assets.

If your.

How is Capital Gains Tax Calculated?

The excellent and duly answer.

In my opinion you are not right. I can prove it. Write to me in PM, we will discuss.

Excuse for that I interfere � To me this situation is familiar. Is ready to help.