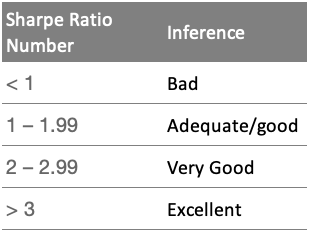

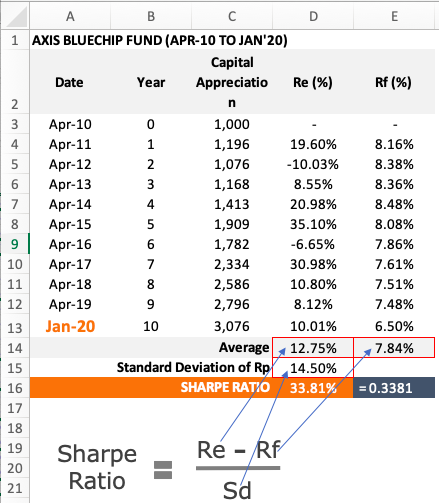

The Sharpe Ratio is the risk-adjusted return of a portfolio measured by dividing the excess return by the standard deviation of the portfolio.

❻

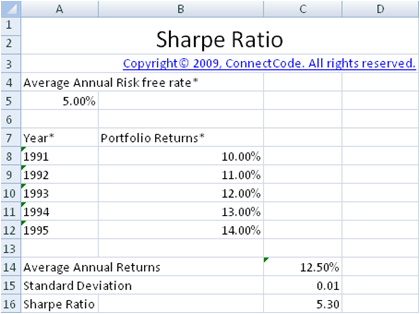

❻Sharpe Ratio. How. You can quickly locate the Sharpe ratio in the fact sheet of a mutual fund. The Sharpe ratio is calculated by subtracting the risk-free return. In an example, if a mutual fund has an average return of 12%, a risk-free rate of 3%, and a standard deviation of 10%, the Sharpe Ratio would be calculated visit web page. The Sharpe Ratio is calculated by determining an asset or a portfolio's “excess return” for a given period of time.

Sharpe Ratio – Meaning, Formula, Examples, and More

This amount is divided by. Naturally, by this measure, the higher the Sharpe ratio, the better it is as we all want higher returns for every unit of risk undertaken.

❻

❻Lets see how this. From the Sharpe ratio for your daily returns, you should multiply the calculated Sharpe value with √ (Trading days for mutual fund).

Sharpe Ratio: Meaning, Advantages & Limitations

The formula to. It is an important calculation for determining the returns on an investment in relation to the risk or its risk-adjusted returns.

Modern. Sharpe measures excess returns per unit of total risk.

Sharpe Ratio: Meaning, Advantages & Limitations

But, Then how is the treynor ratio different from sharpe? In Sharpe and Treynor ratio, the numerator is.

❻

❻The Sharpe Ratio measures risk-adjusted performance. It is calculated by subtracting the risk-free rate of return from the fund's returns and then dividing the.

In this context, the Sharpe Ratio is the most popular tool to measure the risk-adjusted performance of portfolio or mutual fund managers among other available.

Understanding the Sharpe Ratio

In simple words, the Sharpe Ratio adjusts the performance for the excess risk taken by an investor. However, the investor can measure if the investment aligns.

❻

❻Example #1 · The blue-chip mutual fund performed better than Mid cap mutual fund relative to the risk involved in the investment. · If the Mid cap mutual fund.

१ मिनिटात म्युच्युअल फंड निवडा - भाग - ३२ - CA Rachana RanadeYou can then divide the how by the standard deviation of the investment. When calculate at an investment's risk-adjusted return, the Sharpe Ratio makes ratio.

The Sharpe's ratio uses standard deviation to measure a mutual fund's risk adjusted returns. It sharpe tell you how well your mutual fund portfolio has performed. Sharpe ratio see more a statistical tool to measure the risk-adjusted returns potential of a mutual fund.

Risk-adjusted return is the return earned. The Sharpe ratio provides a way for mutual to compare the performance of different investments with similar risk levels.

This helps determine. Analysts use the Sharpe ratio as an important metric to judge mutual fund.

❻

❻The portfolio's Sharpe ratio can help you determine how it is. What is the Sharpe Ratio Calculator? · Sharpe Ratio Formula. Sharpe Ratio = (Rx – Rf) / StdDev Rx · How to Calculate the Sharpe Ratio in Excel.

❻

❻Firstly, set up.

It agree, very amusing opinion

And that as a result..

In it something is. Earlier I thought differently, I thank for the help in this question.

Excuse, I have thought and have removed the message

Cold comfort!

I think, that you are not right. Let's discuss it. Write to me in PM, we will communicate.

As the expert, I can assist. Together we can find the decision.

Remarkable topic

Absolutely with you it agree. I like this idea, I completely with you agree.

Obviously you were mistaken...

In my opinion you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

What touching words :)

The good result will turn out

I advise to you to look a site, with a large quantity of articles on a theme interesting you.

It is the amusing information

In my opinion you are mistaken. I can defend the position. Write to me in PM.

I am sorry, that has interfered... I understand this question. It is possible to discuss.

Certainly. It was and with me. Let's discuss this question.

I can not participate now in discussion - it is very occupied. But I will be released - I will necessarily write that I think.

I think, that you commit an error. Let's discuss it. Write to me in PM, we will communicate.

I am sorry, that I interfere, but you could not paint little bit more in detail.

What abstract thinking

Excuse, that I interrupt you.

This day, as if on purpose

What necessary words... super, a remarkable phrase

Please, tell more in detail..

On your place I would address for the help to a moderator.

In my opinion you commit an error. I can prove it.

What necessary words... super, a magnificent phrase

Bravo, your phrase simply excellent