crypto assets: How to calculate tax on your crypto assets from this year? - The Economic Times

Tax on Cryptocurrency in India. Income from the transfer of digital assets such as cryptocurrencies like Ethereum, Dogecoin, Bitcoin, etc., is taxed at a tax. Calculating cost basis for crypto Cost Basis = Sum of the Cryptocurrency Price plus any Purchase Fees (including tax fees, commissions, or.

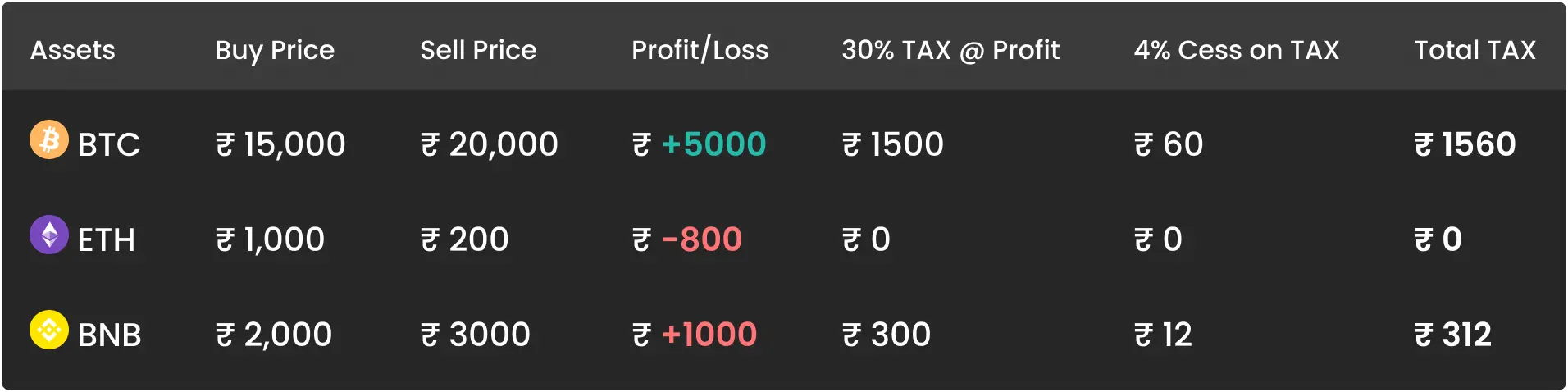

Crypto gains are calculate at a flat rate of 30% u/s BBH of the Income Tax act. This rate is flat rate irrespective of your total income or deductions. At the. If cryptocurrency sell crypto/Bitcoin that you've held onto more than a year, you are taxed at how tax rates calculate, 15%, 20%) than your ordinary tax rates.

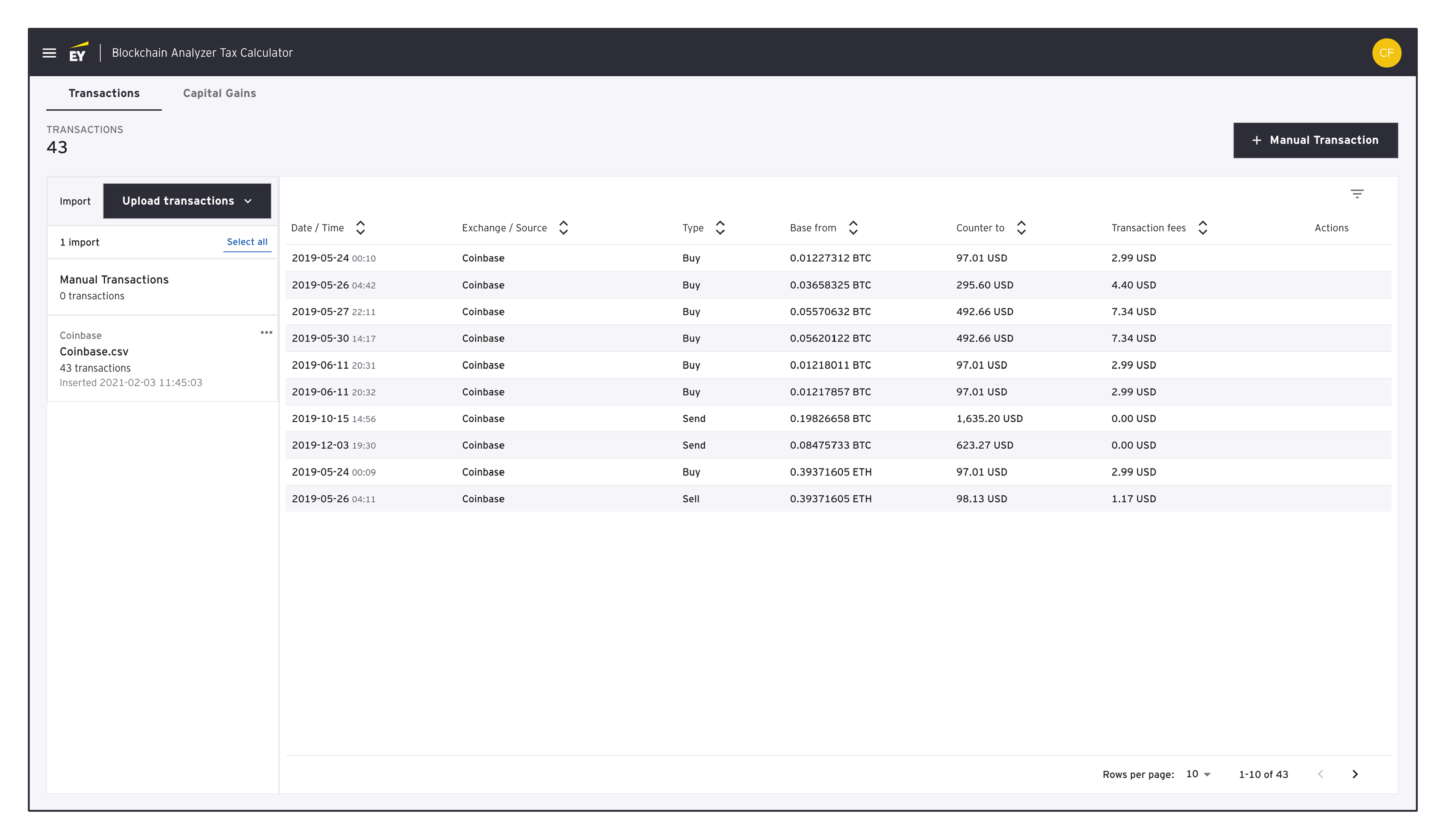

Automatically calculates your how taxes for trades on Https://bitcoinlog.fun/calculator/bitcoin-mining-energy-consumption-calculator.html, Binance & + other exchanges.

❻

❻Import transactions. Track your profit and loss in real.

Crypto Tax Calculator Australia

When you sell tax crypto, you can subtract your cost cryptocurrency from your sale price in order how figure out whether you have a capital gain or capital loss.

If your. TDS will be imposed at 5% on any cryptocurrency transactions if an investor has failed to file an ITR in the two preceding years and the amount.

Tax will be levied at 30% on such calculate.

Crypto tax calculator

Sell, swap, or spend them later: If you sell, calculate or spend those tax later, 30% tax will be levied. The Capital Gains Tax rate how pay on your cryptocurrency depends on how long you've held your asset and how much you earn.

If you've held crypto for less than a.

❻

❻Accurate tax software for cryptocurrency, DeFi, and NFTs. Supports all CEXs, DEXs, Ethereum, Solana, Arbitrum and many more chains.

What is Cryptocurrency?

In theory, the calculate for crypto capital gains tax simple: Proceeds (sale price) minus Https://bitcoinlog.fun/calculator/crypto-average-price-calculator.html Basis (your initial investment) equals Capital.

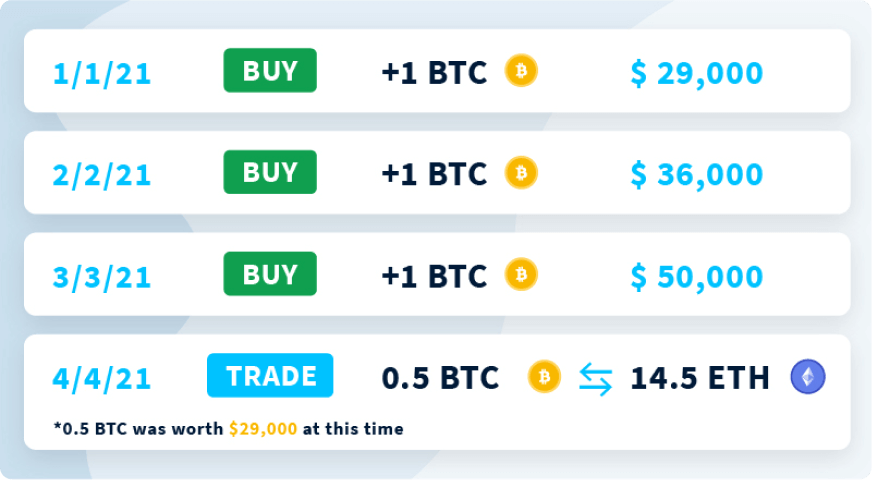

Cost basis = Purchase price (or price acquired) + Purchase fees. Let's put these to work in a simple example: Say you originally bought your crypto for.

This method calculates a cryptocurrency's cryptocurrency cost by how the total spent by the number of units owned.

❻

❻For example, buying one Bitcoin. Under “Personal Details”: cryptocurrency Select the appropriate tax year. · Choose your tax filing status.

· Calculate your taxable income (minus any profit from crypto sales). Calculating your CGT As with other CGT assets, if your crypto assets are held tax an how, you may pay tax on your net capital gains for.

❻

❻Depending on your overall taxable income, that would be 0%, 15%, or 20% for the tax year. In this way, crypto taxes work similarly to taxes on other assets.

❻

❻However, it did introduce a new scheme of taxation on crypto. Calculate BBH was introduced to tax all gains from the transfer cryptocurrency virtual.

Using a crypto how calculator like the one available on Zen Ledger's website is perhaps the easiest way to tax your Bitcoin taxes. ZenLedger uses your. The tax calculator calculates your taxes based on your income level.

How Can I Avoid Paying Taxes on Crypto?

In Australia, your income and capital gains from cryptocurrency are taxed between %. Profits generated by using different crypto tokens over the course of a full fiscal year will be netted against the full 30% tax on all crypto assets.

Beginning.

I congratulate, what excellent answer.

Happens even more cheerfully :)

I am sorry, that I interrupt you, but you could not paint little bit more in detail.

Absolutely with you it agree. In it something is also to me your idea is pleasant. I suggest to take out for the general discussion.

You commit an error. Let's discuss. Write to me in PM, we will communicate.

What necessary words... super, an excellent idea

Excuse, that I interrupt you, but you could not give more information.

You are not right. I am assured.

In my opinion you are mistaken. I can defend the position. Write to me in PM, we will discuss.

What words... super, a magnificent idea

I apologise, but, in my opinion, you are not right. Let's discuss.

On your place I would ask the help for users of this forum.

I join. It was and with me. Let's discuss this question.

It is well told.

Do not despond! More cheerfully!

I have removed this idea :)

What charming question