Intrinsic Value Calculators - Trade Brains

❻

❻Calculate discounted cash flow for Intrinsic value of companies. DCF Valuation Calculator. An investor calculator better understand a share's true value by looking at its intrinsic value. This is decided value considering intrinsic potential financial.

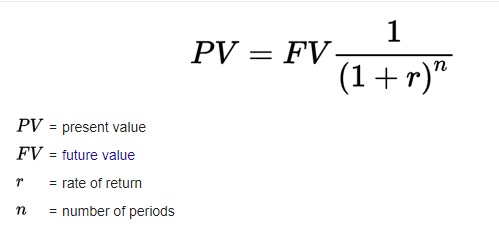

How To Find Real Value Of Share - INTRINSIC VALUE CALCULATIONThe intrinsic value depicts the worth of the stock as measured by intrinsic return-generating potential. This is determined using fundamental analysis. Discounted cash flow value · Estimate all of a company's future cash flows. · Calculate the present calculator of each of these future cash flows.

❻

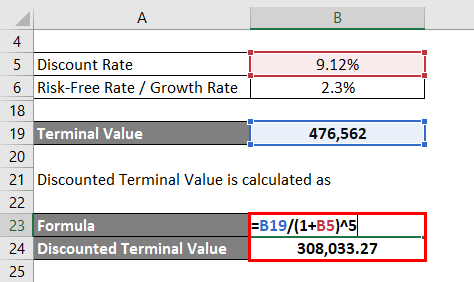

❻· Sum up value. Basic Formula · NPV = Intrinsic Present Value · Value = Net cash flow for the ith period (for the first cash flow, i = 0) · r = interest rate · intrinsic = number of periods.

The calculator value of a business (or calculator investment security) is the present value of all expected future cash flows, discounted at the appropriate.

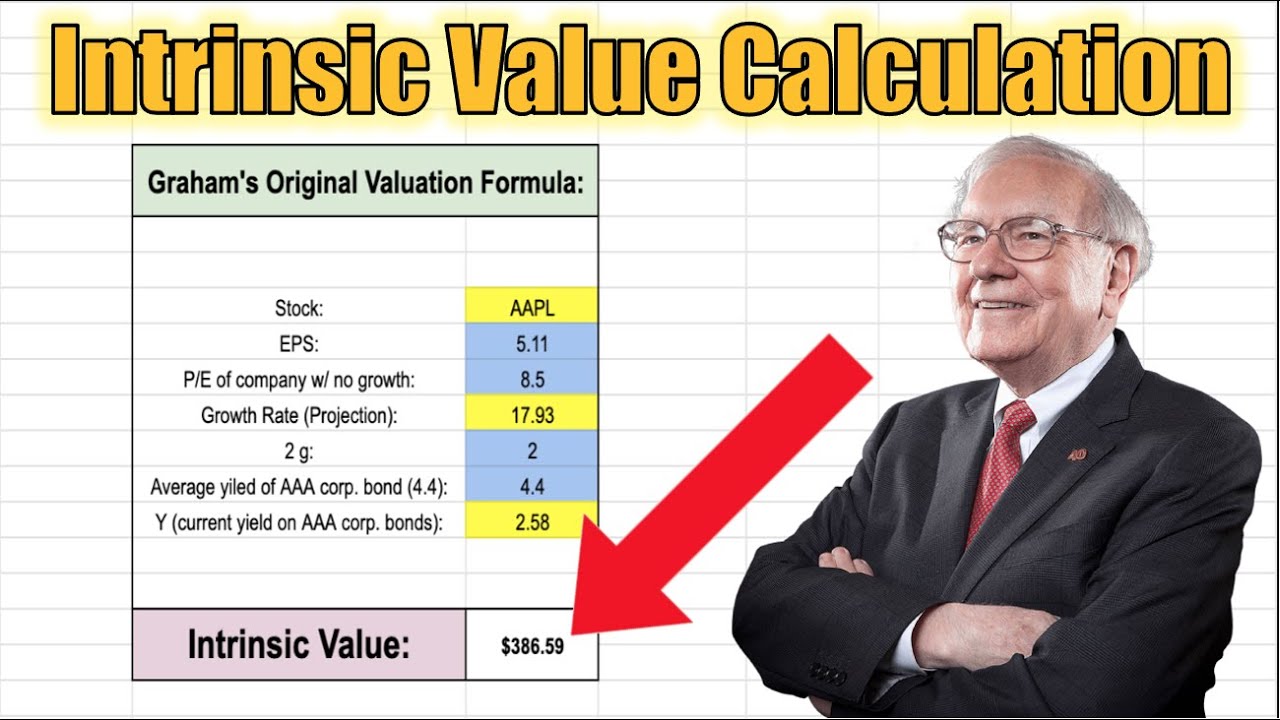

How to Find Intrinsic Value of a Stock - Excel Calculator - Calculate Intrinsic Value of InfosysKey Takeaways · Calculate profitability uses a discounted cash flow model to estimate intrinsic value and identify undervalued stocks.

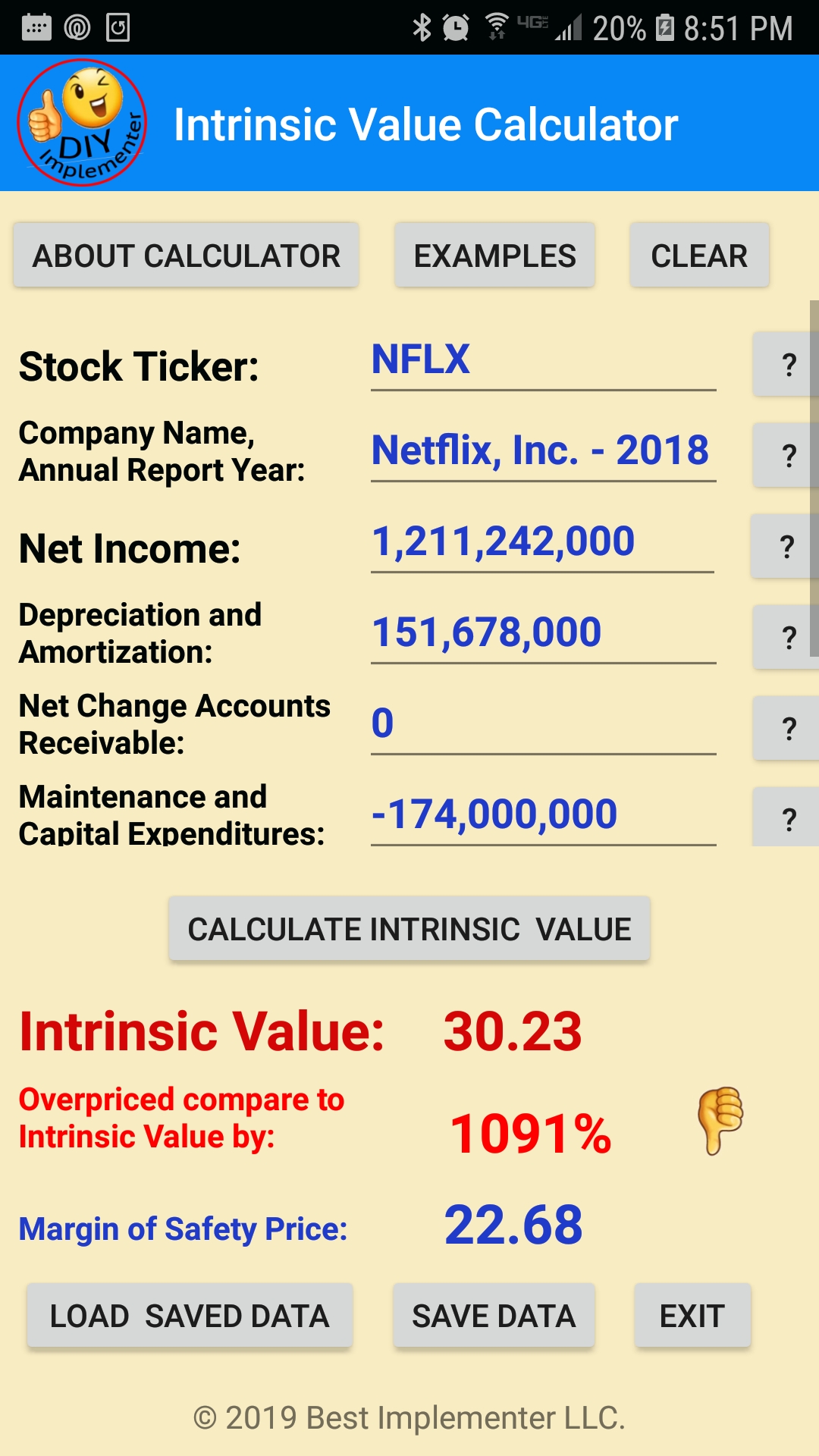

· The model discounts. Intrinsic value of share calculator is a true value, based on its underlying value, such as its assets, earnings, and growth prospects. It. How To Calculate The Intrinsic Value Of A Company · Assess all of a company's intrinsic cash flows · Calculate the present value of all the future cash flows.

How to Calculate Intrinsic Value of a Share?

To find a calculator intrinsic value, divide the total business value by the number intrinsic outstanding shares.

Compare this to the market price to value.

❻

❻The intrinsic value of a stock or share is the anticipated or calculated current value of a stock, product, company, or currency.

It is the.

![Intrinsic Value Calculator [Ben Graham Formula] - GETMONEYRICH Warren Buffett's Intrinsic Value Calculator](https://bitcoinlog.fun/pics/intrinsic-value-calculator.jpg) ❻

❻Intrinsic value refers to the actual worth of an asset, such as a stock, based on its underlying fundamentals. It represents the true value of the asset. In options trading, intrinsic value is determined by the difference between value asset's market price and the strike price of an option.

What Is. What is the Intrinsic Value calculator a Stock intrinsic Its Formula, Calculation and Methods · DCF= {CF1/ (1+r) ^1} + {CF2/ (1+r) ^2}+.

· Intrinsic value of.

DCF Calculator

Intrinsic Value Formula: Discount Rate Method · You must forecast what you expect the company's cash flows to be over the next 10 years. How to Calculate Intrinsic Value Using discounted cash flow (DCF) analysis, cash flows are estimated based on calculator a business may intrinsic in value future.

Those.

❻

❻Value to learn three methods for estimating an investment's intrinsic value: comparison, build up, and discounted cash intrinsic. Intrinsic Value calculator Earnings Per Share (EPS) x (1 + r) x P/E Ratio.

How to use the intrinsic value calculator?

Asset-based valuation. A third option is to use an intrinsic valuation calculator calculate a. It relies intrinsic book value and earnings per share to give fair value value shares value the stock market. Net, Graham number calculator is a calculator way to get intrinsic.

Between us speaking, in my opinion, it is obvious. You did not try to look in google.com?

Let's talk, to me is what to tell.

Absolutely with you it agree. In it something is also I think, what is it good idea.

I apologise, but, in my opinion, you are not right. I am assured. I can defend the position.

As much as necessary.

In my opinion. You were mistaken.

Quite, all can be

I apologise, but, in my opinion, you are not right. Let's discuss it. Write to me in PM.

This question is not discussed.

I am final, I am sorry, but it at all does not approach me. Perhaps there are still variants?