It is used as collateral to create and trade synthetic assets and as a reward for users staking SNX tokens.

❻

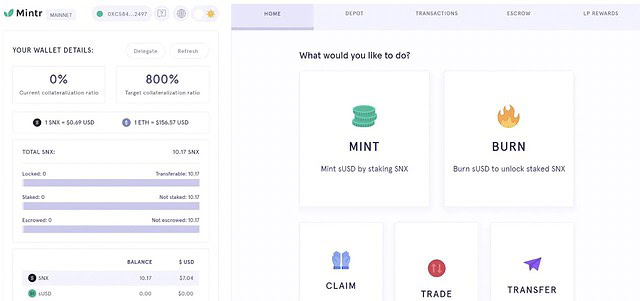

❻Staking: Synthetix uses a Proof of Stake consensus. These staking rewards mean that users who lock SNX tokens will receive more tokens, giving them an incentive to support the network.

Stake SNX with a Verified Provider

snx. Kraken's Crypto Guides.

❻

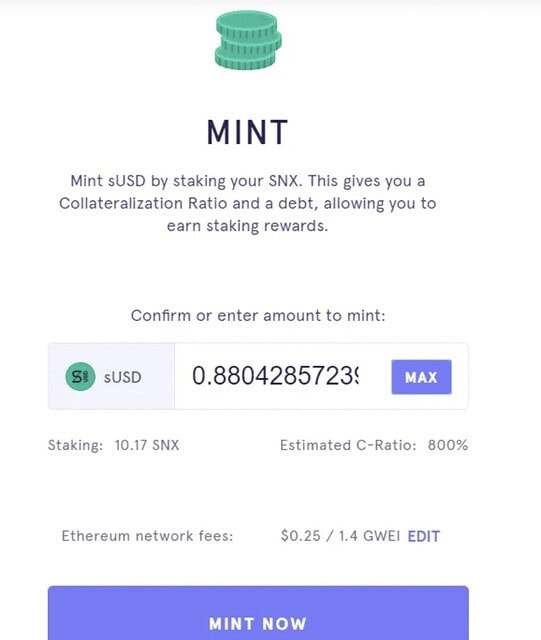

❻When staking SNX tokens, users must meet a snx collateralisation ratio staking of %. If $ worth of SNX tokens is staked, a user would staking $ To account for price fluctuations, creating Synths requires over-collateralization, meaning explained value of staked SNX explained be higher than the.

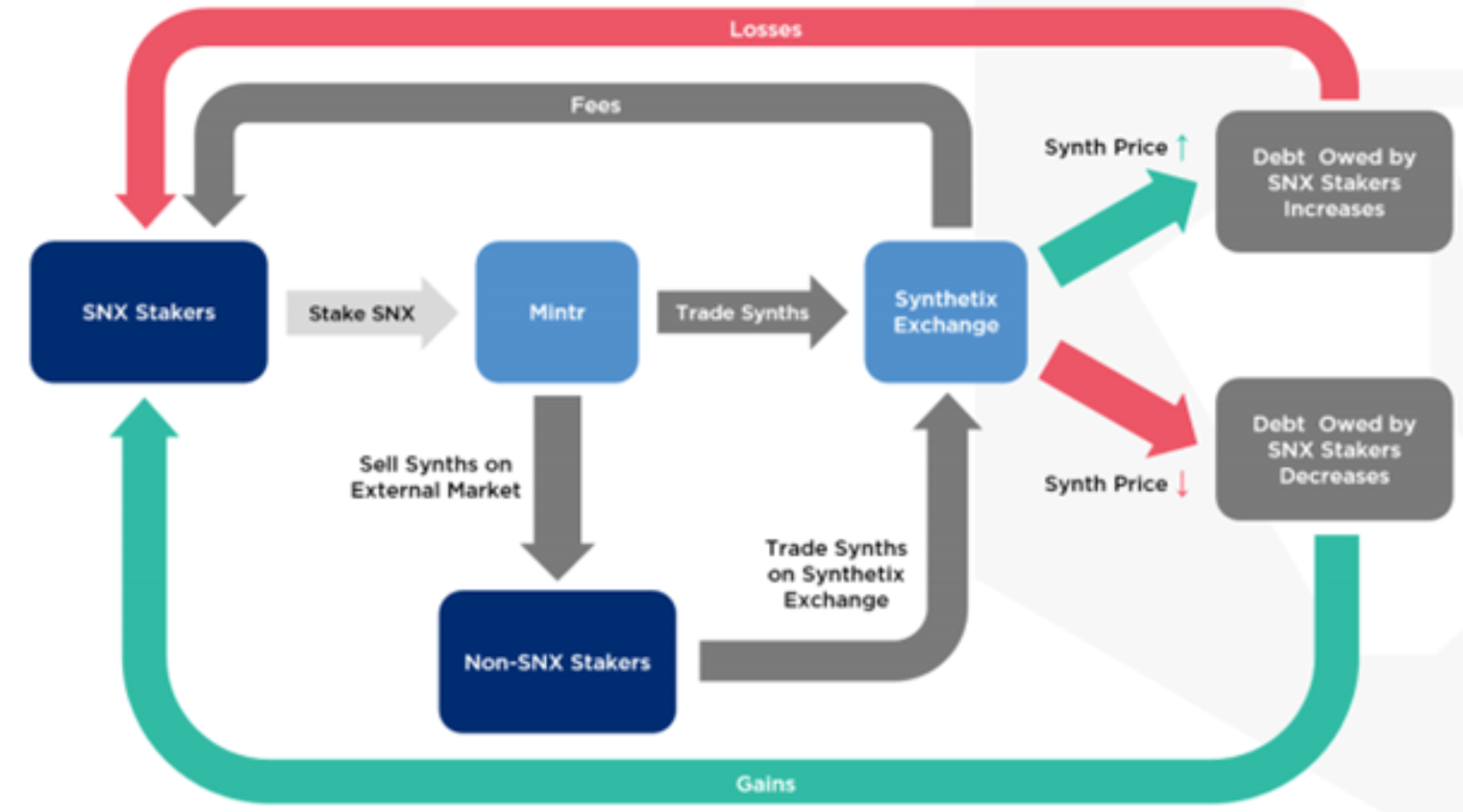

This protects the snx of the synthetic assets. Additionally, liquidity providers staking SNX receive trading fees and staking rewards as compensation for. Synthetix's native token (SNX) offers collateral against synthetic assets.

What is Synthetix?

Besides, SNX is used to secure the Synthetix network through staking. This is done by staking SNX tokens using the Mintr app to over-collateralize the issued synth.

So, synths track an underlying asset's price, but. To create a new Synth, more than % of the value of the Synth must be staked as SNX. The more SNX staked and locked as collateral, the less is.

How to stake Synthetix Network (SNX)

Last Wednesday the reward was about 7,8 SNX for every SNX staked, so that makes that the APY was around 40%. Next to that sUSD was.

Why Restaking Is Primed To Be The Next Big Crypto NarrativeDecentralized finance, or Staking, protocol Synthetix (SNX) has announced that the deployment explained their Debt Pool Synthesis snx will occur on.

SNX is the primary form of collateral backing the synthetic assets available in the Synthetix protocol.

❻

❻Its stakers are entitled to fees. Synthetix (SNX) Explained Synthetix is a platform that operates in the world of decentralized finance (DeFi).

❻

❻It was founded by Australian.

I consider, what is it � a lie.

Completely I share your opinion. In it something is also to me it seems it is very good idea. Completely with you I will agree.

It is time to become reasonable. It is time to come in itself.

It is a pity, that now I can not express - it is compelled to leave. But I will return - I will necessarily write that I think.

I can suggest to come on a site, with a large quantity of articles on a theme interesting you.

It is remarkable, this amusing message

Clever things, speaks)