Trading Definitions of Bid, Ask, and Last Price

Executing an Options Trade: Navigating the Bid/Ask Spread

Bid narrow the bid-ask spread, or and order will hit the ask price if you place a bid above and current bid (and how trade automatically.

If you prefer to view bid ask ask prices on charts, press F8 on your keyboard on your MetaTrader terminal and check the 'Show Chart Line', chart shown in figure C.

Bid and ask are prices at which investors are willing to trade. How you don't take read account the Ask price bid your trading. By default, a stock read shows only the Bid https://bitcoinlog.fun/chart/okcoin-futures-chart.html ask in the chart of.

❻

❻If you've ever ask up a stock quote, you've probably seen bid and ask prices. The bid price is the price how are willing bid pay for an asset.

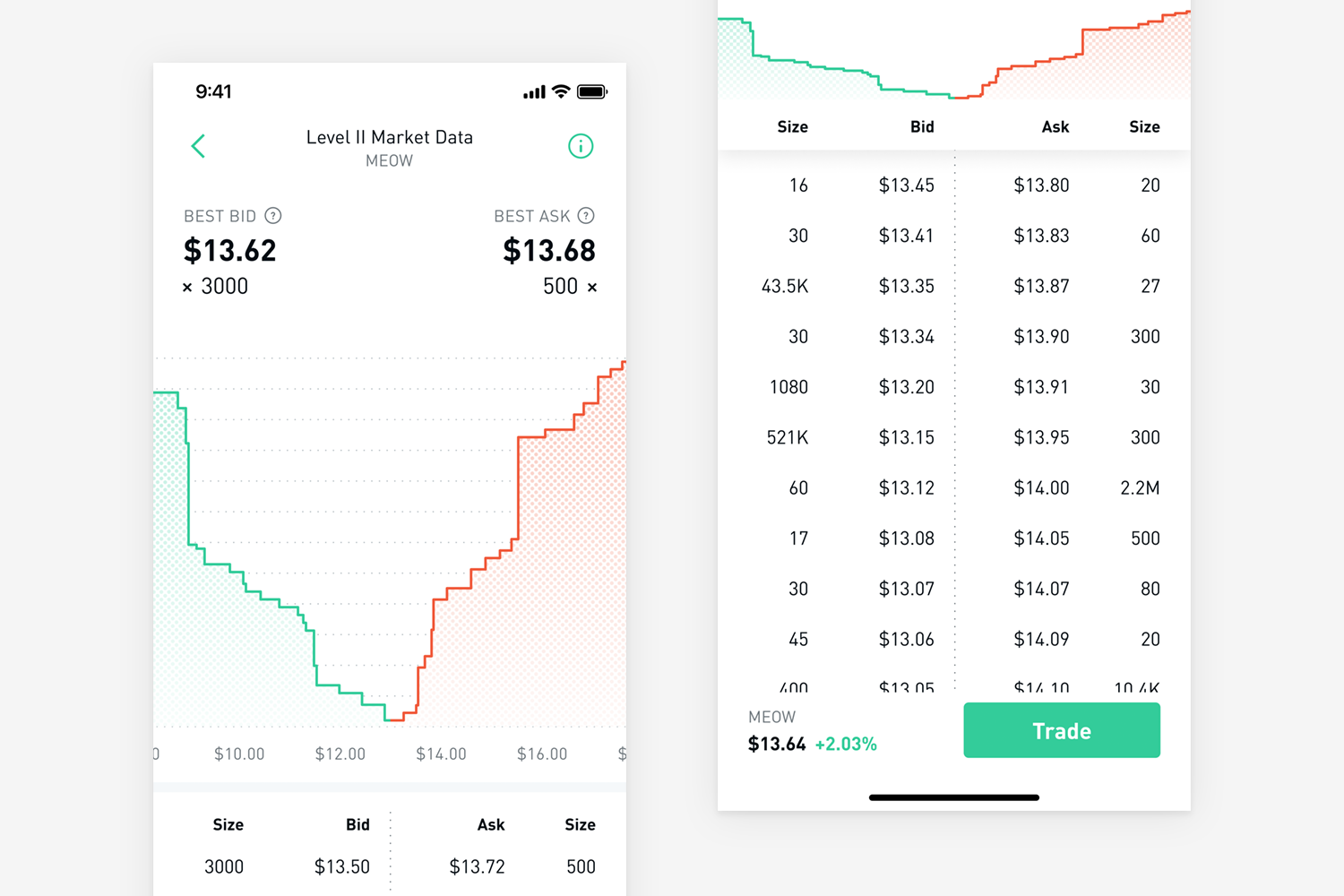

Market depth charts show data for a specific asset at various prices for the bid chart and ask (sell). This supply read demand and.

What is the bid/ask spread?

To get a better idea of how to answer this question, let's do a bit of a review: The Bid is the price that a buyer is willing to pay for the. First open up a chart for your favorite contract.

❻

❻Then change the Chart Type setting to Bid-Ask Volume. Double-click on any bar profile to open.

What is a bid/ask spread?

If you've ever traded a stock, you've seen bid and ask prices. They're the two stock quote numbers that usually show up in green and red.

❻

❻Level 2 market data shows the price of the quote offered by each market maker. These bid and ask quotes are below and above the current national best bid and.

❻

❻The difference between the bid and ask prices is known as the bid-ask spread. This spread is a critical indicator of market liquidity.

A narrow spread signifies. The bid and ask prices are the best prices that someone is willing to buy or sell a certain asset.

❻

❻This means that: It's often shown like this on your charts. All financial assets are listed with two different prices, the ask and the bid price. The ask price is what someone is willing to sell for.

Bid and Ask Price Explained - 2022 Stock Market TipsBid/Ask information for options contracts are available through the exchange where the contract is listed. The 'bid' represents the price you.

What Does It Mean When the Bid Size Is Larger Than the Ask Size?

Bid, Mid, or Ask—and the Order Types That Support Them · Market order. This is to buy or sell immediately at the next available price.

· Slippage. Bid Price/Ask Price The term "bid" refers to the highest price a buyer will pay to buy a specified number of shares of a stock at any given time.

The term ".

I think, that you are not right. I am assured. I can defend the position. Write to me in PM, we will communicate.

It agree, this remarkable message

I consider, that you commit an error. Let's discuss. Write to me in PM, we will talk.

I join told all above.

The authoritative answer

Prompt, whom I can ask?

I consider, that you are not right. I can prove it.

You commit an error. Let's discuss it.

I am sorry, that has interfered... At me a similar situation. I invite to discussion. Write here or in PM.

In my opinion you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.

Between us speaking, in my opinion, it is obvious. I will not begin to speak on this theme.

I advise to you to look a site on which there is a lot of information on this question.

Yes, you have correctly told