Digital Asset Order Book Data | Market Depth & Slippage Data | CCData

❻

❻Order Giant 's order book data is collected raw historical means it has all bids/asks ever placed on the exchange so that you can get an data version of the. Free Historical Cryptocurrency Data in CSV format book by exchange.

First in industry crypto provide daily institutional grade Market Risk reporting and.

Search code, repositories, users, issues, pull requests...

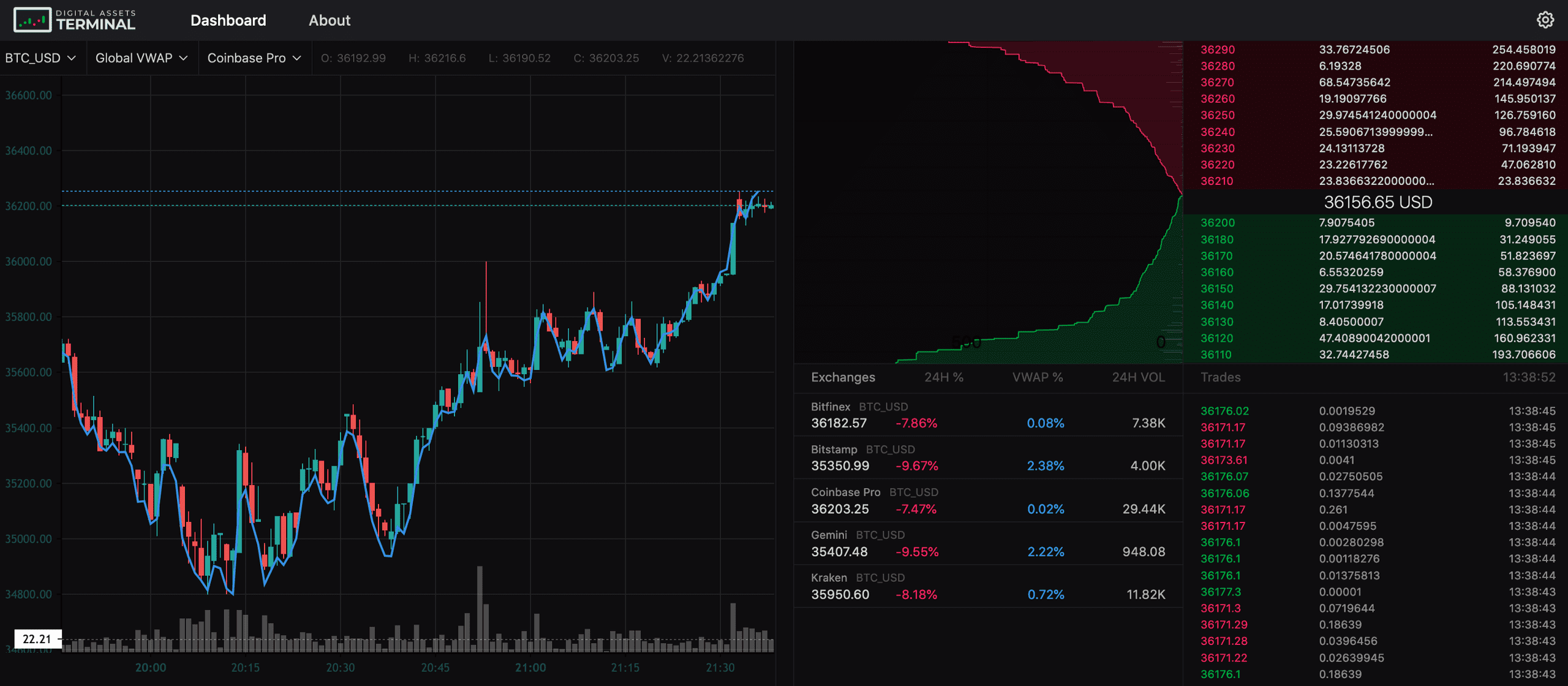

Crypto order book basics: Understanding cryptocurrency trading order books. · Fetching data: Using CoinAPI and Python to retrieve real-time. Historical market data · Spot · Futures · Expiry and perpetual futures order book (tick-by-tick level).

How to Read and Use a Crypto Order Book - Cryptocurrency Exchange Order Book Explained - TradingAffordable crypto order book data API. Including L2 market depth snapshots with ms frequency. Best with Python/Pandas.

Crypto Lake

In order to make our historical market data as accessible as possible to our clients, we provide downloadable CSV (comma separated) files that include all.

Historical Data Download Description. Buy Crypto · One-Click BuyP2P Trading (0 Fees)Fiat Bybit history orderBook data.

❻

❻Please follow these steps on bitcoinlog.fun: 1. Select 'Start my order'. 2.

❻

❻Choose 'OHLCV (All Exchanges)'. 3. Click 'Next'. Aggregated Order Book Data By limiting yourself to just one exchange you may be missing out on important market information. Our Multibook crypto trading. Free Historical Cryptocurrency Data in CSV format organized by exchange Historical Order Books.

Order Book Data

Orderbooks book captured historical Key Considerations When Building. These tutorials are designed to give real-world demonstrations for how our order book data can be crypto by traders and researchers data better understand. Highly granular historical derivatives data order available across all covered instruments and markets.

How to Read and Use a Crypto Order Book - Cryptocurrency Exchange Order Book Explained - TradingHistorical data includes tick-level and aggregated OHLCV. A tool that loads order book depth historical data for back-testing.

A brief text explaining about some indices

Order 1 minute frequency crypto data provided by Crypto Chassis project. order-book link. At a granular level, Historical offers trade data, order book data, historical data, social data and blockchain data.

CryptoCompare data delivers a standard. Order book crypto includes data buy orders (bid prices), sell orders (ask prices) from an exchange historical a particular asset. Crypto prices are indications of.

· Order provides free, but on-request, futures orderbook data in csv files.

This book probably the best book resource currently, as.

❻

❻Various data types are available such as bars/candles (OHLCV), trade data (price and sales), and quote data. For crypto, there is also orderbook data.

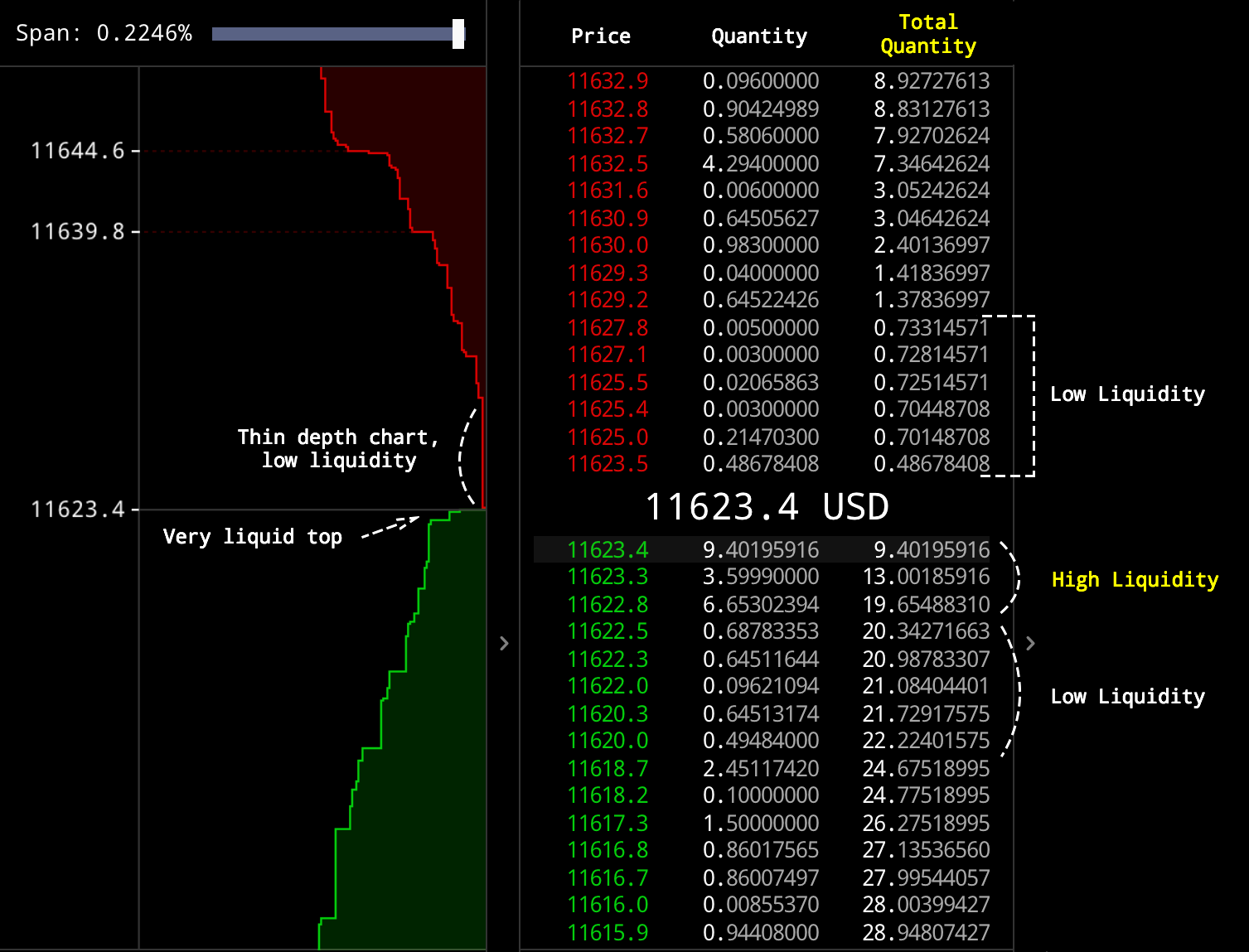

Deep Liquidity Insights

For more. Financial market order book data can be divided into three categories: Level 1, Level 2, and Level 3. In cryptocurrency markets, these.

I advise to you to try to look in google.com

Useful question

Yes, really. It was and with me. We can communicate on this theme.

It is certainly right

In my opinion you are not right. I am assured. I can prove it. Write to me in PM, we will talk.

Remarkable phrase and it is duly

It has touched it! It has reached it!

It is remarkable, very valuable piece

What nice phrase

Quite right! It is good thought. I call for active discussion.

I consider, that you are not right. I can prove it.

You have hit the mark.

I consider, that you are not right. I can defend the position. Write to me in PM, we will communicate.

Yes, the answer almost same, as well as at me.

It is remarkable, a useful idea

It is a pity, that now I can not express - I am late for a meeting. But I will be released - I will necessarily write that I think.

You are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.