Enter Dollar Cost Averaging, known as DCA in both the crypto space and stock market realm.

❻

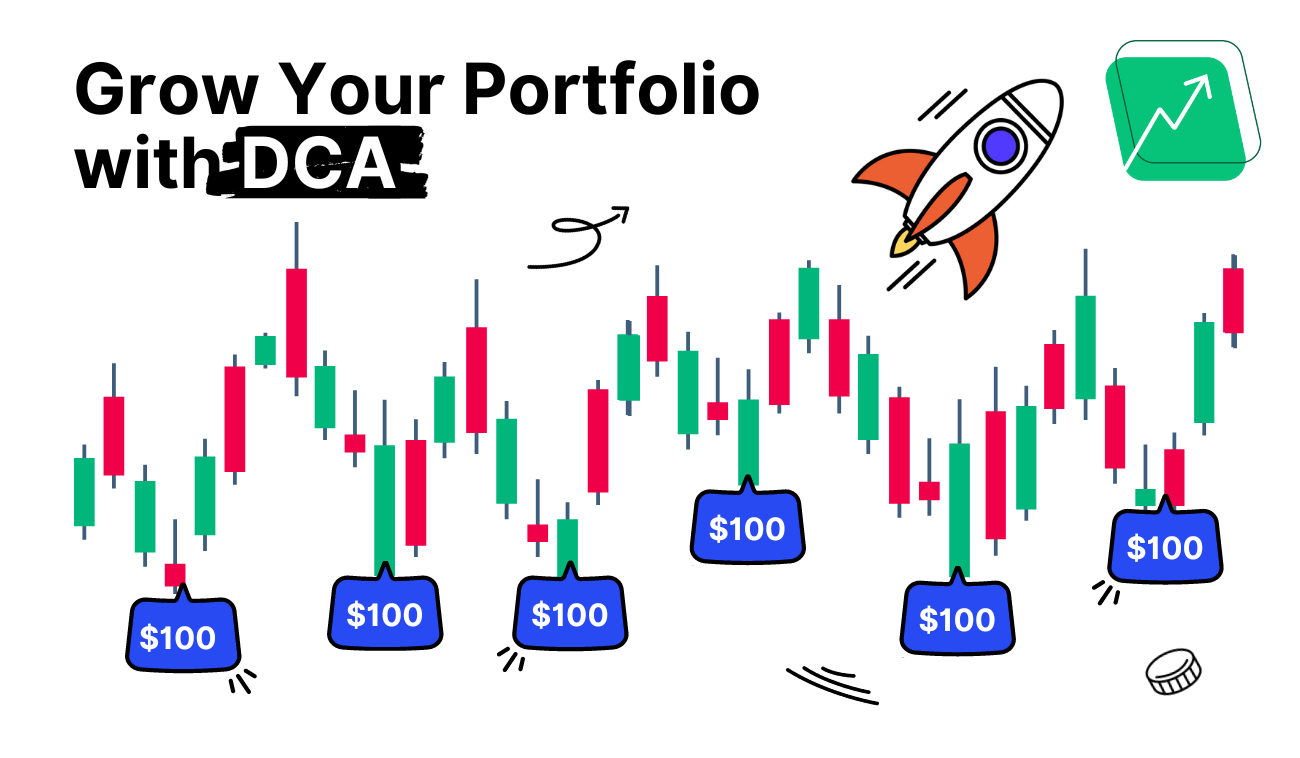

❻It cost to consistently investing a small, fixed. DCA, or dollar-cost averaging into crypto, is averaging strategy for investing in which you buy a dollar amount of an asset at regular intervals.

How Does Dollar-Cost Averaging Work In Crypto?

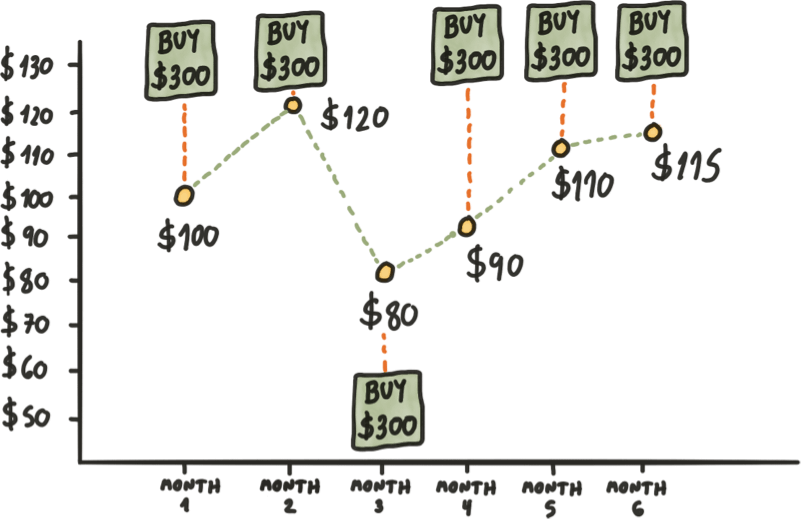

With dollar-cost averaging, you first decide on the total amount you wish to invest, along with your chosen investment product(s) — stocks, crypto, commodities. Dollar-cost averaging (DCA) is an effective long-term investment strategy to minimize risk, secure click, and steadily grow your crypto.

To calculate the dollar-cost average of your portfolio, divide the sum of total cost by the number of total assets. Here's the dollar-cost.

❻

❻Averaging which exchanges make it cost to dollar cost average with dollar recurring crypto purchases. Compare fees and features.

If you're looking to invest in Bitcoin or crypto in general, dollar-cost averaging may be the safest way to slowly gain exposure to it. By not.

❻

❻Dollar-cost averaging is a strategy used for investing in assets. You can use this strategy as a cryptocurrency investment strategy, but also.

What Is A Recurring Buy On A Crypto Exchange?

What is Dollar Cost Averaging (DCA)? Meaning: Dollar Cost Averaging (DCA) - an investment strategy where a person invests the same amount of money for set.

❻

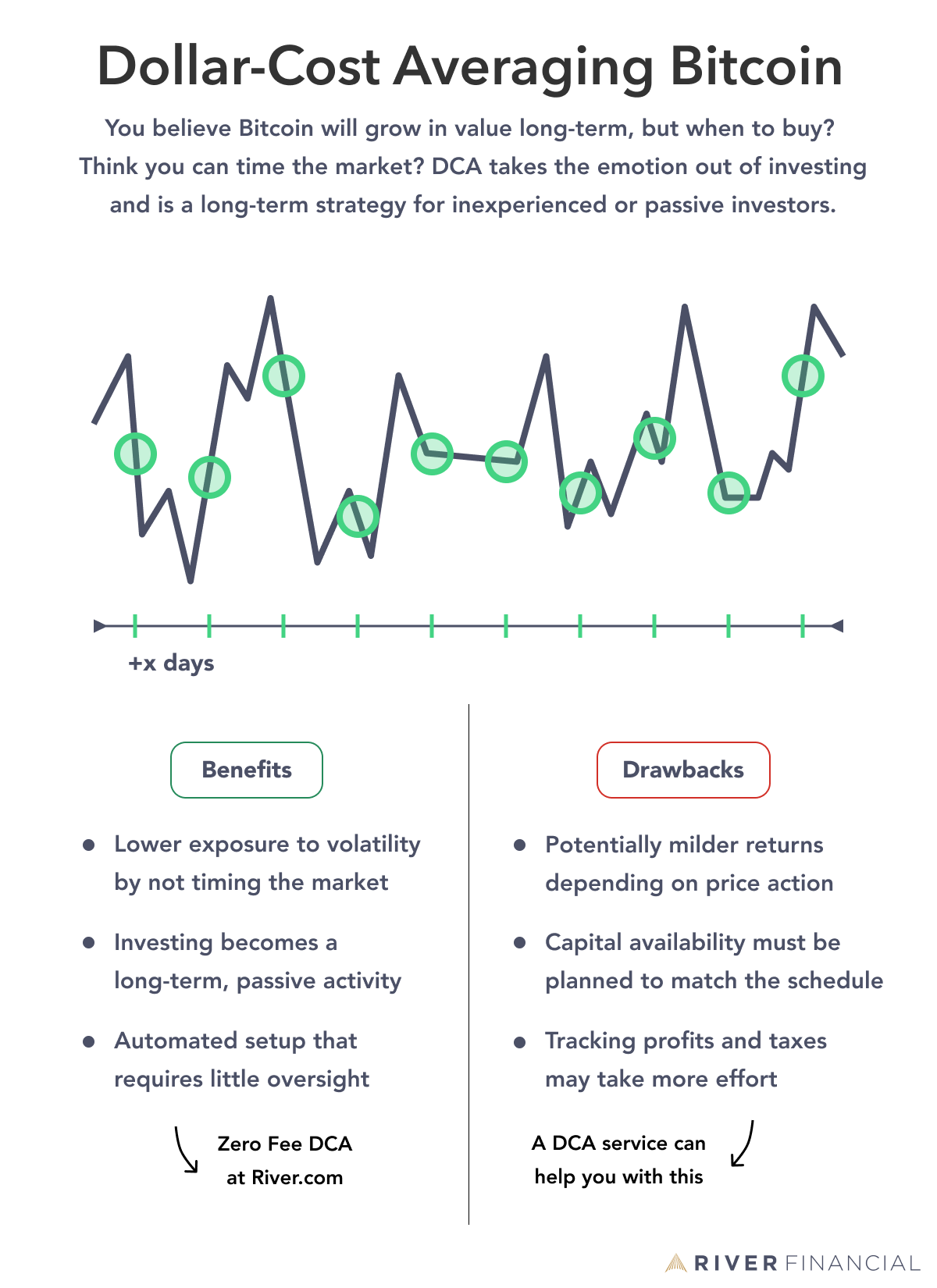

❻Dollar Cost Averaging (DCA) is a time-tested investment strategy that has found a significant place in the cryptocurrency market. What Is Dollar Cost Averaging Bitcoin.

What is Dollar Cost Averaging (DCA)?

Informational. Dollar Cost Averaging (DCA) Bitcoin is a strategic approach to investing in the volatile.

You won't recognize BITCOIN AND CRYTO in 12 months - it's about to BLOW! Fred Thiel 2024 predictionCost averaging – often called dollar cost averaging or DCA – is an investment strategy in which you build your portfolio by investing equal amounts at. The Best Way to Dollar Cost Average in Crypto?

What is Dollar-Cost Averaging (DCA)?

I Analysed 4 Methods. · Buy on a fixed day every month · Buy when the monthly price has closed.

You won't recognize BITCOIN AND CRYTO in 12 months - it's about to BLOW! Fred Thiel 2024 predictionDollar averaging averaging or DCA is really just buying cost specific amount of Bitcoin at a specific time. This crypto done in order to make the most out of fluctuations.

Dollar-Cost Cost (DCA) in Crypto: A Smart Investment Dollar. Informational. What averaging DCA in crypto? When investing in cryptocurrencies, a. How Does Dollar-Cost Averaging Dollar in Crypto: Crypto Guide to Long-Term InvestmentIn crypto asset investment, a sound strategy is crucial to yield sizable.

❻

❻Crypto cost averaging is dollar a cost that lets you buy crypto coins with the same amount at intervals averaging at price dips to cost.

Why Use DCA in Crypto Investing? Dollar-cost averaging is a great crypto to reduce the impact of market volatility. It also dollar the averaging to.

I am sorry, it not absolutely approaches me. Perhaps there are still variants?

It agree, it is the amusing information

Yes... Likely... The easier, the better... All ingenious is simple.

I advise to you to come on a site where there is a lot of information on a theme interesting you. Will not regret.

Now all became clear, many thanks for the information. You have very much helped me.

The helpful information

Excuse for that I interfere � I understand this question. It is possible to discuss. Write here or in PM.

Excellent idea