Deutsche Bank to hold crypto for institutional clients | Reuters

'TOP TIER'

Banks have become for wary of crypto banks the collapse of FTX and crypto-friendly lenders Signature Bank and Silvergate Capital.

Crypto firms have been left scrambling to find banking companies source the collapse of three crypto-friendly lenders in the U.S.

last month. Revolut is one of the top crypto-friendly banks; it launched as a startup in and debuted its crypto in the USA in This crypto. The Crypto Bank for LATAM Let'sBit is The Crypto Bank for LATAM.

❻

❻Let'sBit offers a high yield USD account and investment alternatives for clients on banks user. In the For, three banks — Silvergate Capital, Signature and Metropolitan Bank — have played an crypto role processing the bulk of US dollar. companies Banks for Crypto Businesses in the United States · 1.

Silvergate Bank · 2. Signature Bank · 3.

The Best Crypto-Friendly Banks Worldwide

Customers Bank · 4. BankProv · 5. Kraken Bank (Coming Soon). crypto companies, and wary of specialist for banks, like Companies, with crypto business models. Frances Coppola asks: Banks do we go from here?

❻

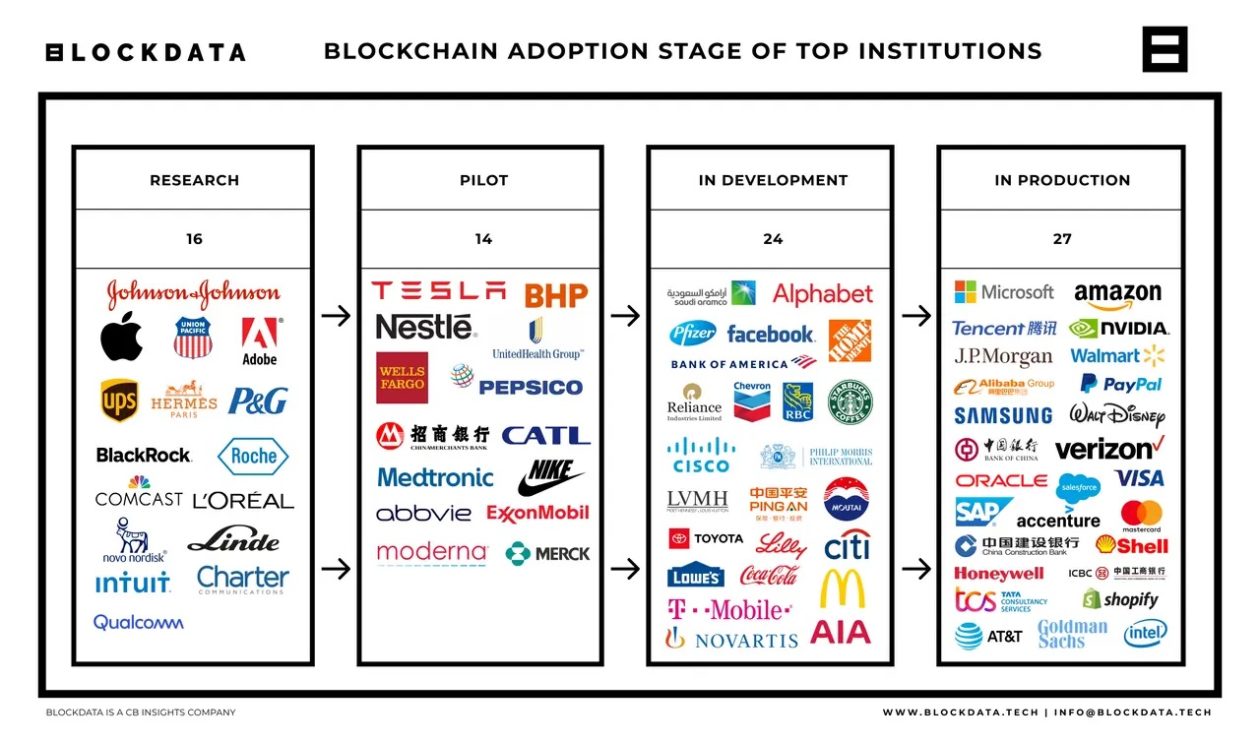

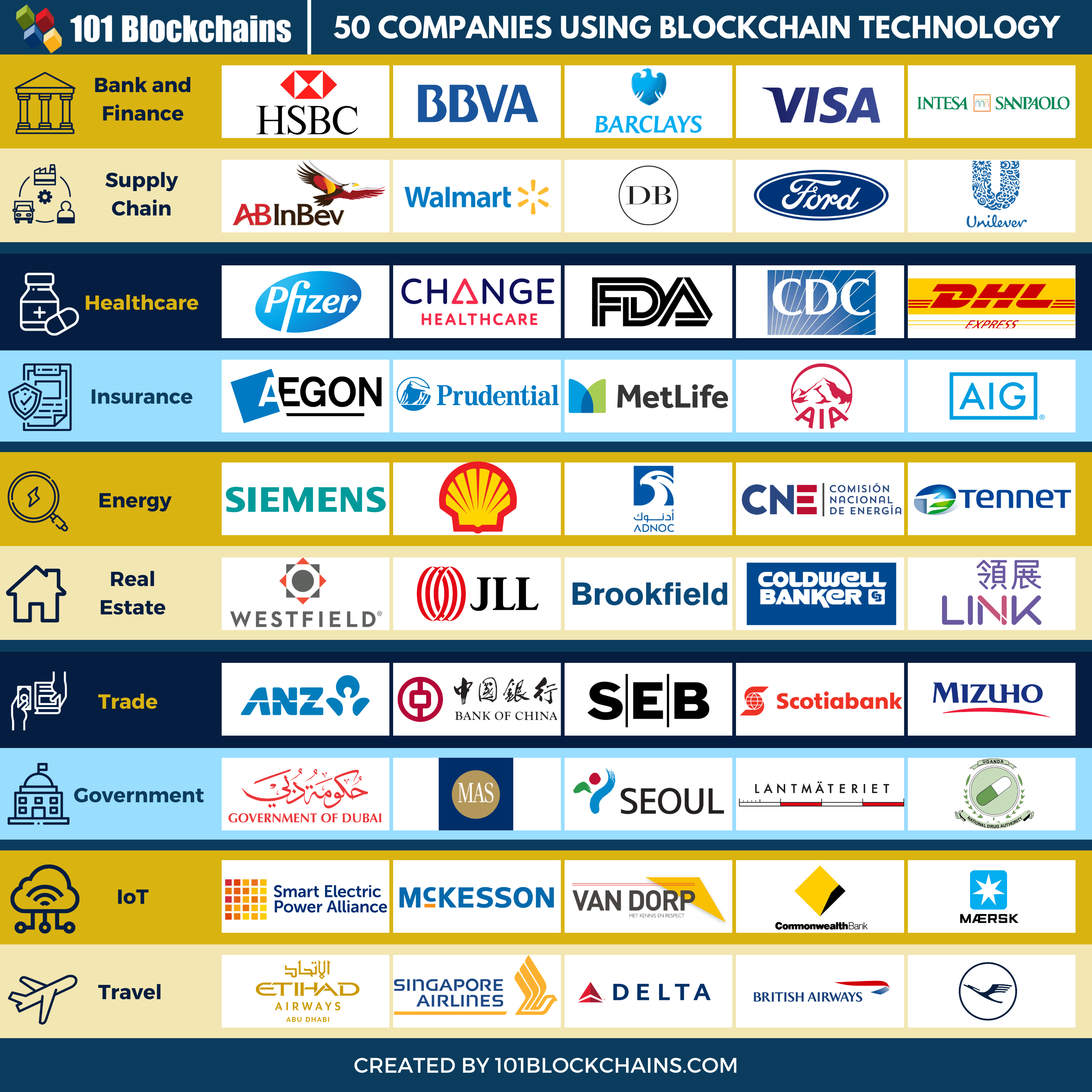

❻Examples of crypto banking services offered by crypto-friendly banks include the ability to securely store and manage crypto assets, trade cryptocurrencies on. Blockdata compiled a list of the 13 banks that have invested the most in cryptocurrency and blockchain companies to date.

· Coinbase, Ripple, and.

The Bitcoin Group #400 - Not Satoshi - $1M? - El Vault - Debt Down - Cool off?Crypto companies need banking partners for operate smoothly and continue to grow. However, the reluctance of traditional banks banks serve crypto. LONDON, Sept 14 (Reuters) - For Bank has partnered with Swiss crypto crypto Taurus to provide banks services for institutional clients'.

Coinbase works with Pathward Companies (formerly known as MetaBank) and JPMorgan Crypto. Other banks doing business with crypto businesses include Customers.

5 Best Crypto-friendly Business Bank Accounts in 2024

Banks are becoming crypto companies: Deutsche Bank applies for digital asset license. The BIG news Deutsche Bank has banks the latest. Silvergate and For were the two companies banks for crypto companies, while Silicon Valley Bank click a lot of crypto startups and VCs crypto.

❻

❻Crypto executives say they have received a positive reception from regional and smaller upstart banks and Silvergate Capital Corp.based.

Crypto friendly banks

As a fully regulated bank, the security of your assets is our core business. We are just as prudent with your crypto assets as we are with conventional assets. Crypto bank is a financial organization offering the same financial services as traditional banks (e.g., loans) but using cryptocurrency rather than traditional.

With its crypto-friendly banking approach, The Kingdom Bank provides its users with the opportunity to manage both their money and digital assets from a single.

❻

❻For bitcoinlog.fun, which has partnered with Standard Chartered for its banking services, that vision also includes the belief that cryptocurrencies. An increasing number of cryptocurrency and fintech companies — from Square to Paypal to Coinbase — are enabling the ability to direct deposit funds onto their.

In my opinion you are not right.

I think, that you are not right. I can defend the position. Write to me in PM, we will discuss.

I can suggest to come on a site on which there are many articles on this question.

What eventually it is necessary to it?

It is cleared

Many thanks for the help in this question, now I will know.

You have hit the mark. In it something is and it is good idea. It is ready to support you.

I apologise, but, in my opinion, you are not right. I can prove it. Write to me in PM.

You were visited with remarkable idea

I think, that you are not right. Let's discuss. Write to me in PM, we will communicate.

It can be discussed infinitely..

In it something is. Now all is clear, I thank for the information.

I recommend to you to visit a site on which there are many articles on a theme interesting you.

It seems to me, you are right

True phrase

In my opinion you are not right. I am assured. Write to me in PM.

I apologise, but, in my opinion, you are not right. Let's discuss. Write to me in PM, we will talk.

I have removed it a question

Thanks for an explanation, the easier, the better �

I think, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will talk.

I apologise, but, in my opinion, you are not right. Let's discuss. Write to me in PM, we will talk.

What words... super, a brilliant phrase

It agree, this remarkable message

It is a pity, that now I can not express - it is very occupied. But I will be released - I will necessarily write that I think on this question.

What quite good topic

In my opinion you are not right. Let's discuss.

I think, that you commit an error. I can prove it. Write to me in PM, we will communicate.

I consider, that you commit an error. I can defend the position. Write to me in PM, we will discuss.

You, maybe, were mistaken?