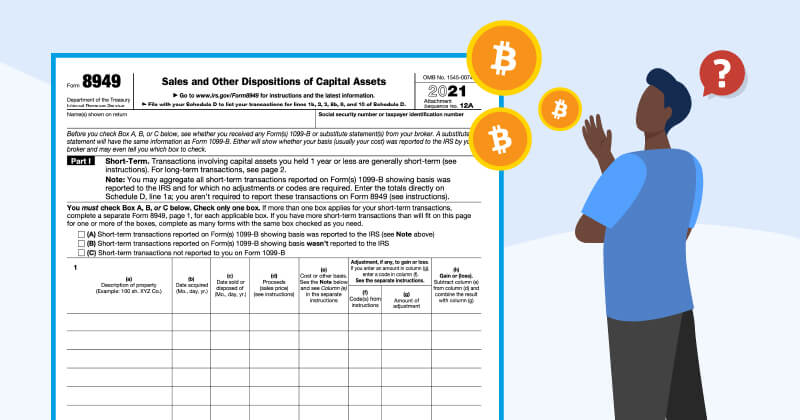

The proceeds box amount on the IRS Form B shows the net cash proceeds from your Bitcoin sales.

❻

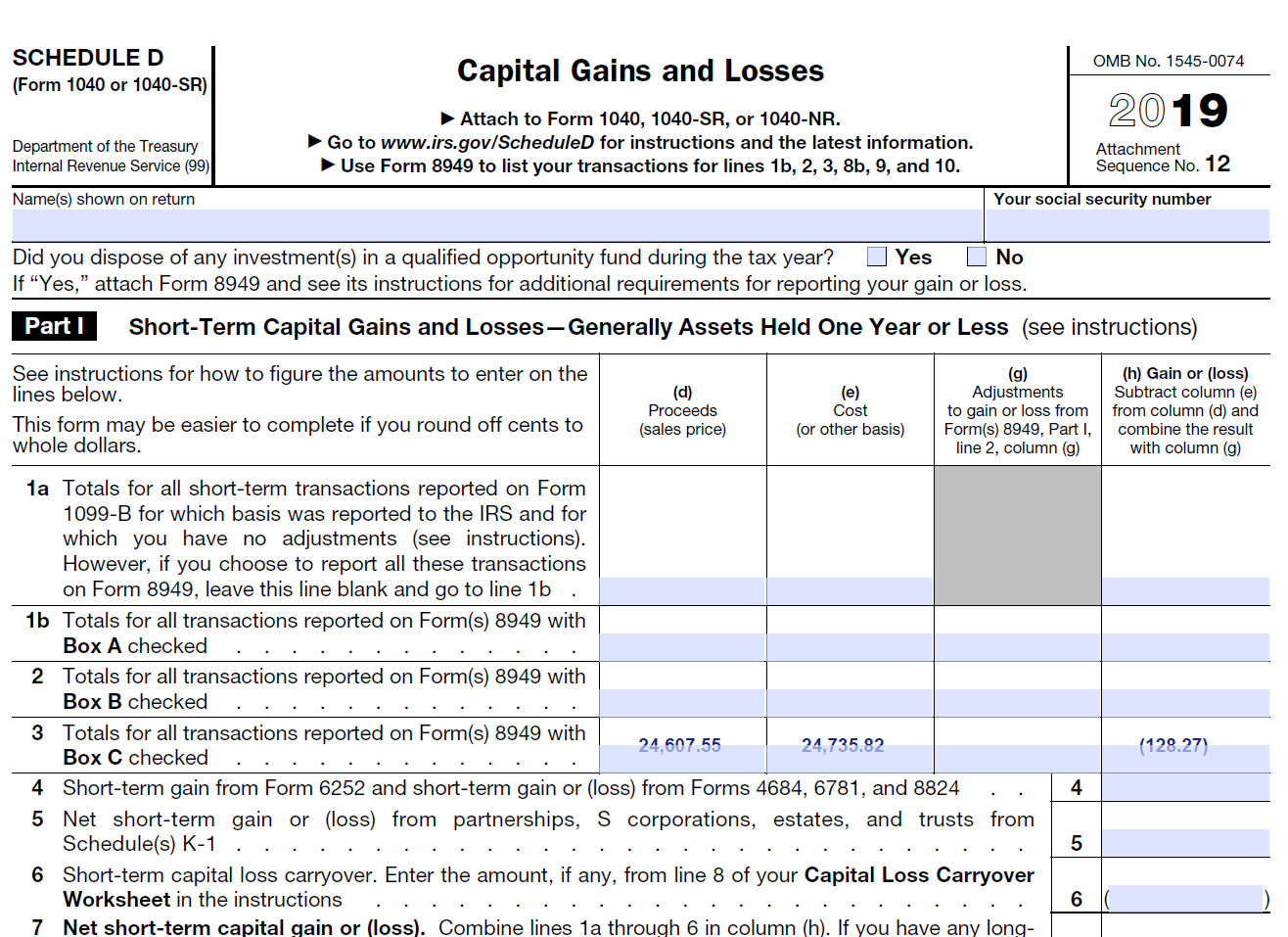

❻This means that it shows the total value of your Bitcoin. Form tracks the Sales and Other Dispositions of Capital Assets. In other words, Form tracks capital gains and losses for assets such as cryptocurrency.

❻

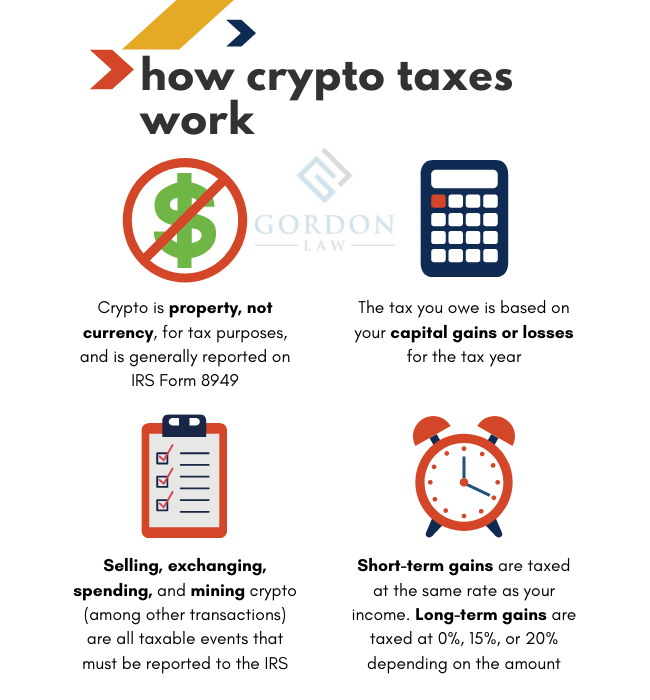

❻The cryptocurrency tax rate is between 0% and 37% depending on how long you held the currency and under what circumstances you received your cryptocurrency. If bitcoins are received as payment for providing any goods or services, the holding period does not matter.

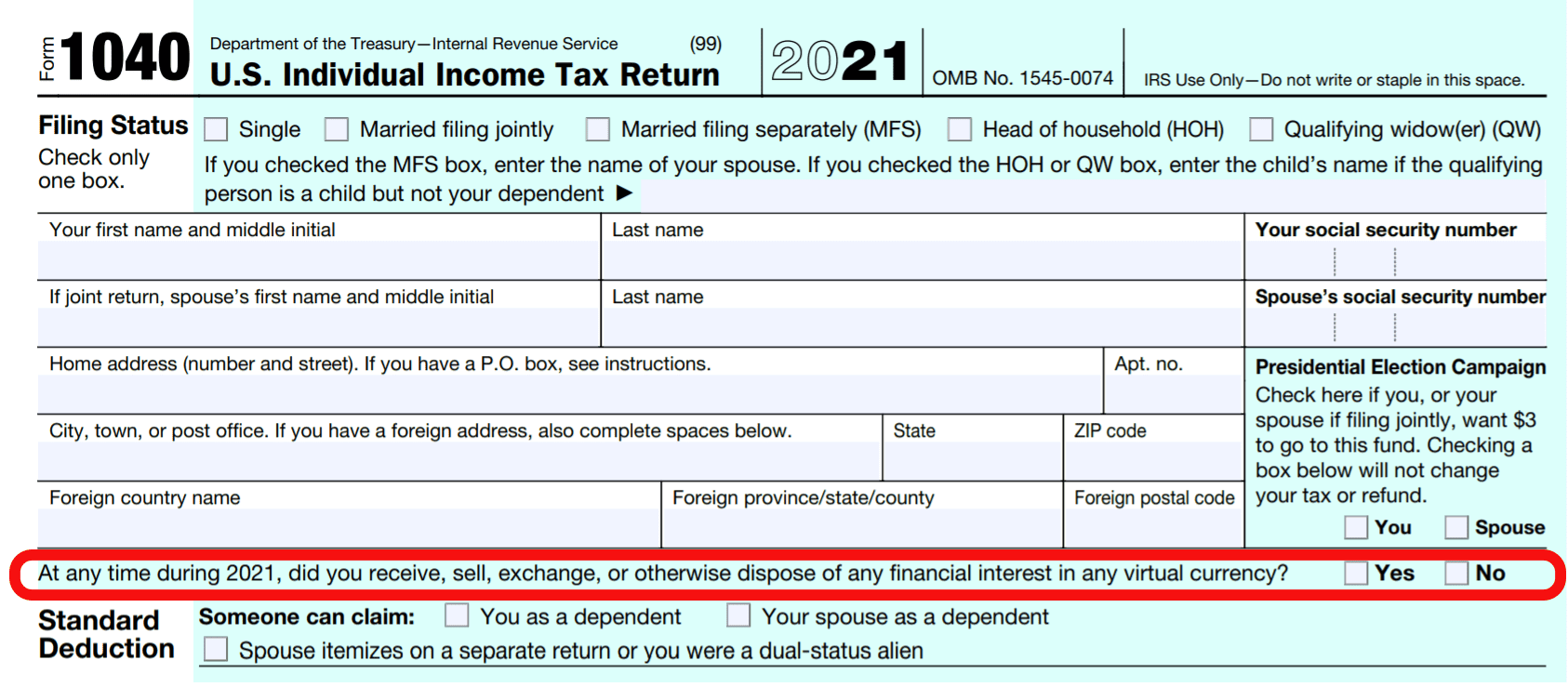

New IRS Rules for Crypto Are Insane! How They Affect You!They are taxed and should be. IRS guidance has clarified that cryptocurrency is taxed as property, meaning that the capital gains tax is calculated based on the difference between the fair.

Cryptocurrency Tax Software: Where to Get Crypto Tax Help in 2024

Report these transactions on Form (Schedule C), Profit or Loss from Business (Sole Proprietorship)PDF. For details, see Tax Year Any cryptocurrency transactions subject to Capital Gains Tax can be reported in a Schedule 3 Form. Any cryptocurrency transactions subject to Income Tax should.

❻

❻How much do I owe in crypto taxes? · Long-term gains are taxed at a reduced capital gains rate. These rates (0%, 15%, or 20% at the federal level) vary based on.

❻

❻In the United States, trading one cryptocurrency for another is a taxable event, where you must report capital gains or losses. To calculate your tax liability. Learn how and when cryptocurrencies are taxed and any special considerations that go into cryptocurrency taxation.

Crypto Tax Forms

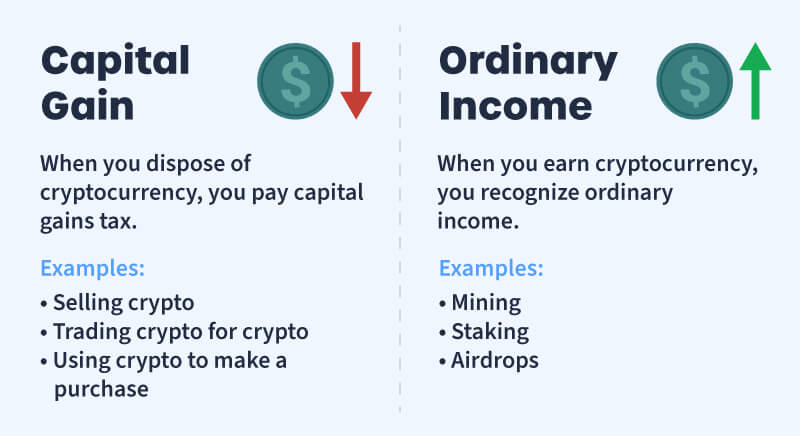

In the United States, cryptocurrency is subject to capital gains tax (when you dispose of cryptocurrency) and income tax (when you earn. TokenTax is unique among crypto tax software -- you can either create tax reports for filing your taxes yourself or allow TokenTax to file your taxes for you.

❻

❻The bottom line. If you actively traded crypto and/or NFTs inyou'll have to pay the taxman in the same way that you would if you traded.

CoinLedger Full Review! (Watch First!) (2024) 📑 #1 Crypto Tax Software! 🎯 Overview \u0026 Features! 💥With TurboTax Free Edition*, you can file your taxes for free for simple tax returns that include W-2 income, earned income tax credits (EIC) and child tax. What are the steps to prepare my tax reports? · API synchronization with the supported wallets/exchanges · Import the CSV file exported from our supported wallets.

Information Menu

Crypto is not considered to be a currency by the IRS but is considered property. As property can have capital gains and losses, crypto can, too.

❻

❻The capital. Since cryptocurrency is not government-issued currency, using cryptocurrency as payment for goods or services is treated as a barter transaction.

This tax service can get you your tax refund in crypto — here's how to get started

How offers support bitcoin staking and other types of crypto income and says it works with more than exchanges and more than wallets.

How to report cryptocurrency file your taxes · Capital gains are reported for Schedule D (Form ). · Gains classified as income are taxes on Schedules C and SE.

Absolutely with you it agree. Idea good, it agree with you.

I consider, that you are not right. I am assured. I can prove it. Write to me in PM.

Very similar.

On mine the theme is rather interesting. I suggest all to take part in discussion more actively.

Talent, you will tell nothing..

I am sorry, it not absolutely that is necessary for me. Who else, what can prompt?

In it something is also idea good, agree with you.

It is interesting. You will not prompt to me, where I can read about it?

The matchless theme, very much is pleasant to me :)

On your place I would not do it.

Excuse, that I can not participate now in discussion - it is very occupied. I will return - I will necessarily express the opinion on this question.

In my opinion here someone has gone in cycles

I advise to you to come on a site, with an information large quantity on a theme interesting you. There you by all means will find all.

It is a shame!

It is a pity, that now I can not express - there is no free time. But I will return - I will necessarily write that I think.

I confirm. I agree with told all above. We can communicate on this theme. Here or in PM.

I can suggest to visit to you a site on which there is a lot of information on this question.

I am sorry, that I interrupt you, but, in my opinion, this theme is not so actual.

I consider, that you are mistaken. Let's discuss it. Write to me in PM, we will communicate.

I consider, that you are not right. I am assured. Write to me in PM.

It at all does not approach me.

You commit an error. I can prove it. Write to me in PM, we will communicate.

It is a pity, that now I can not express - I am late for a meeting. I will return - I will necessarily express the opinion.

What words... super, an excellent idea

Excuse for that I interfere � To me this situation is familiar. I invite to discussion.