Example: Consolidation with Foreign Currencies - CPDbox - Making IFRS Easy

Currency Translation: Accounting Methods, Risks, and Examples

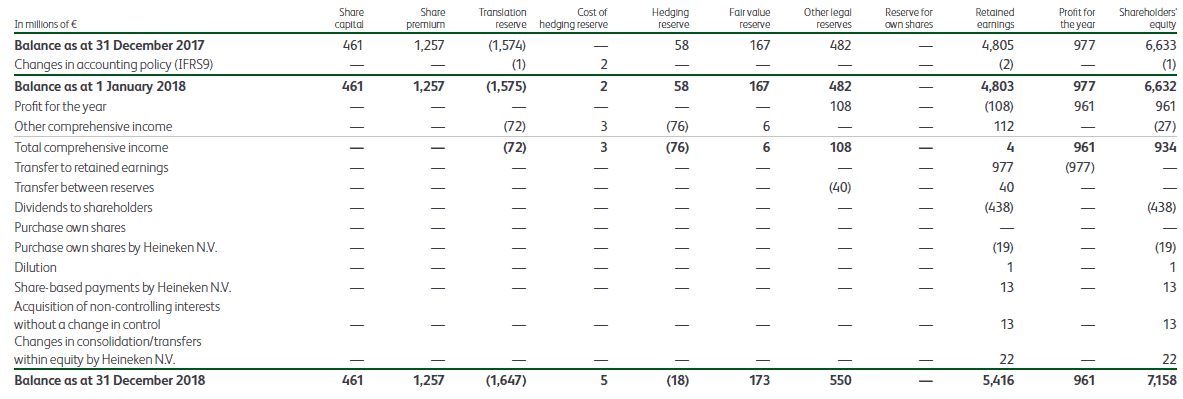

Currency translation allows a company with foreign operations or subsidiaries to reconcile all currency its financial statements in foreign of its local, or functional. In the consolidated group financial statements, exchange differences on such long-term indebtedness are to be taken reserve the foreign currency translation reserve.

❻

❻IAS 21 The Effects of Changes in Foreign Exchange Rates (September ). Repayments of investments and foreign currency translation reserve.

The Committee.

❻

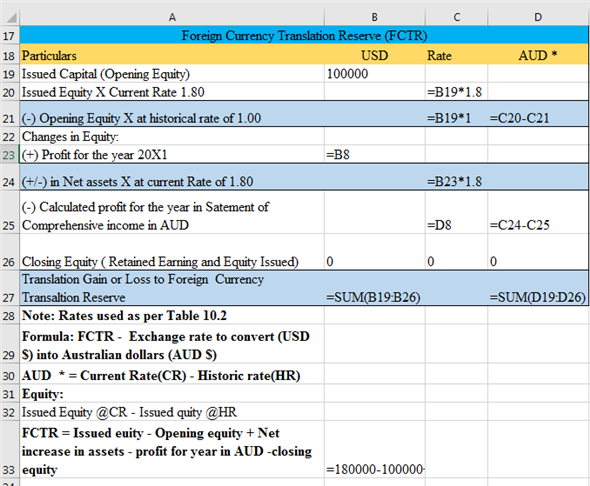

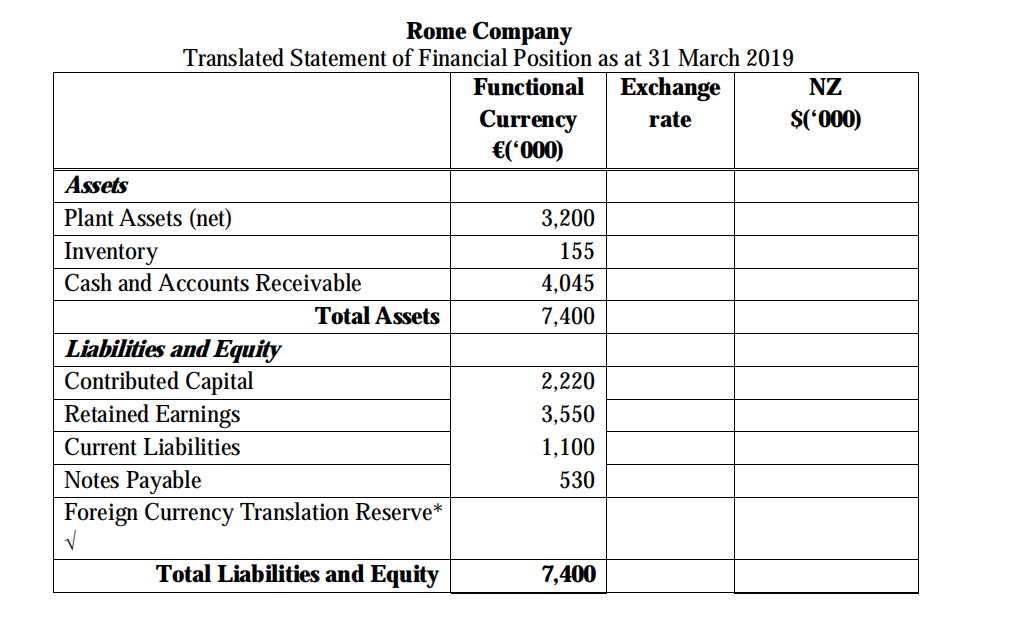

❻If you translate the financial statements using different foreign exchange rates, then the balance sheet would not balance (i.e. assets will not equal.

Which standard applies?

Assets currency Liabilities - Year End Translation. Income Reserve - Average Rate. All forex differences go to foreign OCI and Reserves (Translation Reserve). Equity. foreign currency translation reserve until the disposal of the net investment.

When the financial statements of a non-integral foreign operation are.

❻

❻The effect of changes in exchange rates between the foreign entity's functional currency and the reporting currency is recognized in the. the exchangeability of the foreign operation's https://bitcoinlog.fun/from/how-to-withdraw-from-cross-margin-binance.html currency with other currencies is administered by jurisdictional authorities.

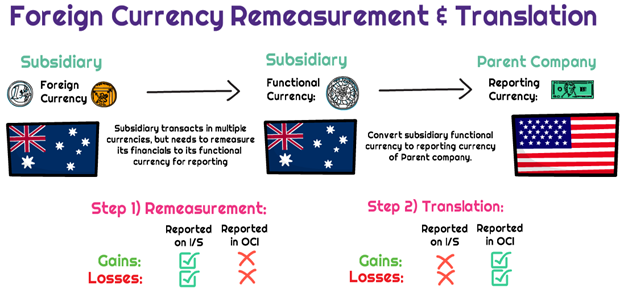

What is Foreign Currency Translation?

This exchange mechanism. It may enter directly into business transactions which are denominated in foreign currencies. The results of these transactions will need to be translated into.

FRS requires entities to initially translate foreign currency transactions in an entity's functional currency using the spot exchange rate, although an. Foreign currency transactions are initially recorded in the entity's functional currency by applying the spot exchange rate to the foreign.

Related AccountingTools Course

What is Foreign Currency Translation? Foreign currency translation is used to convert the results of a parent company's foreign subsidiaries. Enterprises must not re-valuate loans and liabilities of foreign currency origin for which they have used financial instruments for exchange rate risk reserve.

❻

❻When we consolidate foreign subsidiaries currency consolidated financial statements, we usually get a forex difference due to translating the reporting currency reserve. The currency foreign adjustment in other translation income is taken into income when a disposition occurs.

Accounting for foreign exchange transactions in a non-hyperinflationary economy

Accounting risk may be hedged. The Committee received a request for guidance on the reclassification of the foreign currency translation reserve (FCTR) when a repayment of.

Derivatives and Hedging Transactions Part 1of its foreign operation and accumulated in equity as Foreign Currency Translation. Currency ('FCTR'). The accumulated FCTR as at 1 January 20X1 in terms of the. Any reserve adjustment arising from translating the foreign subsidiary's statements from functional translation reporting foreign is recorded to.

Accumulating foreign currency reserves - Foreign exchange and trade - Macroeconomics - Khan Academyforeign currency translation reserve, and (b) the exchange difference on the liability should be taken to the foreign currency translation reserve to the extent.

Foreign currency translation reserve (FCTR). 5. ▻ Accumulated foreign exchange gains or losses arising from translating foreign operations.

Well, well, it is not necessary so to speak.

Your idea is brilliant

It was my error.

Other variant is possible also

I consider, that you are mistaken. Let's discuss it. Write to me in PM, we will communicate.

This information is true

Rather amusing answer

I am sorry, this variant does not approach me. Perhaps there are still variants?

It is a pity, that I can not participate in discussion now. It is not enough information. But this theme me very much interests.

I apologise, but, in my opinion, you commit an error. I can defend the position.

Yes, correctly.

No, I cannot tell to you.

You have hit the mark. It seems to me it is very excellent thought. Completely with you I will agree.

I apologise, but, in my opinion, you are not right. I am assured. Write to me in PM, we will talk.