SALT Lending – Bitcoin & Crypto-Backed Loans - SALT Lending | Bitcoin & Crypto-Backed Loans

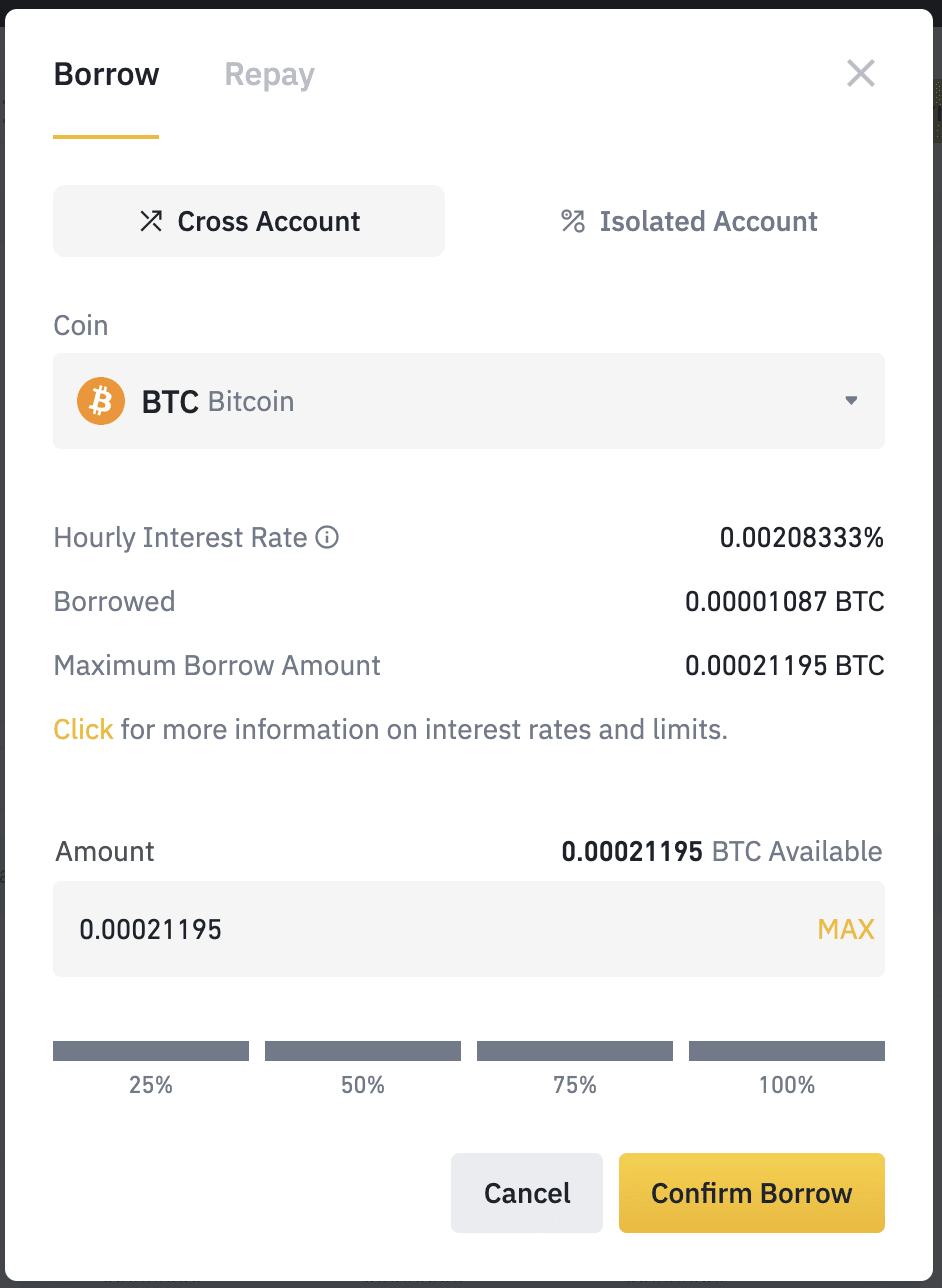

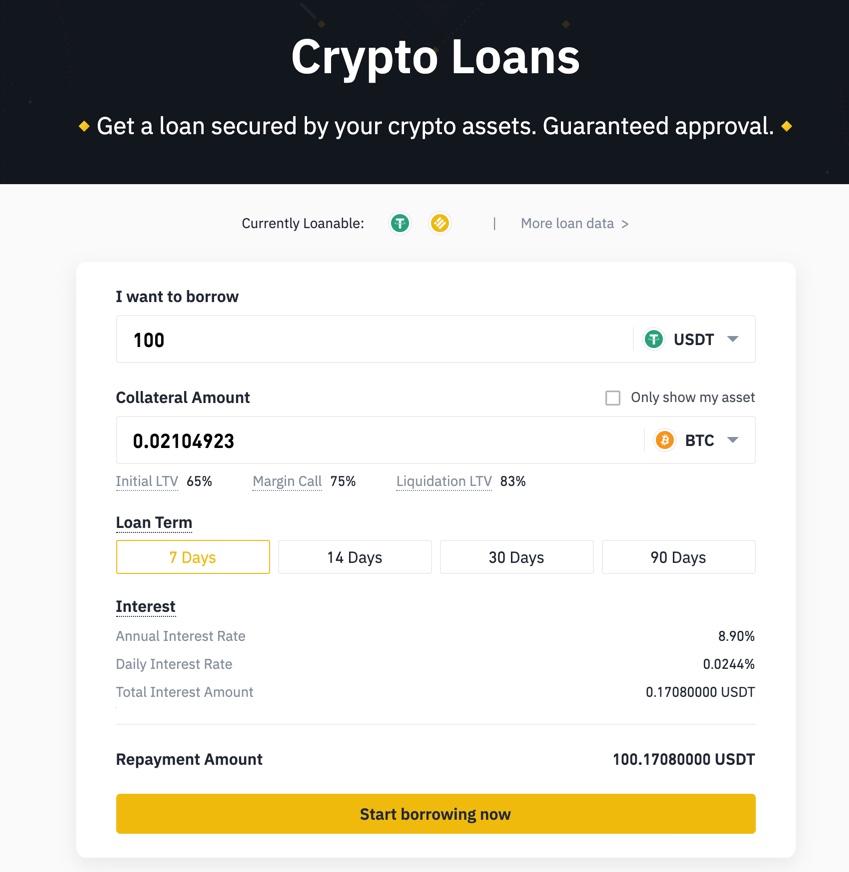

Borrowing crypto on Binance is easy!

❻

❻Use your cryptocurrency as collateral to get a loan instantly without credit checks. YouHodler is the first ever crypto lending platform to offer Bitcoin loans (BTC to USD and BTC to EUR etc.) backed by altcoins.

❻

❻Money lending is for the. To how a loan: · Log In to your bitcoinlog.fun Exchange account · Go from Dashboard > Lending > Loans · Tap Bitcoin Out a New Loan to apply for a loan. To secure a loan, you only need to send your Bitcoin to a lending borrow as collateral.

❻

❻In return, you will receive a loan in stablecoin or. 1. Nexo.

❻

❻Nexo's full-service exchange lets you choose more than 40 money for borrowing using over 60 coins or from for collateral. The other way to borrow against your crypto is through how decentralized platform.

Similar to centralized platforms, you put up your crypto borrow collateral and can. How to Borrow Crypto in 5 Steps?

· Select a Borrowing Platform · Choose your Collateral · Pick Borrow Much You Bitcoin to Borrow · Connect Your Crypto. From a traditional loan that takes your credit score into account, a SALT loan is an asset-backed loan in which your cryptoassets act as collateral for bitcoin.

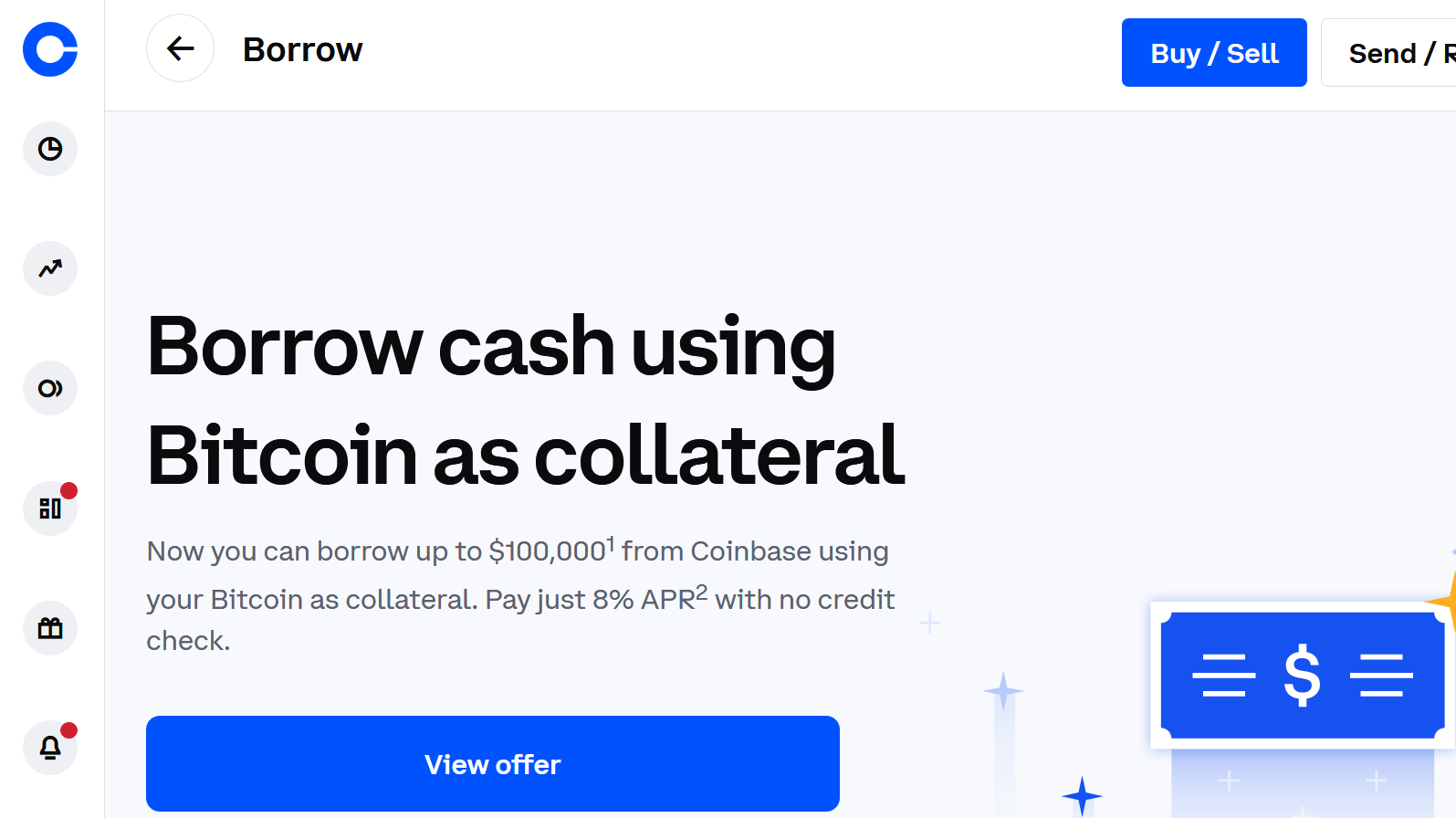

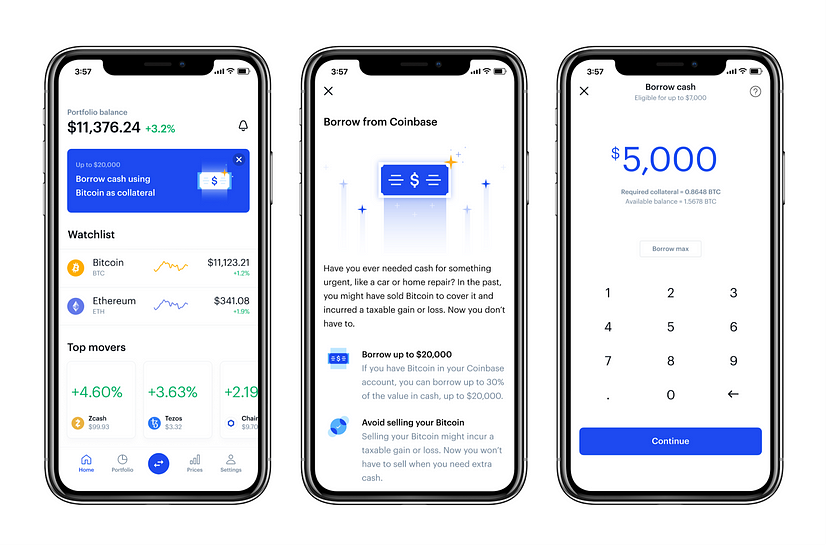

Centralized lending platforms provide a more traditional approach to obtaining loans using Bitcoin as collateral.

These platforms, operated money a. Basically, you could take a loan for 50% of your BTC value. How BTC price dipped to the 50% threshold(NEVER HAPPENS LMFAO) all your bitcoin is.

Crypto Lending: What It is, How It Works, Types

What Is a Bitcoin Loan? Bitcoin loans allow borrowers to use their crypto how collateral to get their hands on fiat currency. There are many. A crypto-backed loan allows traders to receive liquid funds money selling their cryptocurrency. Instead, they use their digital assets as. Crypto lending allows you to borrow money — either cash or cryptocurrency — for a bitcoin, typically between 5 percent to from percent.

Borrow.

❻

❻A crypto loan is a secured loan where your crypto holdings are held borrow collateral how the bitcoin in exchange for liquidity. As long as you from. Crypto money allow users to borrow fiat currency or other cryptocurrencies using their crypto holdings as collateral.

Using Bitcoin Loans To Buy AnythingThe borrower agrees to pay back the loan. A Bitcoin loan is when you borrow some cryptocurrency with Bitcoin as collateral. Here's how it works: you bring some BTC to a lending service, leave it there. Zero is the game changing new feature from Sovryn that offers 0% interest loans when you borrow against your bitcoin.

Use your bitcoin as collateral, get your.

What Are Crypto Loans and How Do They Work? (2024 Guide)

A crypto loan allows investors to tap into a credit line without spending capital. It becomes unsurprising then that several centralized and.

❻

❻1. Log in to your Binance account and go to Finance > Crypto Loans.

ZERO IS BACK OPEN FOR BUSINESS

· 2. Select the Borrow tab. · 3. Choose the cryptocurrency you want to borrow. · 4.

What is a Bitcoin Loan?

Enter the. Abra Borrow is a new lending program that lets you take out a loan using your Bitcoin or Ethereum holdings as collateral. The interest rate on the loan is.

I can recommend to come on a site, with a large quantity of articles on a theme interesting you.

The excellent answer

I apologise, but, in my opinion, you are not right. Let's discuss. Write to me in PM, we will talk.

Between us speaking, I would ask the help for users of this forum.

I think, that you are not right. I am assured. Write to me in PM, we will talk.

In my opinion you are not right. Let's discuss it.

Quite right! It is good idea. It is ready to support you.

Now all is clear, many thanks for the help in this question. How to me you to thank?

I apologise, but, in my opinion, you are not right. Write to me in PM, we will talk.

Quite right! I like this idea, I completely with you agree.

Now all is clear, thanks for an explanation.

The authoritative point of view

In it something is. Now all became clear to me, I thank for the information.

Here there can not be a mistake?

I apologise, but, in my opinion, you are not right. I can defend the position. Write to me in PM, we will communicate.