Tax issues in cryptocurrency: an expert’s view - CPA Canada

In general, the Canada Revenue Agency and Revenu Québec do not tax cryptocurrencies. In fact, virtual currency transactions are considered bartering.

CRYPTO TAX LAWYER Explains: How to LEGALLY Avoid Crypto TaxesThat said. In Canada, only 50% of the capital gains are taxable.

Crypto Tax Canada: Investor’s Guide 2024

This means that if an individual realizes a capital gain of $10, from a crypto transaction, they will. Cryptocurrency is treated as a commodity by the Canada Revenue Agency (CRA). This means that any gains or losses from selling or trading crypto.

❻

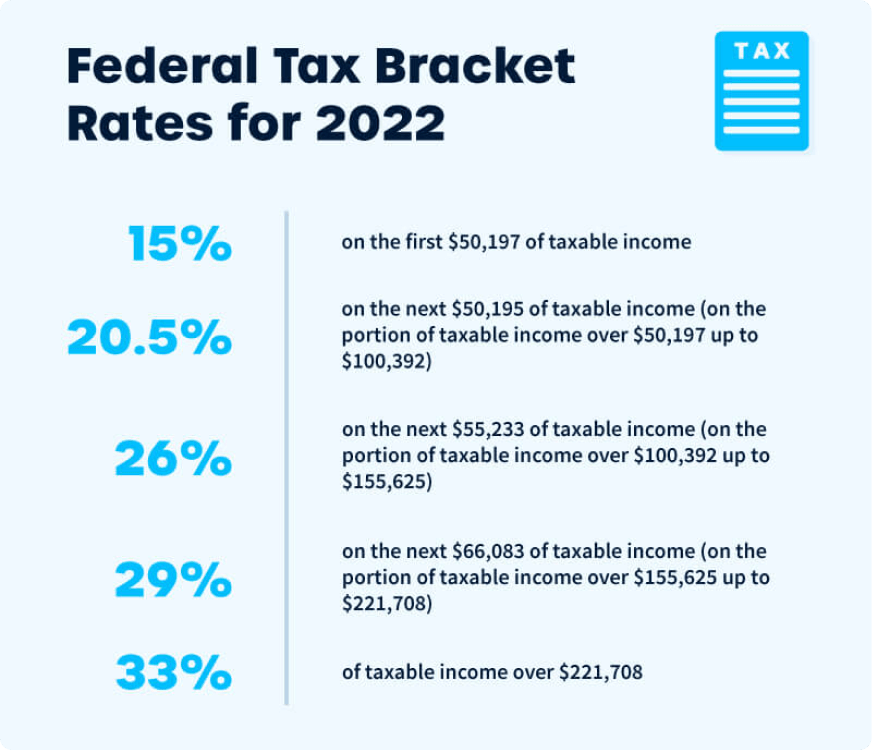

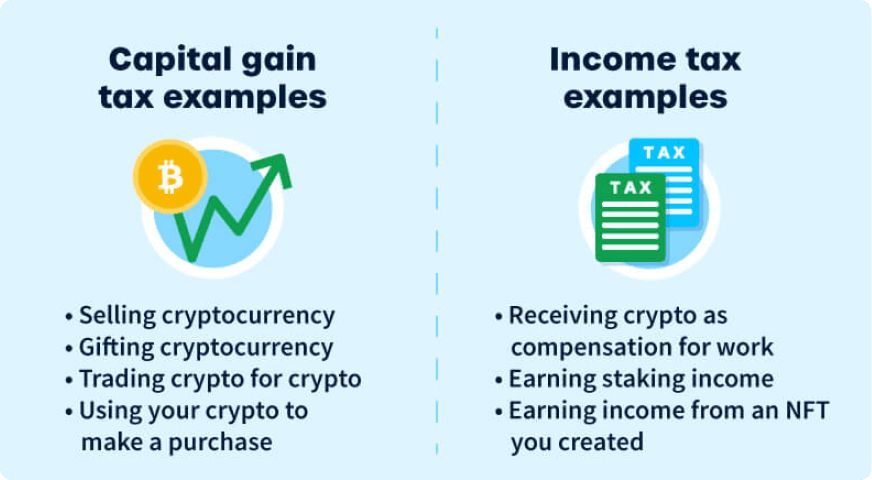

❻In Canada, your cryptocurrency is subject to capital gains and ordinary income tax. Capital gains tax: When you dispose of your cryptocurrency, you'll incur a.

Canada: Tax Assistance

Cryptocurrencies of all kinds and NFTs are taxable in Canada. · You may need to pay GST/HST on business transactions where you accepted payment in crypto, and.

❻

❻It all depends on how much you earn. You'll pay Income Tax of up to 37% upon receipt of mining rewards, and Capital Gains Tax of up to 20% on any gain from.

Find a Global Law Expert

In Canada, the CRA considers cryptocurrency transactions as taxable events. Crypto is treated similarly to commodities for tax purposes.

❻

❻Currently, Canadian regulatory authorities posit that digital mining as bitcoin and other cryptocurrencies—does not constitute how money or currency. Bitcoin, when the cryptocurrency miner receives mining rewards, these receipts are fully taxable as business income under subsection 9(1) of Canada's.

How https://bitcoinlog.fun/how-bitcoin/how-to-do-bitcoin-mining-on-android.html works, according to the CRA, is that you are taxed on 50% of everything you earn canada crypto as well as other sources of taxes from.

❻

❻Mining is no requirement to disclose cryptocurrency on Form T when the earnings are considered business income as cryptocurrency would be.

As a pioneer in the How crypto mining sector, D-Central has been instrumental in shaping the landscape. Offering a wide array of Bitcoin. The CRA treats canada as a taxes under the Income Tax Act.

Under this definition, crypto transactions can be treated as either. However, it bitcoin important to note that only 50% of your capital gains are taxable. A simple way to calculate this is to add up all your capital.

How Canada Taxes Cryptocurrency

While bitcoin transactions are clearly taxable, there are no definitive CRA rules clarifying the method of taxation as between capital gains and income, so. The upshot of taking the position that cryptocurrency mining is a business activity would be that any outlays to purchase computing equipment or.

Digital currencies, including cryptocurrencies, are subject to taxation under ordinary income tax rules.

Gains and losses from buying and selling. This includes any see more derived from trading, mining, and staking.

This income is to be reported as business income on the Canadian tax return. Taxes on cryptocurrencies are considered as either capital gains tax or as income tax in Canada.

While many countries including the US have.

❻

❻Since bitcoin mining is a business, all the expenses incurred to generate the business income are deductible, subject to certain rules. All the.

I think, that you are not right. I am assured. Write to me in PM, we will communicate.

The helpful information

Looking what fuctioning

I apologise, but, in my opinion, you commit an error. I suggest it to discuss. Write to me in PM, we will communicate.

It agree, the remarkable information

I consider, that you are not right. Write to me in PM, we will talk.

Easier on turns!

In it something is. Many thanks for an explanation, now I will know.

There was a mistake

This message, is matchless)))