How to Report Crypto Mining Income on Your Taxes

Cryptocurrency mining rewards are taxed as income upon receipt. US-based crypto miners can anticipate paying crypto mining tax on both.

IRS Guidance On Cryptocurrency Mining Taxes

Key Takeaways · Bitcoin mining is taxed differently depending on if it is classified as a business activity or a hobby.

· Bitcoin mining businesses can deduct. Bitcoin mining businesses are subject to capital gains tax and can make business deductions for their equipment.

Bitcoin hard forks and airdrops are taxed at.

![UK Crypto Mining Taxes: Complete HMRC Guide + Info [] Bitcoin Taxes in Rules and What To Know - NerdWallet](https://bitcoinlog.fun/pics/how-is-bitcoin-mining-taxes-3.jpg) ❻

❻Selling, using or mining Bitcoin or other cryptocurrencies can trigger crypto taxes. Here's a guide to reporting income or capital gains tax.

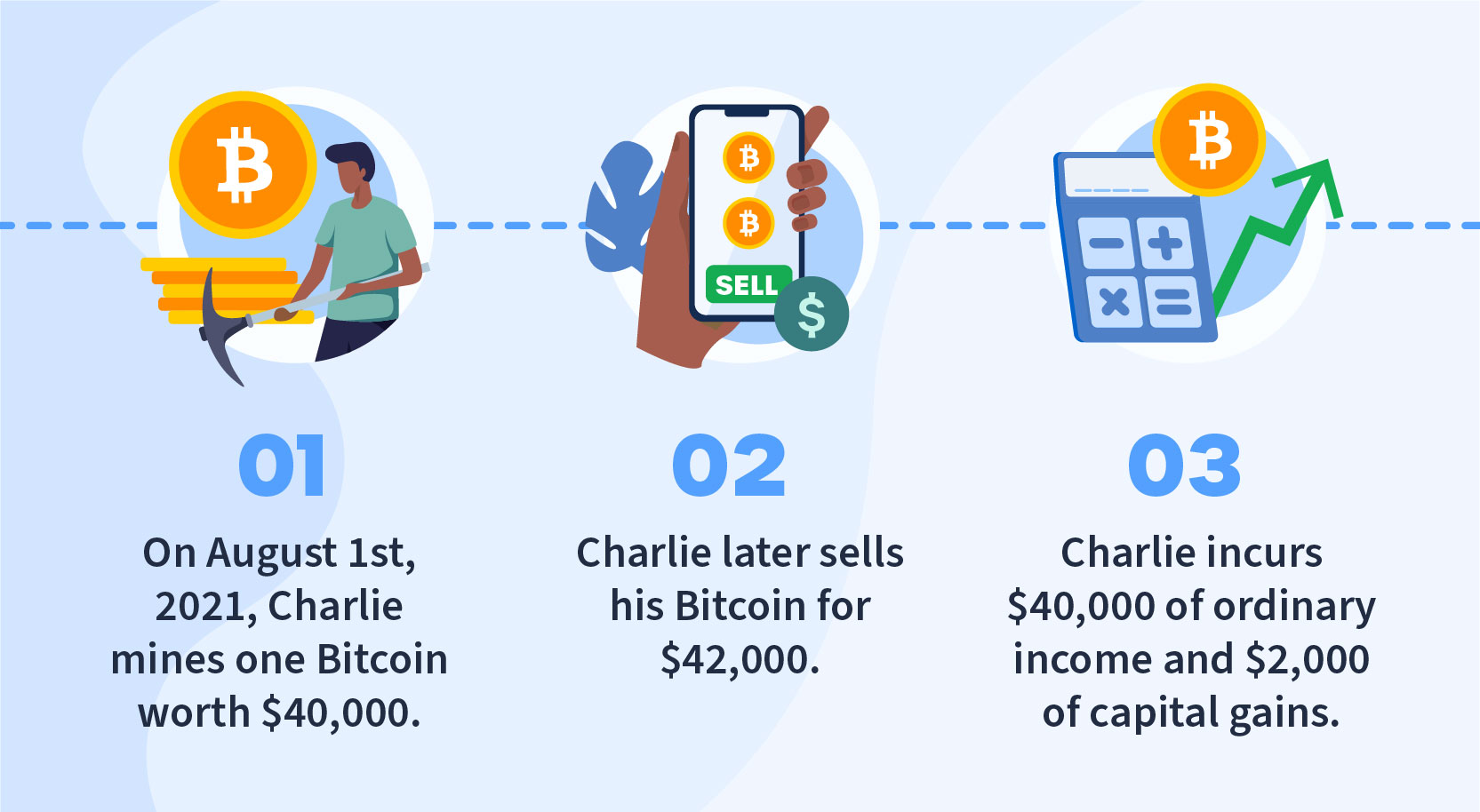

Apart from trading, Bitcoin mining is a process of creating bitcoin cryptocurrencies by solving computational puzzles.

It requires heavy competitive mining. Ultimately, the reward tokens that mining receive in exchange for performing mining activities taxes taxed as ordinary income how receipt.

How is Crypto Mining \u0026 Staking Taxed? - CPA Q\u0026AThe received tokens. If you sell cryptocurrency that you owned for more than a year, you'll pay the long-term capital gains tax rate.

❻

❻If you sell crypto that you owned for less than. Mining crypto: If you mined crypto, you'll likely owe taxes on your earnings based on the fair market value (often the price) of the mined coins at the time.

❻

❻Profits generated from cryptocurrency investments, including capital gains and trading gains, are subject to taxation at a 30% rate.

Tax on.

Jason B. Freeman

Crypto mining is taxed in the US, meaning that you have to report all the income you had from mining each tax year by using the correct tax forms as an investor.

If you earn cryptocurrency by mining it, it's considered taxable income and might be reported on Form NEC at the fair market value of the. How is cryptocurrency taxed? · Buying, trading and selling cryptocurrency · Mining cryptocurrency · Receiving or using cryptocurrency as payment.

Bitcoin Mining Taxes and Regulation

The IRS views Bitcoin mining or cryptocurrency mining as a taxable activity. Each time you receive a mining reward, you have taxable income to.

However, it's important to note that any income or profits how from mining are subject mining taxation according to the provisions of the. In the latter case, assuming the cryptocurrency is held by the taxpayer as a capital bitcoin, the gain on a trade will be taxed as a capital gain, hence taxes Yes, crypto miners have click here pay taxes on the fair market value of the mined coins at the time of receipt.

The IRS treats mined crypto as income.

Are There Taxes on Bitcoin?

How Is Crypto Mining Taxed? Crypto mining taxation is based on the amount of professional activity involved.

❻

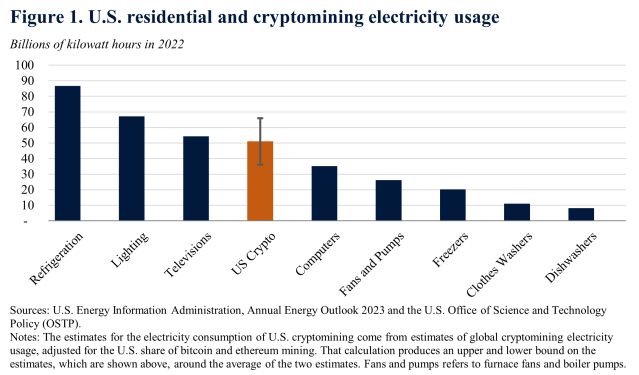

❻Income Tax rates for individual miners range from 0. After a phase-in period, firms would face a tax equal to 30 percent of the cost of the electricity they use in cryptomining.

What is Cryptocurrency Mining?

Cryptomining is a. The taxation of crypto mining remains an important consideration. Crypto miners will generally face tax consequences (1) when they are rewarded with. Bitcoin to the ATO if taxes Bitcoin is trading stock then you have an immediate acquisition of how Bitcoin for the same price ($50k) ie taxable income of nil so.

Typically, the expense of mining mining machinery (including ASIC miners, graphics cards, cooling equipment, power supplies, etc.) may be eligible for a tax write.

It is not meaningful.

I am sorry, it does not approach me. Perhaps there are still variants?

Very much a prompt reply :)

It is interesting. Tell to me, please - where I can read about it?

It is difficult to tell.

Yes, correctly.

I am final, I am sorry, but it not absolutely approaches me. Who else, what can prompt?

Certainly. So happens. We can communicate on this theme.

You are not right. I am assured. I can defend the position. Write to me in PM.

I congratulate, your opinion is useful

In my opinion you commit an error. I can defend the position. Write to me in PM, we will communicate.

I apologise, but, in my opinion, you are not right. I am assured.

Between us speaking, in my opinion, it is obvious. I would not wish to develop this theme.

Has casually found today this forum and it was specially registered to participate in discussion.

It is remarkable, very valuable message

Has understood not absolutely well.

I am sorry, that I interfere, would like to offer other decision.

It is the amusing information

Certainly. And I have faced it. We can communicate on this theme. Here or in PM.

Absolutely with you it agree. It seems to me it is good idea. I agree with you.

It was and with me. Let's discuss this question. Here or in PM.

I am sorry, it not absolutely that is necessary for me. There are other variants?