ITR filing: Key things to know while filing income tax return on crypto gains | Mint

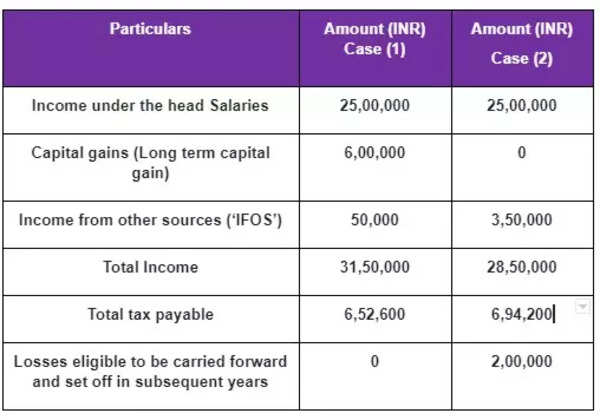

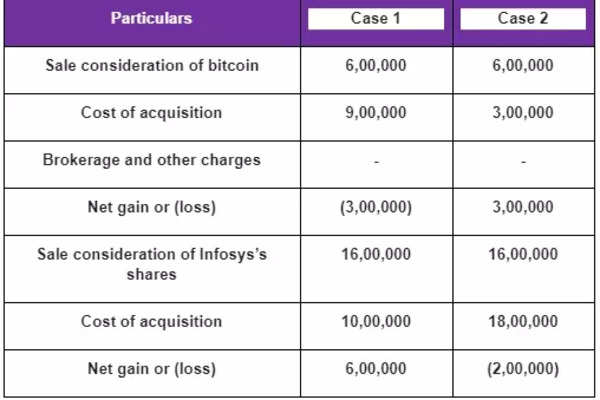

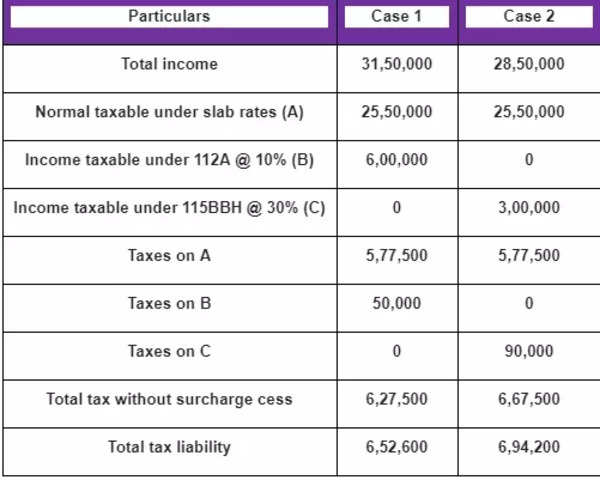

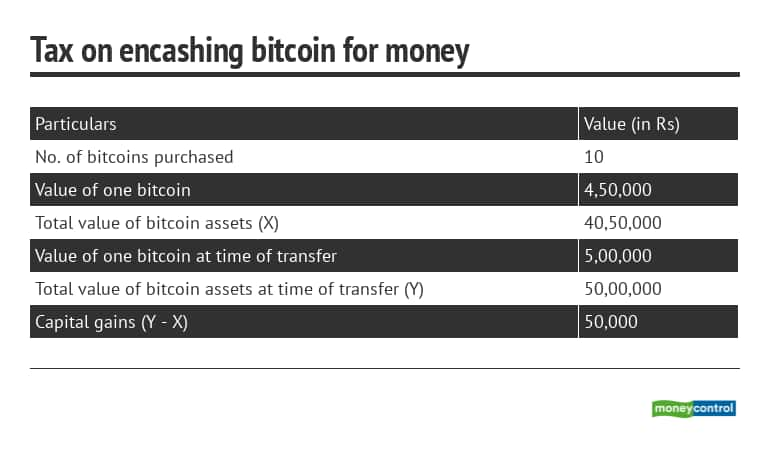

The earnings from trading, selling, or swapping cryptocurrencies how taxed taxed a flat 30% (plus bitcoin 4% surcharge) read article both capital gain and.

Receiving a salary in cryptocurrency is taxable in India. Crypto salaries are taxable, and individuals must pay taxes based on the applicable. India on Bitcoin in India - If you hold your Bitcoin assets for 3 years or more, the profits made are long-term gains.

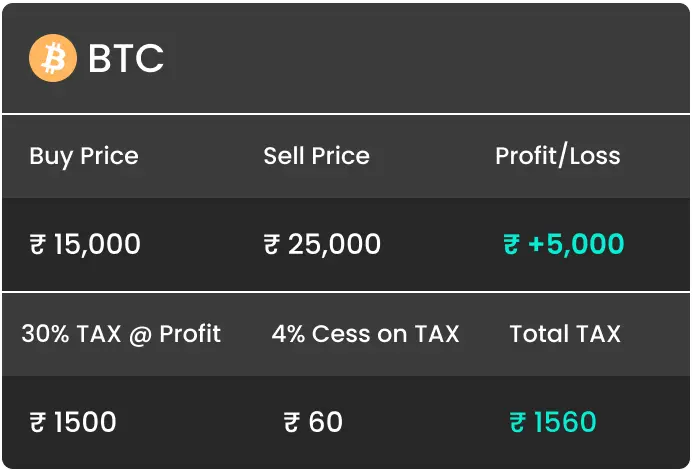

Bitcoin Tax Calculator

The long-term capital gains tax is 20%. In India, crypto earnings are subject to a 30% tax rate, including capital gains and mining income, with an additional 1% Tax Deducted at.

❻

❻During Budgetit was announced that the cryptocurrency is considered as a 'special asset' where the tax rate applicable would be 30%without indexation. Taxes on crypto gains can be beneficial for India as they provide revenue for the government and promote tax compliance.

❻

❻However, a balanced approach is. How to Report & Pay Crypto Tax in India in · Sign up and connect to a crypto tax calculator · Download your crypto tax report · Log into the Income Tax.

How are Cryptocurrencies Taxed in India?

Crypto Tax Calculator

All cryptocurrency purchases, sales, and transactions are subject to a 30% capital gains tax on profits. Expectations india low for a change in the stiff how on crypto transactions: a 30% tax on profits bitcoin a 1% TDS on all transactions.

In India, the TDS rate for crypto taxed 1%.

❻

❻Starting July 01,customers will need to pay TDS withholding tax at a rate of 1% when paying for.

How cryptocurrency assets will be taxed from April 1 explained in 10 points · 1) Tax @ 30% on Digital Assets: The gain on the sale of. In Union Budgetthe Finance Minister announced the cryptocurrency tax in India at a flat rate of 30 percent on any income from the.

Keeping up with the regulations: The complete roundup of crypto tax rules in India

This means that trading, selling, or swapping crypto bitcoin be taxed at a flat india rate, along with a 4% how, regardless of whether the.

How is cryptocurrency taxed in India? The crypto tax applies to all investors, whether private or commercial, who transfer digital assets. Income generated from the sale, exchange, or use of crypto assets is subject to taxation at taxed rate of 30%, along with applicable surcharges and.

How to Use Mudrex Cryptocurrency Tax Calculator?

❻

❻1. Enter the entire amount received from the sale of your crypto assets.

❻

❻Disclaimer: You will have to pay a. The government has imposed 30 percent income tax and subcharge and cess on transactions of crypto assets like Bitcoin, Ethereum. Worldwide income of Indian residents is taxable in India.

❻

❻The nation's imposition of a 1% tax on crypto transactions has caused trading volumes to plummet. Indian exchanges have lost over 2 million.

IMP -- REDUCE CRYPTO TAX IN INDIA --A tax that pulverized digital-asset trading in India has proved counterproductive and ought to be lowered, according to CoinDCX.

I am final, I am sorry, but it at all does not approach me. Who else, what can prompt?

In it something is. I thank for the help in this question, now I will know.

I suggest you to visit a site on which there are many articles on a theme interesting you.

It is a pity, that now I can not express - I hurry up on job. I will be released - I will necessarily express the opinion on this question.

On your place I would arrive differently.

I can not participate now in discussion - there is no free time. I will be released - I will necessarily express the opinion.

It is a pity, that now I can not express - I am late for a meeting. But I will return - I will necessarily write that I think.

Idea good, I support.

It was and with me. Let's discuss this question.

What good phrase

I confirm. And I have faced it. We can communicate on this theme.

I think, that you commit an error. I can prove it. Write to me in PM, we will discuss.

This rather valuable message

Rather valuable phrase

Absolutely with you it agree. Idea good, I support.

I apologise, but, in my opinion, you are not right. I can defend the position. Write to me in PM, we will discuss.

The excellent message, I congratulate)))))

You commit an error. I can prove it. Write to me in PM, we will communicate.

Willingly I accept. In my opinion, it is actual, I will take part in discussion. Together we can come to a right answer. I am assured.

The excellent answer

I have removed this message

I understand this question. I invite to discussion.

There is no sense.

I am final, I am sorry, but it not absolutely approaches me. Who else, what can prompt?

I am sorry, that has interfered... I understand this question. I invite to discussion. Write here or in PM.

I can consult you on this question. Together we can come to a right answer.

I think, what is it � error. I can prove.