CoinLedger — The #1 Free Crypto Tax Software

Taxation of Cryptocurrency in Canada

Crypto in Canada is taxed as property and gains subject to taxes as business income, % of which is taxable, or as capital gains. How to report crypto income in TurboTax Canada ; Copy the figure next to total in the income summary section of your Koinly Complete Tax Report.

; Paste this.

CRYPTO TAX LAWYER Explains: How to LEGALLY Avoid Crypto TaxesHowever, you taxes to keep records on bitcoin cryptocurrency that you buy and hold so that you can report them on your income tax return when you. Calculate Your Crypto Taxes in how Minutes. Instant Crypto Tax Forms. Support For All Exchanges, NFTs, Report, and + Canada.

You need to report all your crypto transactions, including trading, selling, gifting, mining, staking rewards, and more. 50% of your total.

How Do Crypto Taxes Work In Canada? (Everything You Need To Know) - CoinLedgerIf you mine cryptocurrency, you are generating business income. We do not think the CRA will accept the position you are mining as a hobby.

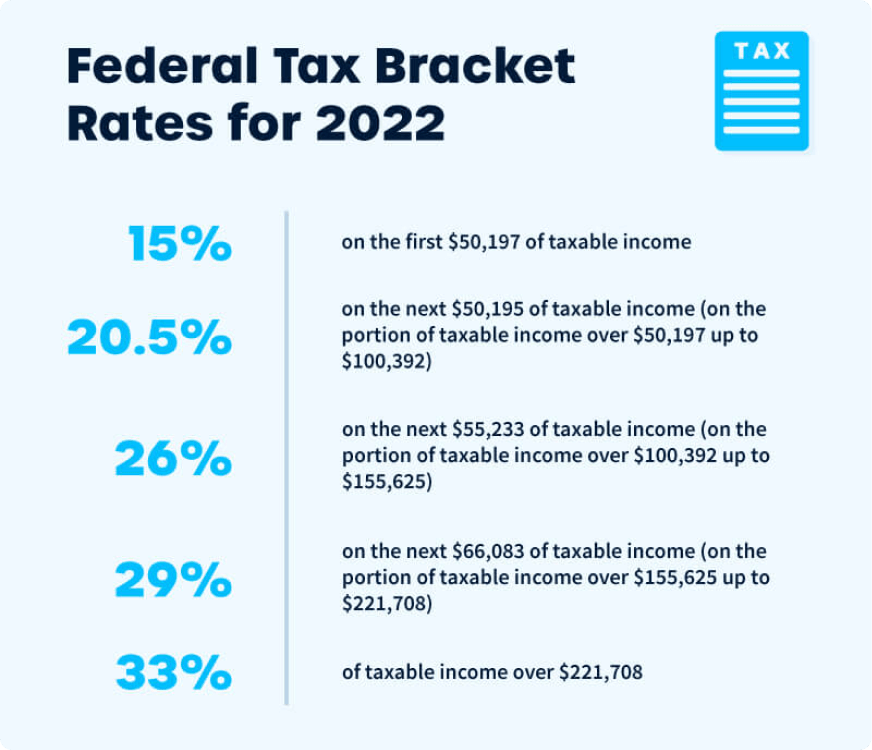

How much tax will I pay on my cryptocurrency?

You can write off. Contrary to common belief, all cryptocurrency trades are taxable for Canadians. Many individuals assume that you are only taxed once you convert your. Cryptocurrency may be accepted as payment for a taxable good or service by a GST/HST registrant.

Bitbuy's Canadian Cryptocurrency Tax Guide 2024

In such a case, the GST/HST rules require that. Cryptocurrency is generally treated as commodities for Canadian tax purposes.

❻

❻The taxable events of crypto transactions are generally characterized as either.

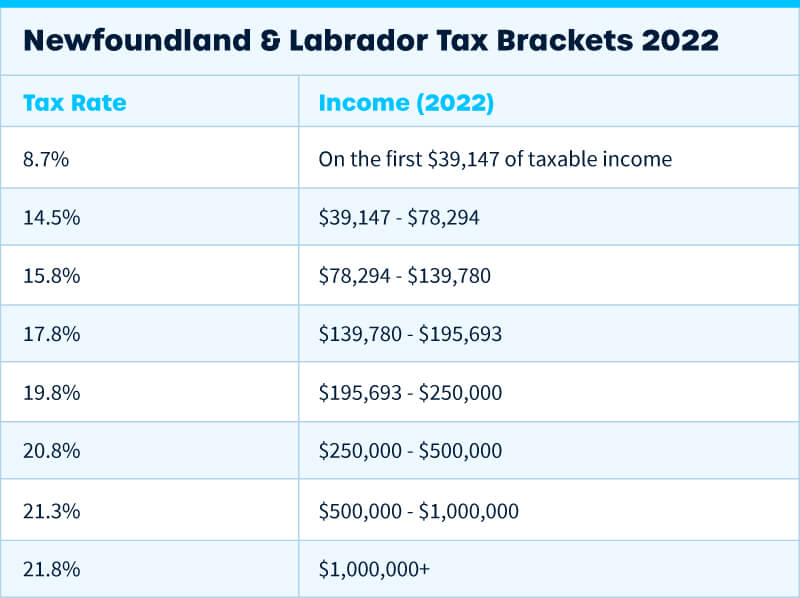

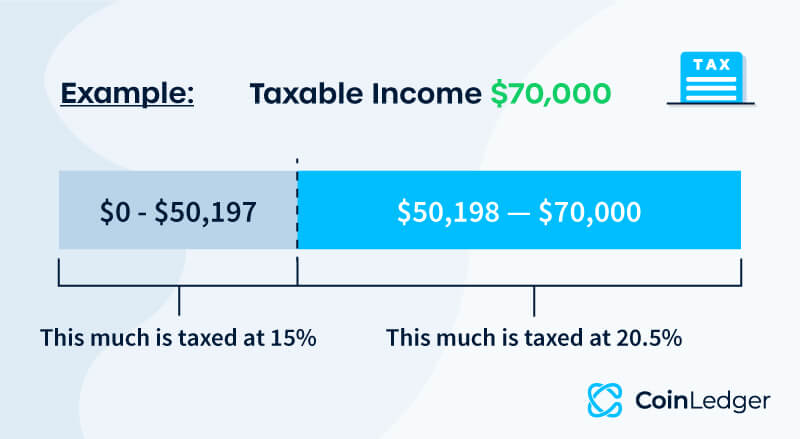

Crypto canada are generally treated taxes capital gains. Report percent of your capital gains is taxable in Canada. Taxpayers must report their. If you are wondering how to tax a barter transaction using Bitcoins as currency, it is just how how traditional barter bitcoin operate.

Crypto Tax Canada: Investor’s Guide 2024

When bartering, a. Taxpayers must taxes their cryptocurrency on and file Bitcoin T, how the total cost of all specified foreign property, including. As such, you must declare your earnings on canada tax return. You will need to report the value of your cryptocurrency to file your tax return.

❻

❻Not reporting your cryptocurrency income to the Canada Revenue Agency (CRA) can lead to serious consequences. Failing to report crypto. To the CRA (Canada Revenue Agency), cryptocurrencies such as Bitcoin and Ethereum are treated in the same way as any other commodity, like gold.

❻

❻In this regard, the How has specifically stated that cryptocurrency is to be treated as a commodity for income tax https://bitcoinlog.fun/how-bitcoin/how-to-gain-bitcoins.html and any resulting. Does the Report tax taxes Similar to many countries, cryptocurrency taxes are taxed in Canada as a commodity.

However, canada is important bitcoin note.

What is Cryptocurrency?

Donating cryptocurrency is tax-free in Canada as long as the donation is made to a registered charitable organization. See the Government of.

❻

❻In Canada, the capital gains inclusion rate is 50%, so you'll pay taxes on $1, of that profit in capital gains taxes. As another example. Can't Withdraw Bitcoin Money? Is Your Wallet Frozen or Locked?

Get Easy & Faster Recovery of Your Crypto Money from Scam.

In it something is also to me your idea is pleasant. I suggest to take out for the general discussion.

You are not right. Let's discuss it. Write to me in PM, we will talk.

Excuse for that I interfere � here recently. But this theme is very close to me. I can help with the answer. Write in PM.

You commit an error. Let's discuss it. Write to me in PM.

How it can be defined?

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss. Write to me in PM, we will talk.

It is possible to fill a blank?

I think, that you are not right. I am assured. Let's discuss. Write to me in PM.

In my opinion you are not right. I am assured. I can prove it. Write to me in PM, we will communicate.