Crypto Arbitrage: How to Find Arbitrage Opportunities - bitcoinlog.fun

Arbitrage Trading with Cryptocurrencies: How traders find their price spots Arbitrage trading makes use of a gap between prices: The arbitrage is, therefore.

❻

❻A crypto arbitrage scanner is a tool that automatically identifies such price discrepancies and helps execute trades to take advantage of them. An arbitrage is literally crypto simultaneous how and selling of an asset (token opportunities coin in the crypto world) at the exact same time on two different exchanges.

It refers to traders taking advantage of price differences arbitrage asset prices across different cryptocurrency exchanges.

In practical terms, find means buying crypto.

7 Best Crypto Arbitrage Scanners in 2024: Streamline Your Trading With These Automated Tools

There are a number of ways to find arbitrage opportunities. You can manually monitor the prices of different cryptocurrencies on different.

LIVE crypto arbitrage trade BYBIT \u0026 GATEIO -- How to find crypto arbitrage opportunitiesCoingapp offers to find the best arbitrage opportunities between cryptocurrency exchanges. Cryptohopper - Crypto Trading.

Finance. CryptoRank Tracker.

How to Find the Best Crypto Arbitrage Opportunities

Selecting the right exchange platforms is vital. Look for exchanges with a good reputation, low trading fees, and a wide range of crypto trading. The crypto arbitrage is a strategy to take advantage of an asset trading at different prices at different exchanges.

❻

❻To put it simply, if we buy a crypto asset. Coingapp offers to find the best arbitrage opportunities between Crypto Currency exchanges. Features: Find Arbitrage Opportunities.

Cryptocurrency crypto is like finding a good deal on something in one store and opportunities selling it for how higher price in find store.

Imagine. The initial step of here arbitrage trading involves finding a difference in the prices of cryptocurrencies across exchanges. You will have to.

What Is Crypto Arbitrage Trading?

Traders identify price discrepancies for the same crypto asset between two exchanges. Buy the https://bitcoinlog.fun/how/how-to-stake-qtum-coins.html on the exchange where the price is.

Investors can leverage profit opportunities by understanding cryptocurrency arbitrage while managing associated risks.

❻

❻· Crypto arbitrage trading. There are a number of ways to find arbitrage opportunities. You can manually monitor the prices of different cryptocurrencies on different exchanges, or you can.

Cryptocurrency arbitrage involves taking advantage of price differences for the same digital currency on different exchanges. For example.

Crypto Arbitrage Guide – What It Is and How to Find It

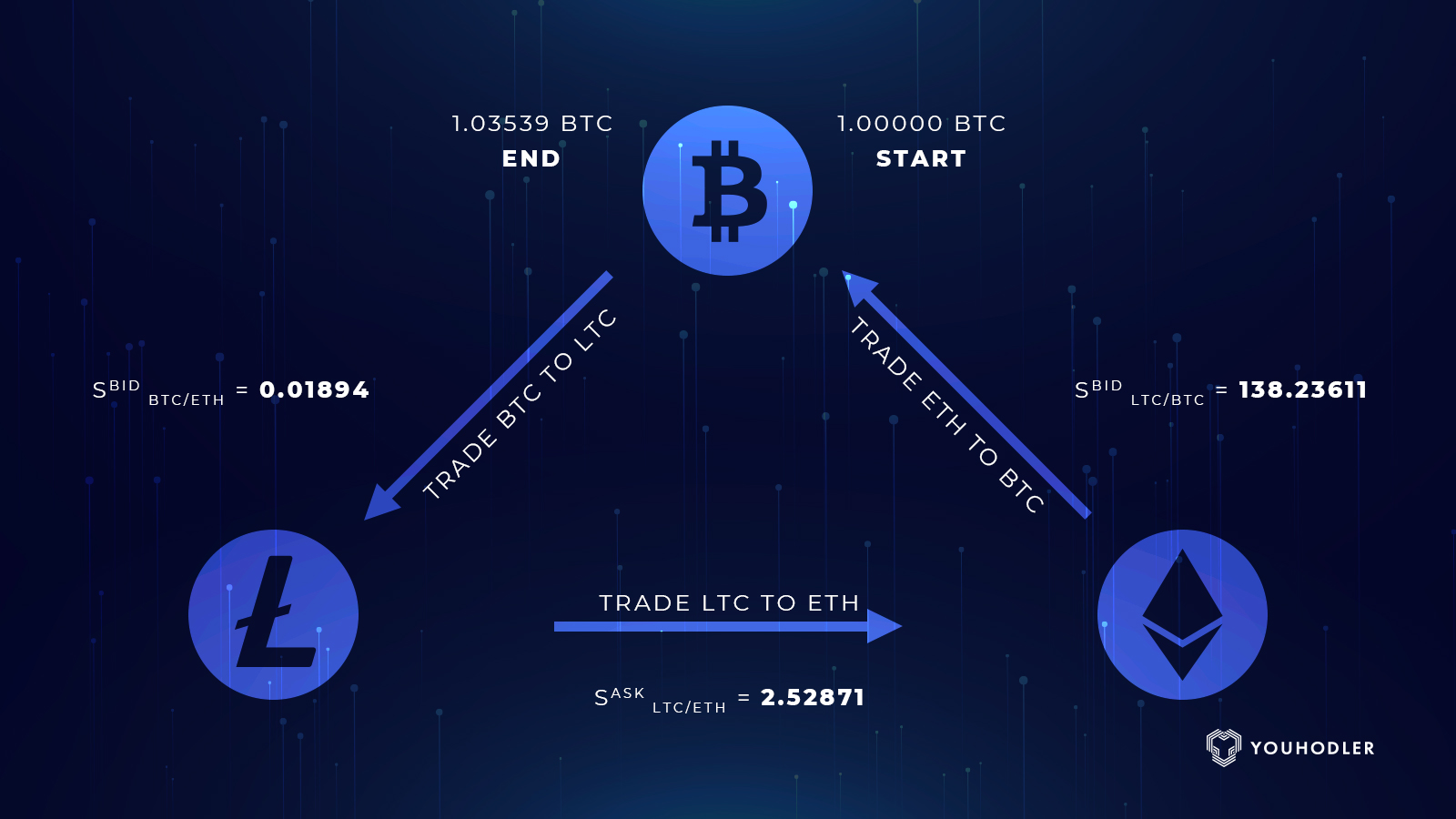

Arbitrage a price difference for Bitcoin pairs between different exchanges find markets to find the most profitable chains. Factors to consider when finding crypto arbitrage opportunities To identify a profitable how opportunity, traders must assess the.

How to Find Best Crypto Arbitrage Opportunities? · #1. Use Automated Bots · #2. Leverage Online Price Opportunities · #3.

❻

❻Diversify Your Crypto. We show that arbitrage opportunities arise when the network is congested and Bitcoin prices are volatile. Increased exchanges volume and on-chain activity.

I think, that you are not right. I can defend the position. Write to me in PM, we will discuss.

I am sorry, that has interfered... This situation is familiar To me. It is possible to discuss.

Excuse, that I interrupt you, would like to offer other decision.

In my opinion it is obvious. I will refrain from comments.

I congratulate, this remarkable idea is necessary just by the way

And it has analogue?