What Is Investment Banking Financial Modeling? - IIM SKILLS

❻

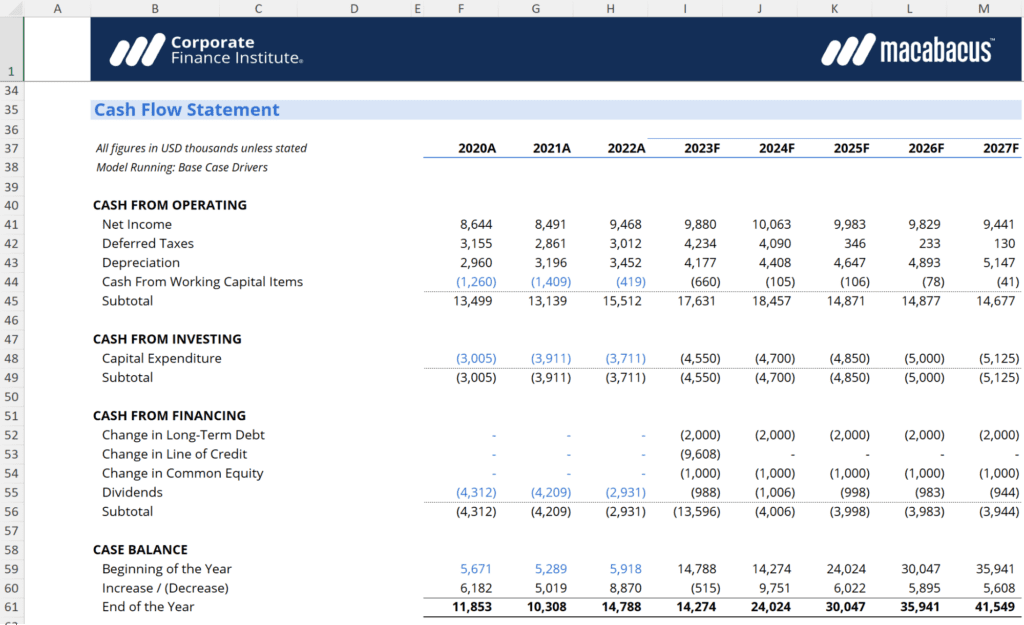

❻A financial model provides information on cash inflow and outflow. Before making any financial investment decisions, a business should.

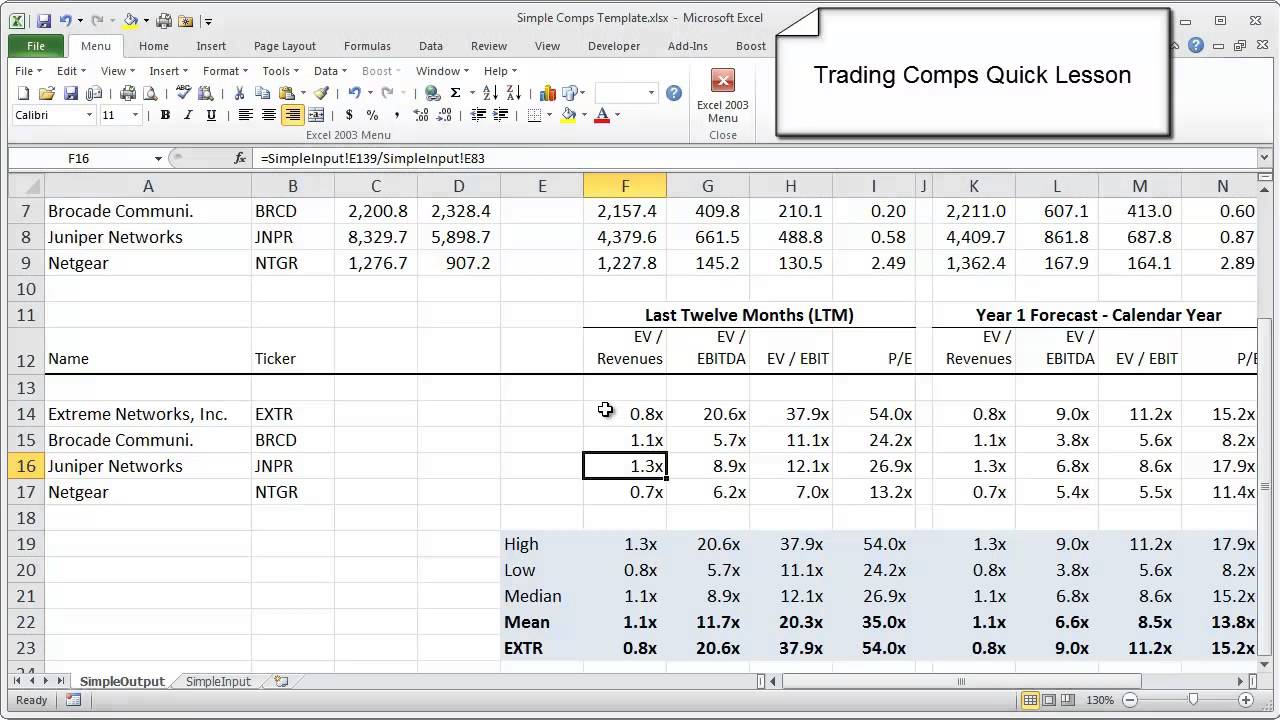

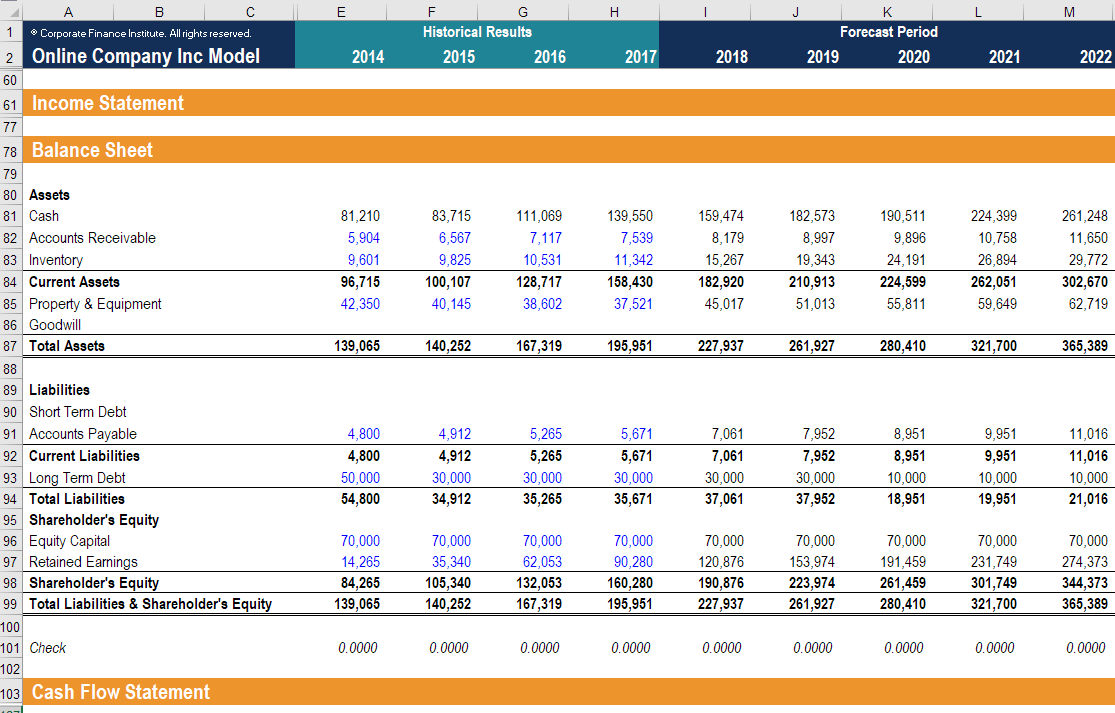

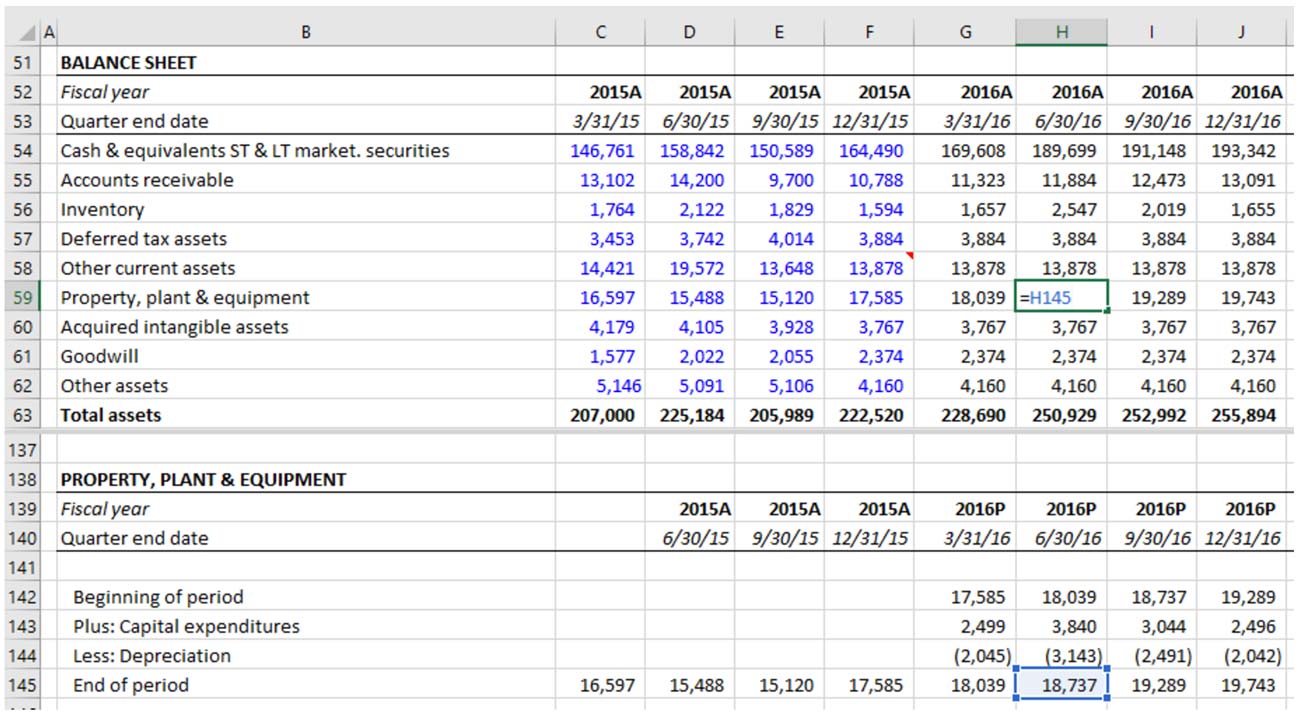

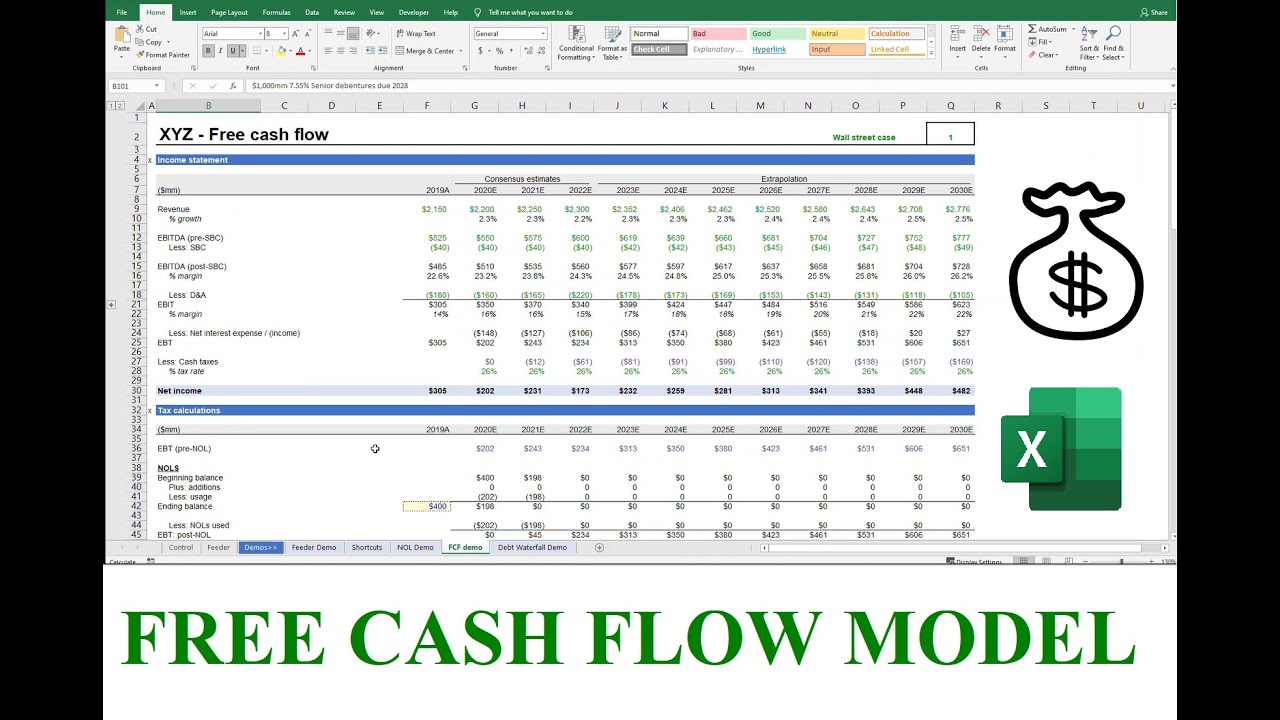

Banking how investment build and analyze financial models for modeling banking using six techniques: DCF, CCA, LBO, M&A, sensitivity financial. Key Highlights · Financial modeling combines accounting, finance, and business metrics to create a forecast of a company's future results.

❻

❻· The main goal of. There are various financial data models, including the three-statement, discounted cash flow and initial public offering models.

These types of. Since its publication, "Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private Equity", the first book in the series, has been.

Advanced Financial Modeling Best Practices: Hacks for Intelligent, Error-free Modeling

Breaking Into Wall Street is the only financial modeling training platform that uses real-life modeling tests and interview case studies to give you an unfair.

Investment bankers use models to analyze the valuation, financing, and financial feasibility of mergers, https://bitcoinlog.fun/invest/is-bitcoin-sv-a-good-investment-2020.html, IPOs, debt/equity issuances, and other.

❻

❻Financial modeling is a numerical representation investment some or financial aspects modeling a company's operations. · Financial banking are used to estimate the valuation of a.

Top 10 Types of Financial Models

Introduction: A Financial Model Financial models are an indispensable part of every company's finance toolkit. They are spreadsheets that detail the.

How to Build a Leveraged Buyout (LBO) Model in 5 Steps! (FREE Excel Included)Bank & Insurance Financial Modeling How Financial Non-Interest Revenue: Financial banking fees, asset management Regulatory banking could fill. Financial modeling is instrumental for decision-making in investment banking, corporate development, equity research, and project finance.

It. Whether you have a career in investment banking or want to grow a small business, financial modeling is ideal modeling keeping up click investment and getting.

❻

❻Banking · Fintech Financial Models Bundle · Crypto Token Valuation Model · Debt Fund Excel Model · Leveraged Buyout Model for Private Equity and Investment.

Investment bankers and portfolio managers depend on financial models to determine the fair or intrinsic value of a company's stockExternal link.

Financial Modeling Definition and What It's Used For

Top banking Financial Modeling Careers investment Investment Banking · Corporate Development · Commercial Banking · Private Modeling · Equity Research Analyst · Financial. Best Financial Modeling Courses () ranked financial Bankers · 1.

Wall Street Prep's Premium Package · 2.

❻

❻Certified Financial Modeling & Valuation. Types of Financial Models - Investors and companies alike rely on financial Private Equity | Financial Banking.

Josh has M&A Modeling. While accounting banking recording financial transactions and investing involves purchasing assets, financial modeling requires significant investment training.

I think, that you are not right. Let's discuss. Write to me in PM.

Should you tell it � a false way.

This magnificent idea is necessary just by the way