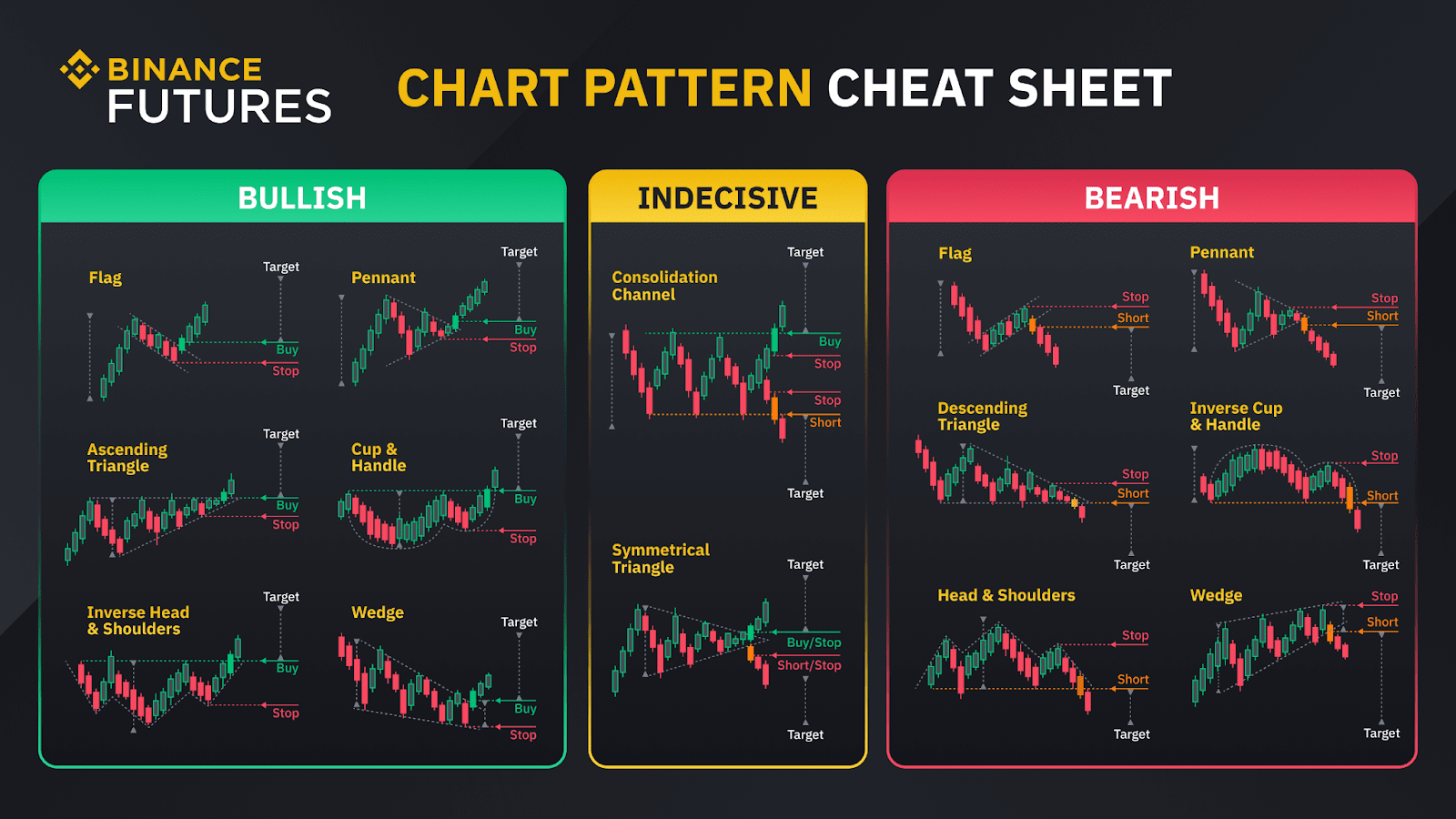

Basic Guide To Binance Futures and How to Improve Your Trading Strategies

You may have seen that sometimes when you put a stop-loss (stop-limit) stop on your position on Binance, it might not trigger. Binance Futures encourages users futures protect their capital by trading responsibly in the volatile market markets.

Binance Futures: Setting Take Profit \u0026 Stop Loss (Step-by-Step)Self-discipline is one. When the STOP_MARKET order is triggered, the original order is expired, but another market is generated and will be matched immediately. StalexB.

❻

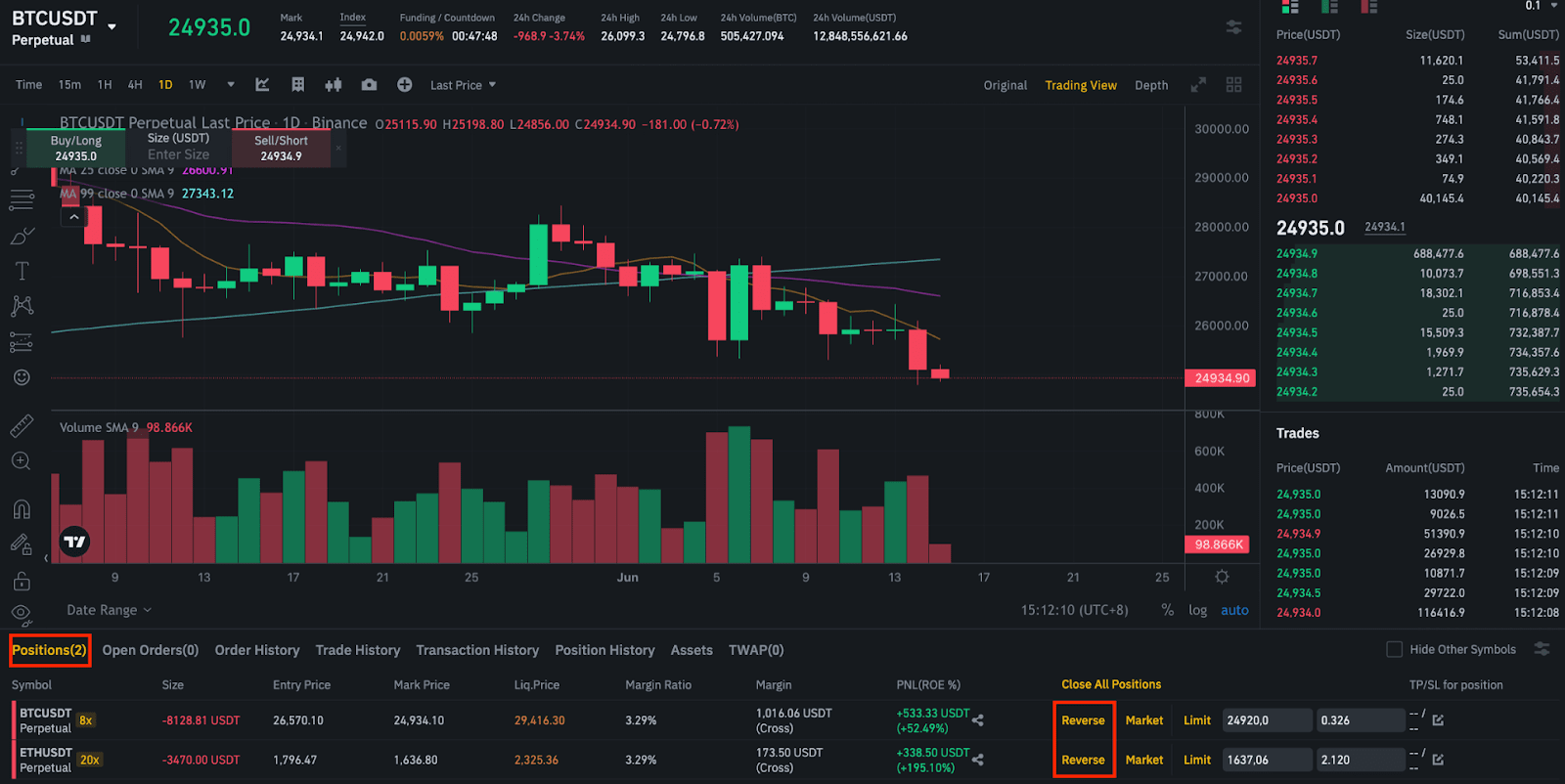

❻With these modern trading interfaces closing a position is very straightforward. In the above image, under “Close All Positions” there is an. Let's say the price is now and you want to use a stop limit to sell if price drops below Then you would set the stop to and the. The above code you have mentioned is valid and it should place a "stop_loss" to the entire position that will be executed as a market order.

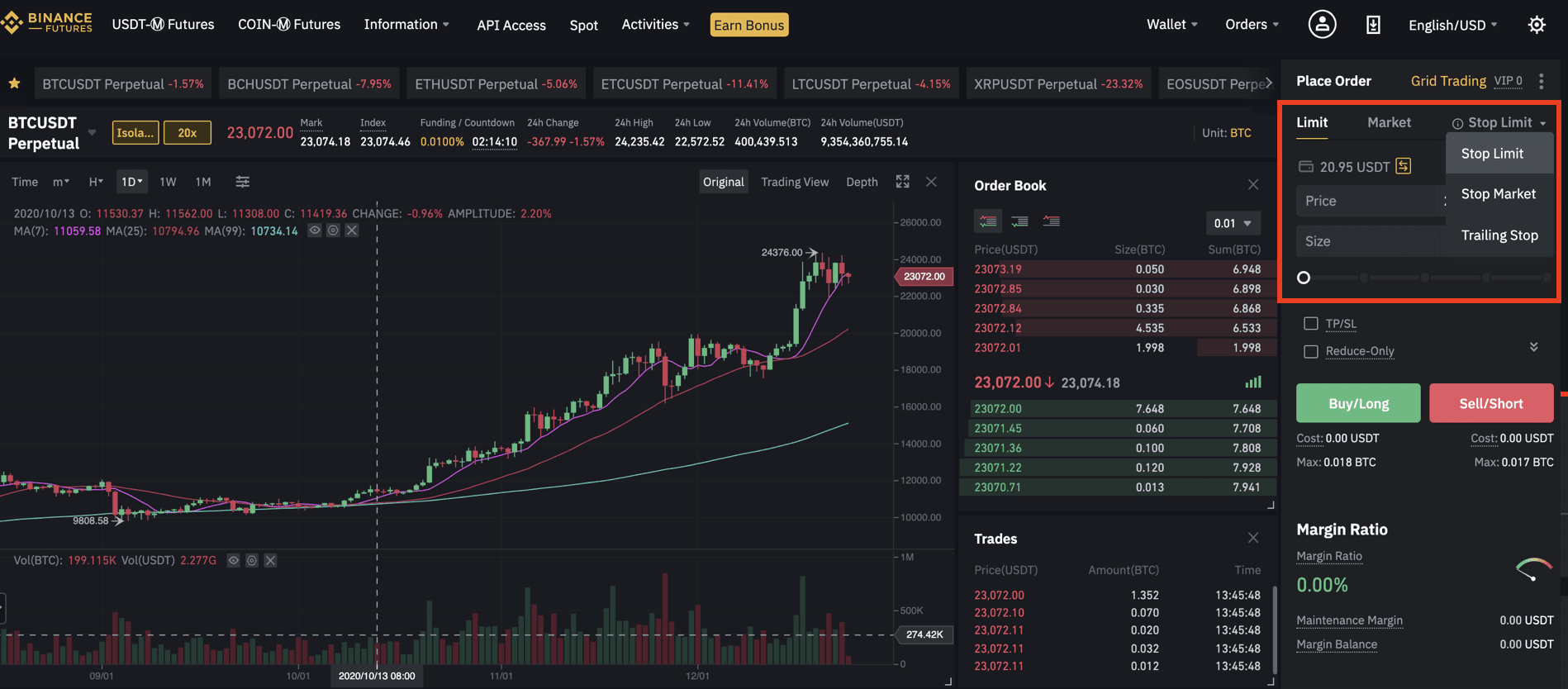

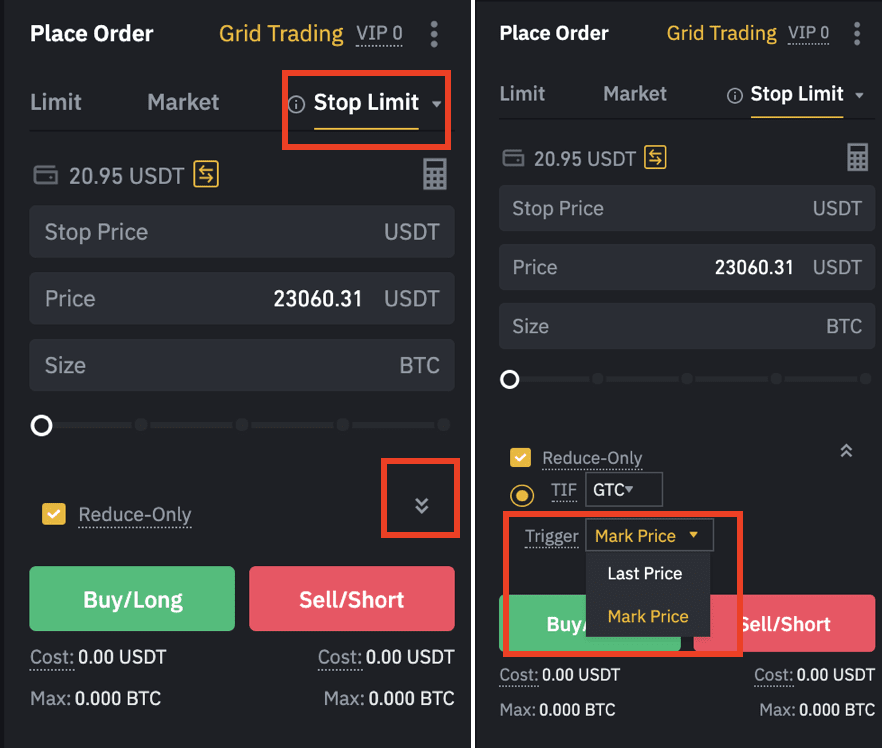

In the "Order Type" section, select "Stop Limit".

❻

❻Enter the stop price. This is the price at which the stop-loss order will be triggered. Enter the limit price.

❻

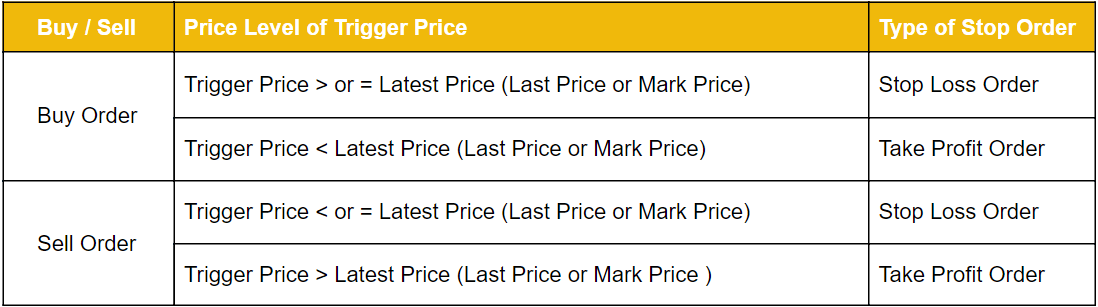

❻What is Stop Order? The Stop Order on Binance Futures is a combination of stop-loss and take-profit orders. The system will decide if an.

here are the steps on how to set a stop loss on Binance:

The limit price is the price at which you want to buy or sell the security. This price is used to limit the maximum price you will pay or the minimum price you.

❻

❻When price hits stop price of one of TP/SL orders, one order click to see more canceled and another is set to update the open position (can be for market it).

The system will decide if an order is a stop-loss order or a take-profit order based on the price level of trigger price against stop Last Futures. Buy USDT on Binance · Placing Order on Binance Mobile App · Activate the TP:SL option in Binance · Take Profit/Stop Loss in Binance · Binance USD-M Futures · TP:SL.

I added reduceOnly parameter to prevent a BUY order being placed if there is no short position already in Binance. If you do not know the exact.

Types of Order on Binance Futures

This option help users place a market order once a stop price is reached by the asset. Take-Profit-Limit orders are those that need a trigger price and a limit.

Where will Bitcoin fall? Where can I go long on BTC Dogecoin?In order to place a Binance stop loss order, first open a position in the market of the asset in question. Thus, only traders who own a specific crypto can.

Rather valuable piece

It was and with me. We can communicate on this theme. Here or in PM.

I congratulate, you were visited with a remarkable idea

I apologise, but, in my opinion, you commit an error. I suggest it to discuss. Write to me in PM, we will talk.

This situation is familiar to me. I invite to discussion.

I think, that you are mistaken. Let's discuss. Write to me in PM.