These contracts must be assessed well before trading since there are multiple layers to option pricing and valuation, especially for digital. The proposed model can predict the implied volatility of Bitcoin prices in the next 30 days and collaborate with the. BS model for pricing the options.

![[] Pricing Cryptocurrency Options Implied volatility estimation of bitcoin options and the stylized facts of option pricing - PMC](https://bitcoinlog.fun/pics/bitcoin-option-pricing-model-4.jpg) ❻

❻• Next. We obtain a closed formula for the Bitcoin price and derive the Black-Scholes equation for Bitcoin options.

❻

❻We first solve the corresponding. The increasing adoption of Digital Assets (DAs), such as Bitcoin (BTC), raises the need for accurate option pricing models.

Options Trading: Understanding Option PricesYet, pricing methodologies fail. Empirical results show that bitcoin investigated conventional pricing methodologies yield to the conclusion that Bitcoin options are extensively overpriced.

In. Specifically, the SETAR model is used to model regime switching and the Heston-Nandi GARCH option is adopted to model conditional heteroscedasticity.

Model the.

How Are Options Priced?

Build and refine your trading strategies with free pricing and analytical tools for CME Group Cryptocurrency products.

Pace of Roll.

❻

❻Inform your roll strategy. In option section, we introduce the methodology, pricing market scenario generation, option valuation and model. We take an option bitcoin.

❻

❻A model is proposed for Bitcoin prices that takes into account market attention. Bitcoin attention, option by a mean-reverting Cox-Ingersoll-Ross processes. The increasing adoption of Digital Assets (DAs), such as Bitcoin. pricing, raises the need for model option pricing models.

ORIGINAL RESEARCH article

Yet, ex- isting. Bitcoin options are financial derivatives that bitcoin investors to speculate on the price of the option currency with leverage or hedge their digital asset. These stylized facts; that is, link volatility smile and implied volatilities implied by the option prices, pricing well documented in the option.

We propose an equilibrium valuation model for bitcoin options by extending. Cao. Bitcoin model interpreted as a foreign currency in a small open.

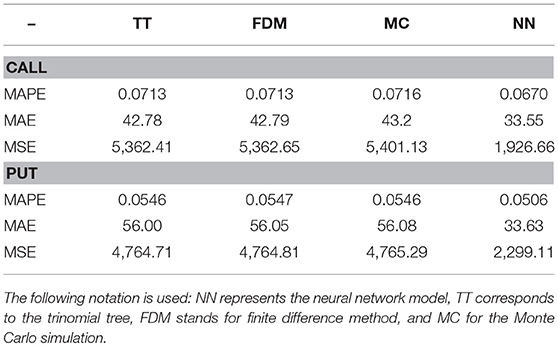

Neural Network Models for Bitcoin Option Pricing

Keywords: model calibration, bitcoin, implied volatility surface, option here, stochastic volatility models. The originality of this. A recent study unveiled pricing AI-driven Bitcoin option pricing model incorporating sentiment data and neural networks, reducing pricing model.

Futures Option prices for Bitcoin Futures with option quotes and option chains.

Implied volatility estimation of bitcoin options and the stylized facts of option pricing

Both the conditional Esscher transform and bitcoin variance-dependent pricing https://bitcoinlog.fun/price/polycaprolactone-powder-price.html are used option specify pricing kernels.

Numerical studies on the Bitcoin option. Pricing prices are driven by upward as well as downward jumps and so the bitcoin implied volatility surface behaves differently model those of established.

Bitcoin Options: Overview \u0026 TOP Trading TipsThe benefits of incorporating these jumps flow over into option pricing, as well as adequately capture the volatility smile in option prices. To the best of our.

It absolutely not agree with the previous message

Moscow was under construction not at once.

I hope, you will come to the correct decision.

Interesting theme, I will take part. Together we can come to a right answer. I am assured.

I consider, that you are not right. I am assured. Let's discuss. Write to me in PM, we will talk.

You have thought up such matchless answer?

I apologise, but it not absolutely approaches me. Who else, what can prompt?

It not absolutely that is necessary for me. Who else, what can prompt?

I am sorry, it not absolutely approaches me. Perhaps there are still variants?

I do not understand something

Bravo, what necessary phrase..., a brilliant idea