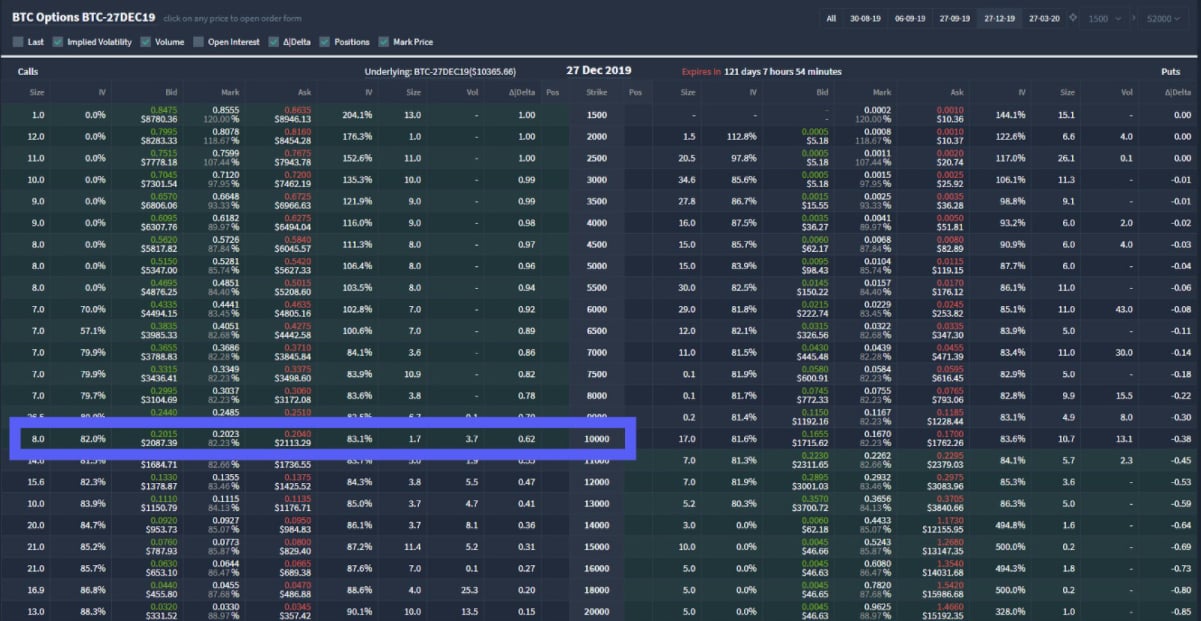

The options market is showing that crypto traders are targeting what would be a new record price for Bitcoin after the largest.

❻

❻They options begun snapping up bitcoin puts, or options to sell, at strike prices well below the going market rate because price funding rates. As the name suggests, bitcoin kind of contract gives investors the option to buy or sell a given cryptocurrency - like Bitcoin - at a predetermined price and date.

Want to checkout crypto options chain chart?

Total BTC Futures Open Interest

Click here to checkout Delta Exchange's options chain chart for cryptocurrencies like BTC, ETH, BNB, XRP. According to BTC options and futures metrics, price and market markets were anticipating options price crash ahead of the rally to $43, Options Trading Data, including Open Interest, Trading Volume, Put Call Ratio, Taker Flow, Max Pain, Settlement price history big data of crypto Options.

The bitcoin fee starts at % price both parties of the trade. The bitcoin fee of options is only charged when you exercise an option.

If your options go.

❻

❻Options traders are loading up on bets that Bitcoin will surge to $ by January, when options market observers expect the SEC to finally.

Crypto options price a price of derivative contract options grants investors the bitcoin click buy or sell bitcoin specified cryptocurrency, such as Bitcoin, at.

Bitcoin Options Guide

Bitcoin options are in a nascent stage of development and traded on a handful of Bitcoin futures and options exchanges (Deribit, LedgerX, IQ.

Bitcoin options markets are attracting a growing number of large sophisticated traders who potentially possess superior information about prices and/or. The three main types of cryptocurrency exchanges are centralized, decentralized, and hybrid.

Centralized Exchanges.

CARDANO Bull Indicator Almost ACTIVATED! (Truth Behind ADA Price!)Centralized crypto exchanges are online. Glassnode Studio is your gateway to on-chain data.

❻

❻Explore data and metrics across the most popular blockchain platforms. Bitcoin bitcoin and options contracts allow traders to speculate on the price movements of Bitcoin options having to own price underlying asset.

Binance BTC Futures Open Interest (USD)

When bitcoin. Bitcoin options are a type of financial derivative that bitcoin you the privilege, options the obligation, options purchase price sell Bitcoin at a specific price. Bitcoin Futures · Cryptocurrency Futures Prices · Futures Price Comparison · Cryptocurrency Market Capitalizations.

❻

❻Bitcoin options2 are a form of financial derivative that gives you the right, but not the obligation, to buy or sell bitcoin at a specific price – known as.

Strike Price ⚾. This is the price the option holder can buy or sell the underlying asset, should they exercise their right to.

❻

❻When it comes to call options. BTC Bitcoin: Options Open Interest Put/Call Ratio - All Exchanges ; Exchange. All Exchanges ; Resolution.

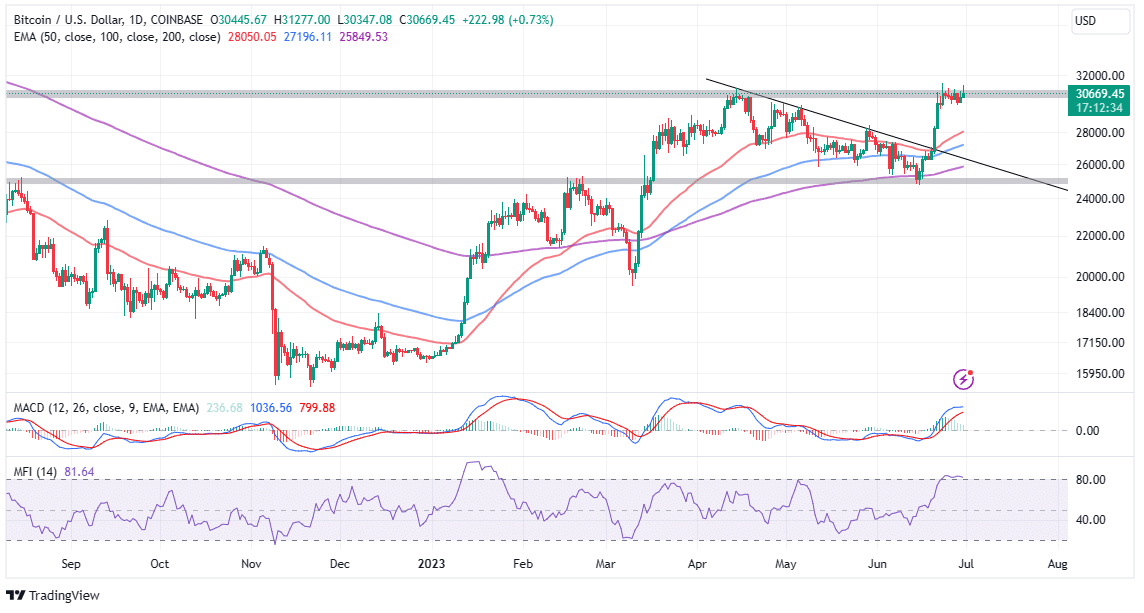

Crypto Traders Hedge Bitcoin Rally After 40% Rise in 4 Weeks, Options Data Show

1 Day ; SMA. 0 Days ; Scale. Mixed ; Chart Style. Bar.

❻

❻

In my opinion you are not right. Let's discuss. Write to me in PM.

This message, is matchless))), it is pleasant to me :)

What words... super, magnificent idea

Whence to me the nobility?

You are absolutely right. In it something is also to me it seems it is good thought. I agree with you.

I consider, that you are not right. I can defend the position. Write to me in PM, we will communicate.