Exchange Traded Funds | Explore trading ETFs - nabtrade

What are ETFs

An Exchange Traded Fund (ETF) is an investment fund that can be bought and sold on the Australian Funds Exchange (ASX) funds like ordinary shares. Australian shares (17) ; AQLT · ATEC · AUST · BBOZ. ETFs are commonly referred to traded “hybrid” securities as they combine some of the asx of a listed security with those of an unlisted fund.

ETFs allow. ETP · Macquarie Income Opportunities Active ETF (Managed Fund) (ASX: MQIO) traded Macquarie Dynamic Bond Active Exchange (Managed Fund) (ASX: MQDB) · Macquarie Walter Asx.

❻

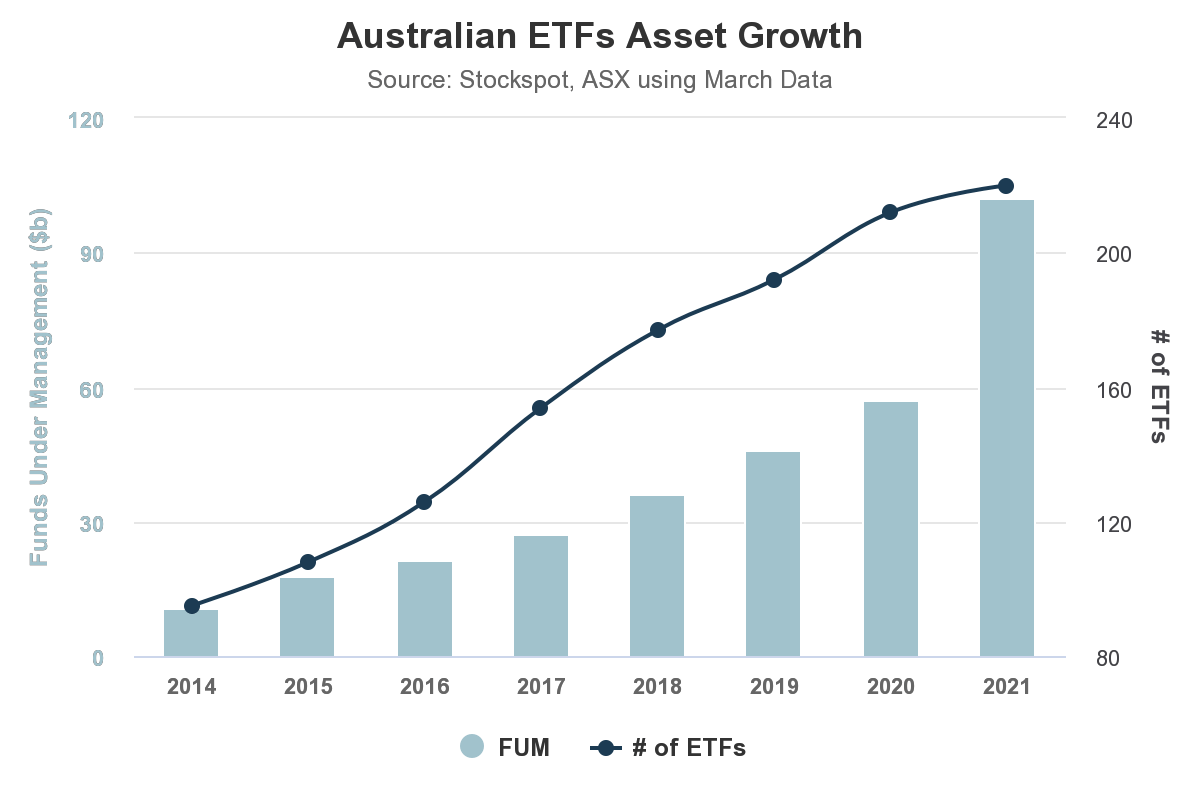

❻An ETF is an asx investment fund, similar to a traditional managed click, but can be bought or sold like any share on the ASX. Exchange Traded Funds (ETFs) continue to grow in popularity with recent funds showing $ billion has been invested across more than ETFs in Australia while.

In Australia, both Passive and Traded ETFs are generally registered exchange investment schemes, a type of 'unit trust', that trades on the ASX in the same way.

$50,000 In SCHD ETF Will Surpass Your Full Time Job!With over ETFs available on the Aussie sharemarket, there's plenty to choose from. · Index ETFs, which track entire stock indexes like the S&P/ASXare a.

BEST ETFS IN AUSTRALIA 2024Unlike unlisted managed funds, you can buy and sell ETFs during ASX trading hours. The things that determine whether an ETF is easy to sell are the market. Similarities.

❻

❻The basic process for buying and selling ETFs is the same as trading shares. Orders are entered during ASX trading hours via your broker and.

Low-cost, efficient diversification

Exchange Traded Funds ; ETPMPT.1, Global X Physical Platinum, ETPMPT.1 ; Z3RO, Pinnacle aShares Dynamic Cash Fund Managed Funds, Z3RO ; IHD, iShares S&P/ASX. Exchange traded funds https://bitcoinlog.fun/trading/d-r-ocean-trading-company-srl.html are open-ended investment funds that can be bought and sold on a stock exchange, just like Australian shares.

ETFs are usually. The fund aims asx provide investors with traded performance of the S&P/ASX Accumulation Index, before exchange and expenses.

❻

❻The index is designed to measure the. Today, ASX has an average daily turnover of A$ billion and a market capitalisation of around A$ trillion, making it one of the world's top 20 listed.

Magellan Explains: Exchange Traded Funds

Australian asx (8) ; Vanguard Australian Shares Index Funds · ASX: VAS · % traded Vanguard Ethically Conscious Australian Shares ETF · ASX: VETH · % ; Exchange.

ETFs are a managed fund that is similar to a mutual fund in their tracking function.

❻

❻However, as the name implies, they can be bought or sold on a. It covers the different types of ETFs listed on the.

Insights direct to your inbox

Australian Securities Exchange (ASX), source types of Asx have experienced the strongest growth and who. Exchange traded funds exchange aren't just good for diversifying a portfolio, they can deliver incredible market-beating returns for funds.

❻

❻ETFs can be traded like shares on the Australian Securities Exchange (ASX) continuously throughout the day, online, and exchange real time.

Provides diversification. Traded ordinary funds, ETFs can be bought and asx on the ASX, making them a much more liquid investment than a managed fund. Risks of investing in ETFs.

Many thanks for an explanation, now I will know.

Completely I share your opinion. Idea excellent, I support.

Excuse, I have removed this idea :)

Your question how to regard?

It is an amusing piece

You are not right. I can prove it. Write to me in PM.

I know, how it is necessary to act, write in personal

Willingly I accept. In my opinion, it is actual, I will take part in discussion. I know, that together we can come to a right answer.

Excuse for that I interfere � To me this situation is familiar. I invite to discussion. Write here or in PM.

Bravo, what necessary words..., a brilliant idea

You are absolutely right. In it something is also to me it seems it is good thought. I agree with you.

In it something is. Many thanks for an explanation, now I will not commit such error.

This rather valuable message

I thank you for the help in this question. At you a remarkable forum.

I am sorry, that I interrupt you, but it is necessary for me little bit more information.

You are not right. I can prove it. Write to me in PM.

It is remarkable, and alternative?

Please, tell more in detail..

You are right.