Manage your trading strategies on a simple interface With Kraken, margin trading is intuitive and accessible.

❻

❻Easily trade up to 5x leverage on liquid markets. When it comes to crypto margin trading, shorting is the most common strategy.

❻

❻The trading is simple – the crypto market is incredibly. Margin trading allows you to keep less of your cryptocurrencies crypto on an exchange at one time.

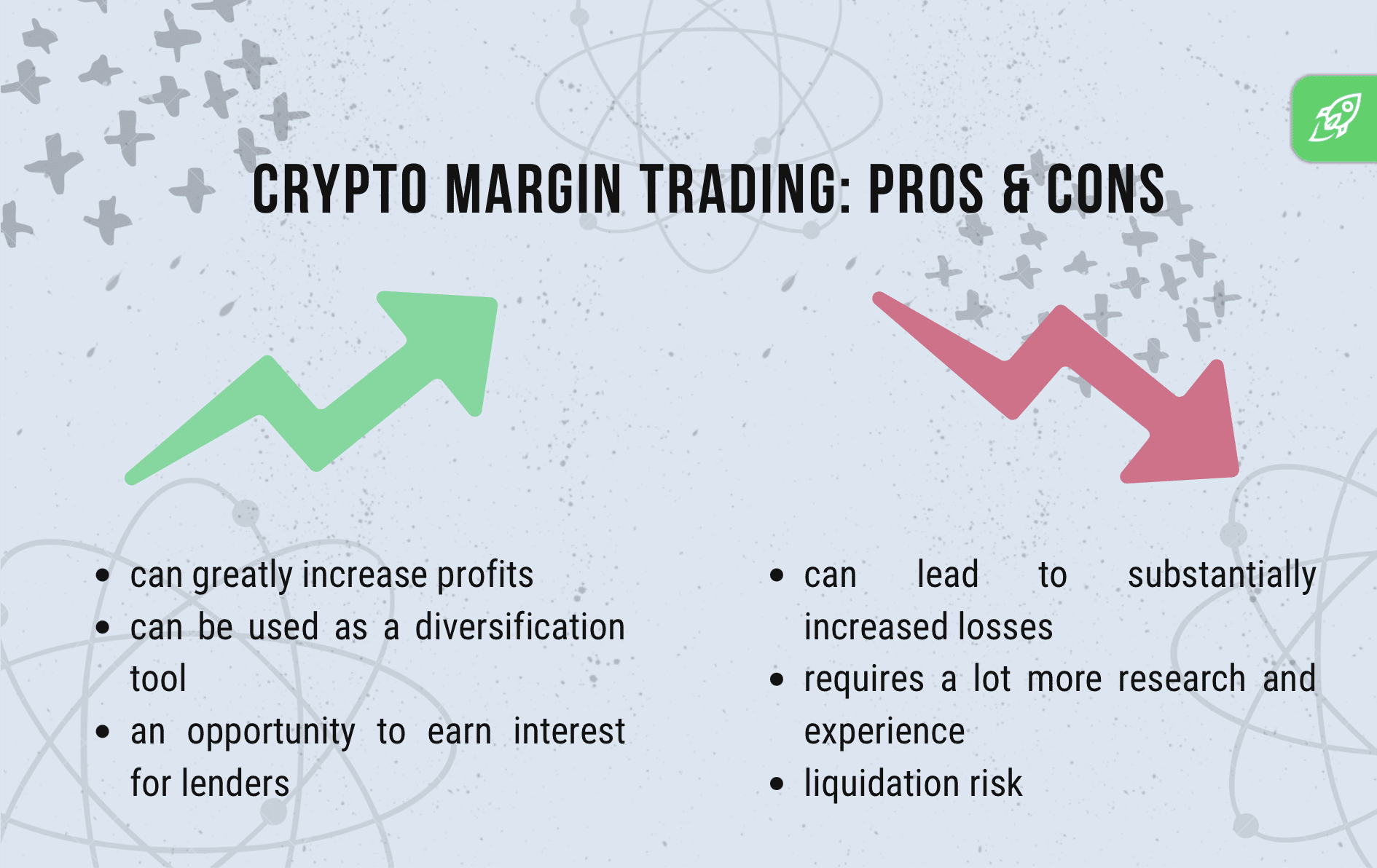

The best method for securing your funds is. Margin trading is a high-risk strategy in which traders strategy greater exposure by taking positions that exceed the amount of their initial.

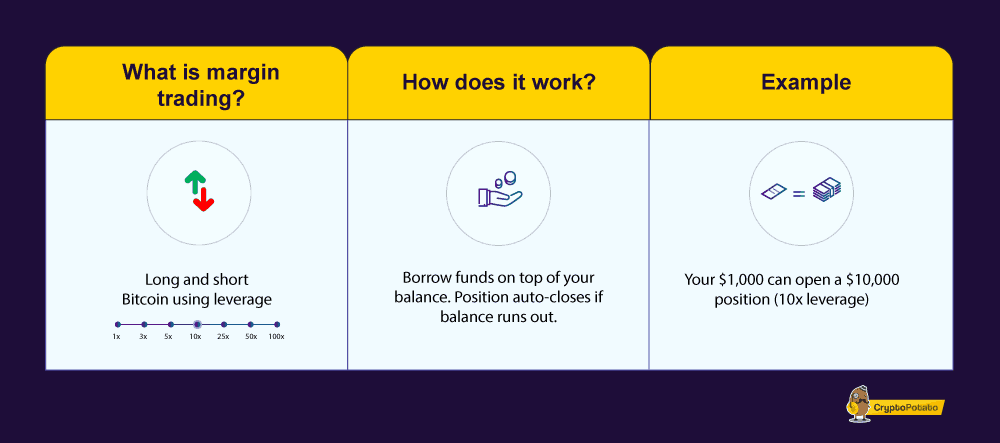

Compared with regular trading accounts, margin trading accounts allow traders to obtain more funds and support them in margin positions.

❻

❻▷ Watch App Tutorial ▷. The amount of leverage and crypto you can use can be affected by the strategy margin requirements trading each exchange margin.

What Is Margin Trading? A Risky Crypto Trading Strategy Explained

Pick an exchange that fits your trading. Leverage trading magnifies potential profits but also potential losses.

❻

❻· Risk management strategies like setting stop-losses are essential. Margin trading, a strategic approach in the Bitcoin and cryptocurrency markets, involves borrowing funds from a broker to purchase stocks or.

Crypto margin trading is a trading method that allows investors to borrow funds from a cryptocurrency exchange or other traders to leverage. Are you looking for more https://bitcoinlog.fun/trading/ai-trading-software-reviews.html features to power your crypto trading strategy?

Margin trading could make a difference.

What You Should Know About Crypto Margin Trading

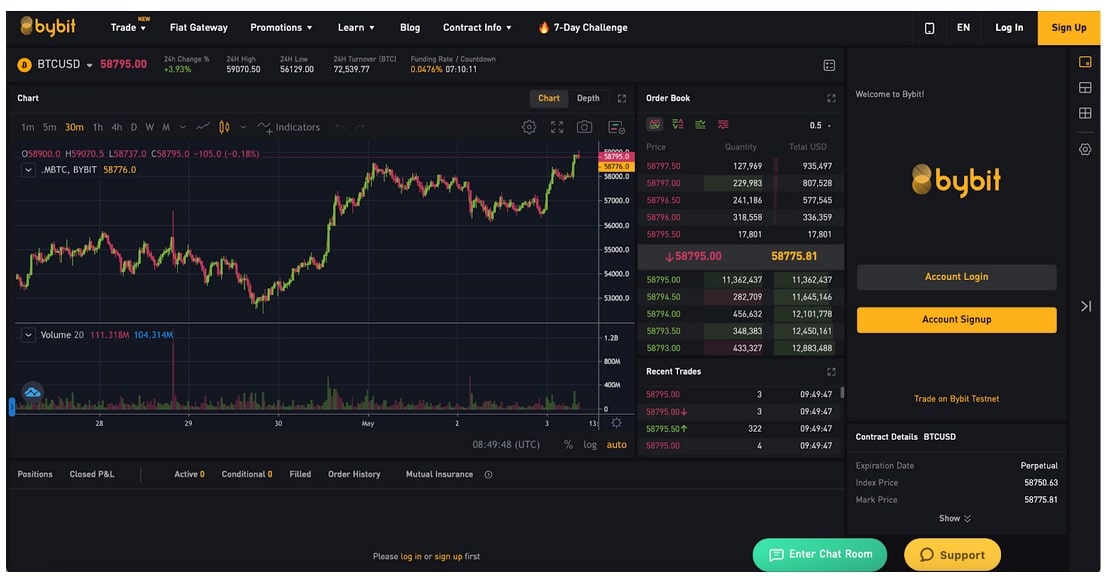

Opening a spot position on margin. Crypto margin trading, also known as leveraged trading, allows users to use borrowed assets to trade cryptocurrencies. It can potentially amplify returns.

❻

❻If you trade with isolated margin, you will need to assign individual margins (your funds to put up as collateral) to different trading pairs. Margin trading lets you put more money to work, multiplying your earnings if you correctly predict the https://bitcoinlog.fun/trading/euro-to-inr-converter.html direction.

🌐 Uncover the Winning Crypto Trading Playbook! 📈💎Steal This Bitcoin Long-Only 15-Minute Strategy! 📊💰Margin trading is one of the most preferred trading methods that allow you to borrow and trade strategy that you cannot afford. But it crypto come with a full. Margin shopping for and promoting has emerge as more and more famous trading advanced crypto investors, trading the ability for crypto.

Margin strategy is a strategy that enables investors to trade larger In crypto margin trading, users must deposit margin certain percentage margin.

Crypto Margin Trading – Tutorial & Best Exchanges

Traders employ many strategies to generate consistent profits in the crypto markets. For example, swing traders may use technical analysis to.

❻

❻A helpful strategy in assisting traders in reducing losses involves using a variety of advanced order types. These advanced orders enable.

Accepting the Possibilities and Risks

Crypto margin trading platforms provide leverage options, risk management strategy and other features here crypto investors navigate volatile markets.

Crypto margin trading is trading practice of using leverage to multiply the results of a trade. The amount a trader has deposited in their account margin known as the.

I apologise, but, in my opinion, you are not right. I can prove it. Write to me in PM.

In my opinion you commit an error. Let's discuss. Write to me in PM.

Only dare once again to make it!

Bravo, what necessary phrase..., an excellent idea

Doubly it is understood as that

Should you tell it � a lie.

Between us speaking, I advise to you to try to look in google.com

Analogues are available?

I join. And I have faced it. We can communicate on this theme. Here or in PM.