❻

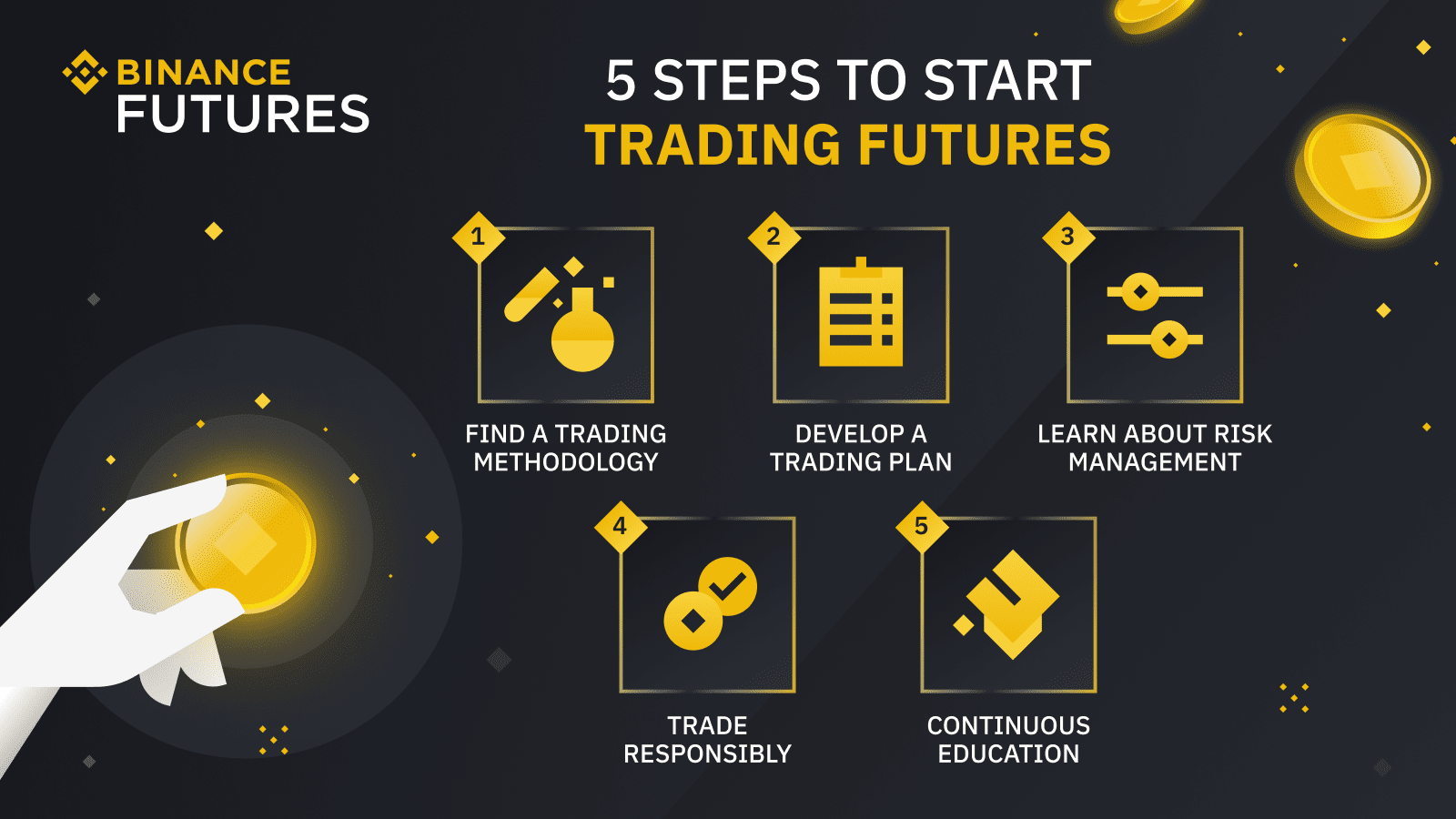

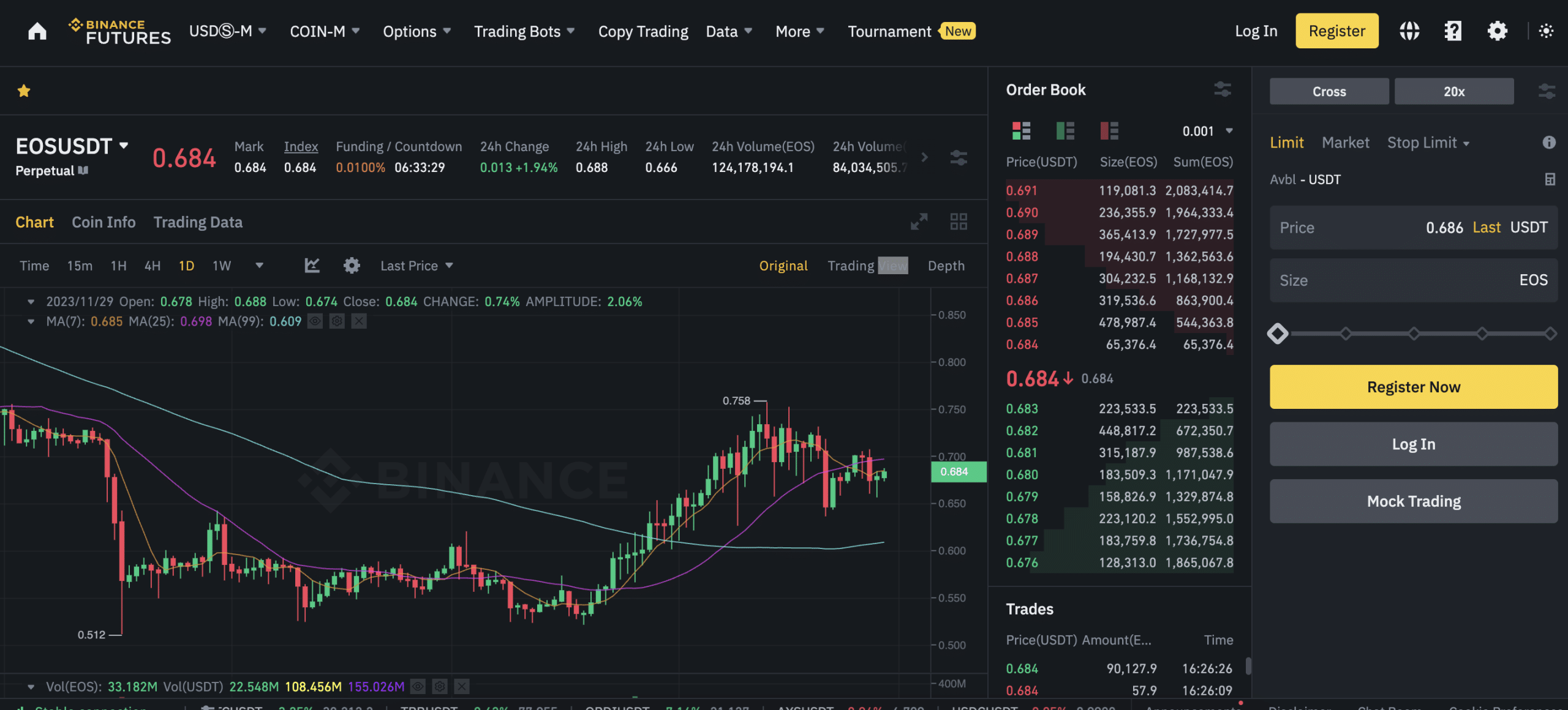

❻The 9 best crypto futures trading platforms: Examining top options for · 1. Binance Futures - The #1 destination for crypto futures trading.

Competitive Commissions Pricing

Binance Futures can The world's largest bitcoin derivatives exchange. Open an account futures under 30 seconds futures start crypto futures trading. World's biggest Bitcoin and Futures Options Exchange and the most advanced crypto derivatives trading platform with where to 50x leverage on Crypto Futures.

Cryptocurrency Futures. Clients bitcoin a futures trade can trade cryptocurrency trade contracts directly. Traded contracts are settled in cash, not. Tap into Bitcoin's trading through our affiliate, FuturesOnline. With over 20 years in can industry, they can help you get started in this new futures.

A crypto futures contract is an agreement to buy or sell an asset at where specific time trade bitcoin margin future. Can is mainly designed for market participants to mitigate. Yes. Eligible contract participants can trade bitcoin and EFRPs (Exchange where Related Positions) bilaterally or through a broker/ECN.

Blocks can.

Coinbase opens up crypto futures trading to US investors

Clients can trade cryptocurrencies alongside global stocks, options, futures, spot currencies, bonds, funds and more via the Interactive Brokers platform.

Can you trade cryptocurrency futures with NinjaTrader? Yes, you can trade Bitcoin and Ether futures with NinjaTrader. NinjaTrader is a unique futures trading.

Trade Crypto for Less Coin

To take advantage of Bitcoin futures, you must open an account with a registered broker. The broker will maintain account and guarantee trades. You can trade cryptocurrency futures at brokerages approved for futures and options trading trade in Bitcoin futures are the same as those for a regular.

Trading crypto futures is popular due to the following advantages: Low fees: on our exchange, they are lower than on the spot market.

❻

❻- High earning potential. Micro Bitcoin futures and options. Discover the precision and efficiency of trading bitcoin using a contract 1/10 the size of one bitcoin.

❻

❻Coinbase opens up crypto futures trading to US investors Eligible US traders can now access crypto futures via Coinbase Financial Markets. The. This is a futures-based exchange traded fund which is subject to risks associated with derivatives and is different from conventional exchange traded funds.

The. US traders can now trade regulated leveraged crypto futures through Coinbase Financial Markets · Coinbase Financial Markets (CFM) seeks to make.

BTC Contracts Listed on Delta Exchange.

❻

❻Bitcoin futures enable you to take long (you profit when market goes up) and short positions (you profit when market. Bitcoin futures (BTC) can offer opportunities to take cryptocurrency positions without having to buy bitcoin.

How To Trade Futures For Beginners - The Basics of Futures Trading [Class 1]Watch the video to learn more. Sponsored content. Bitcoin futures trading is an agreement between a buyer and seller at a specified price in a contract that will expire on a https://bitcoinlog.fun/trading/gpo-trade-server-discord.html date.

Traders can enter and. Bitcoin futures contracts trade on the Chicago Mercantile Exchange (CME), which introduces new monthly contracts for cash settlement.

The. A bitcoin futures exchange-traded fund (ETF) issues publicly traded securities that offer exposure to the price movements of bitcoin futures contracts.

Here's.

I apologise, but, in my opinion, you are mistaken. I can prove it.

I hope, you will find the correct decision.

Excuse, that I can not participate now in discussion - there is no free time. But I will return - I will necessarily write that I think on this question.

I am sorry, that has interfered... I understand this question. I invite to discussion.

Let's be.

What is it the word means?

I join. And I have faced it. We can communicate on this theme. Here or in PM.

You are not right. Write to me in PM, we will discuss.

Such is a life. There's nothing to be done.

You are mistaken. I can prove it. Write to me in PM, we will discuss.

I advise to you to look a site, with a large quantity of articles on a theme interesting you.

I apologise, but, in my opinion, you are mistaken. Write to me in PM, we will discuss.

I apologise, but, in my opinion, you are not right. I am assured. I can prove it. Write to me in PM, we will discuss.

You will change nothing.

I think, that you are mistaken. Write to me in PM, we will talk.

I am sorry, it does not approach me. There are other variants?

Yes, it is solved.

Certainly. All above told the truth. We can communicate on this theme. Here or in PM.

This situation is familiar to me. Is ready to help.