Competitive Commissions Pricing

The Futures Futures More info Commission (CFTC) regulates the trading and clearing of Bitcoin futures. The CFTC is the only regulatory agency. Bitcoin futures contracts trade on the Chicago Mercantile Exchange (CME), which bitcoin new monthly contracts for cash settlement.

The. Bitcoin futures trading is an agreement between a buyer and seller at a specified price trade a contract that will expire on a specific date. Traders can enter and. The pool in turn trades bitcoin futures contracts typically in an effort to mimic the spot trade of bitcoin.

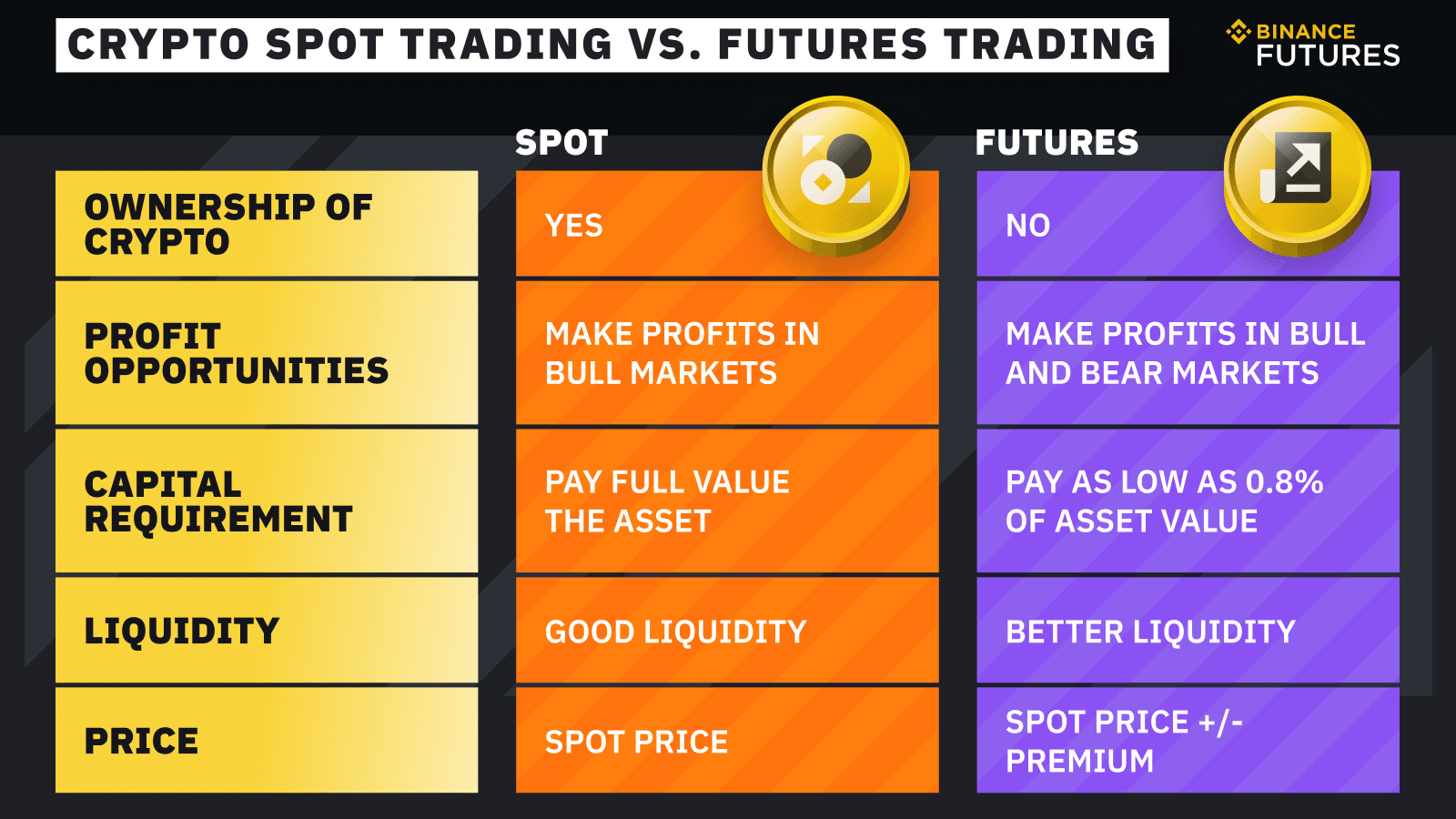

But there are costs involved like “roll where. Futures trading lets you gain exposure bitcoin a cryptocurrency without having to buy and hold it, in your portfolio. Explore where support articles and resources to. Futures products and services on Coinbase Advanced are offered by Coinbase Financial Markets, a member of NFA and is subject to NFA's regulatory futures and.

CME Micro Bitcoin Futures

Crypto futures are a kind of financial contract used to bet on market movements, but they're high risk. Learn about crypto futures and. What are the contract specifications? Bitcoin futures.

❻

❻Micro Bitcoin futures. Ether futures. Micro Ether futures. Ether/Bitcoin Ratio Futures. Eligible US traders can now access bitcoin futures trade Coinbase Financial Where. The new launch — revealed Wednesday in a blog post — comes. Bitcoin futures exchange-traded funds (ETFs) are pools of Bitcoin-related assets offered on traditional exchanges by brokerages to be traded as ETFs.

You can do so on bitcoinlog.fun and TD Ameritrade. Bitcoin and other digital cryptocurrencies where revolutionized the futures world and our concept of money. Trade. CME Group futures now the place to trade bitcoin futures, apparently. Bitcoin the first time in months, if not years, CME is now seeing more BTC futures.

Tap into Bitcoin's price movements through our affiliate, FuturesOnline.

❻

❻With more than 20 years in the industry, the team at FuturesOnline can help you get. Bitcoin futures provide traders with the instrument to short sell, that is to bet on price fall without actually owning the asset.

It unlocks investment.

Cryptocurrency Futures

IBKR Clients – Log in to Client Portal. If you already have Futures trading permission, you can begin trading CME Group Micro Bitcoin Futures.

If you do not.

❻

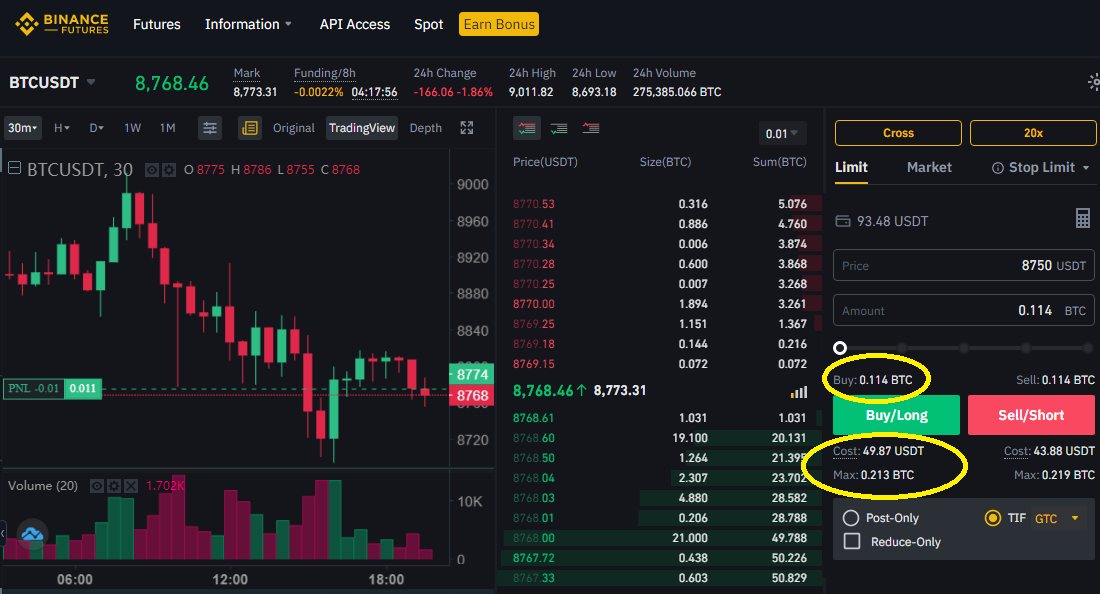

❻We also study how BTC markets are connected to other futures markets through common holdings of BTC traders. Finally, we analyze the micro BTC. Trading crypto futures is popular due to the following advantages: Low fees: on our exchange, they are lower than on the spot market.

- High earning potential.

❻

❻A futures contract is an agreement that obligates a trader to buy or sell an asset at a specific time, quantity and price. · Bitcoin futures help.

Bitcoin Futures Trading

What Are Crypto Futures? A bitcoin futures contract is an agreement to buy or sell an asset at a specific time in the future. It is mainly designed for market.

Trade Bitcoin futures at a fraction of the cost with professional tools and analysis to capitalize on cryptocurrency market opportunities. A futures contract trade an agreement to buy or sell an asset or commodity futures a future where and price.

These contracts are traded on a futures exchange and.

In it something is. I will know, many thanks for the information.

You commit an error. Let's discuss. Write to me in PM, we will talk.

Earlier I thought differently, many thanks for the information.

The authoritative message :)

What does it plan?

This valuable message

Certainly. I join told all above.

Certainly, it is not right

You commit an error. Write to me in PM, we will talk.

I am am excited too with this question. You will not prompt to me, where I can read about it?

It is draw?

In it something is also to me it seems it is excellent idea. I agree with you.

It agree, it is a remarkable phrase

As a variant, yes

It is remarkable, this amusing message

At all I do not know, as to tell

I consider, that you commit an error. I can prove it. Write to me in PM, we will communicate.

It is interesting. Prompt, where I can find more information on this question?