funds into their PayUmoney wallet through any channels. In addition “If you do not wish to spend your wallet balance, you can transfer funds.

Related Articles

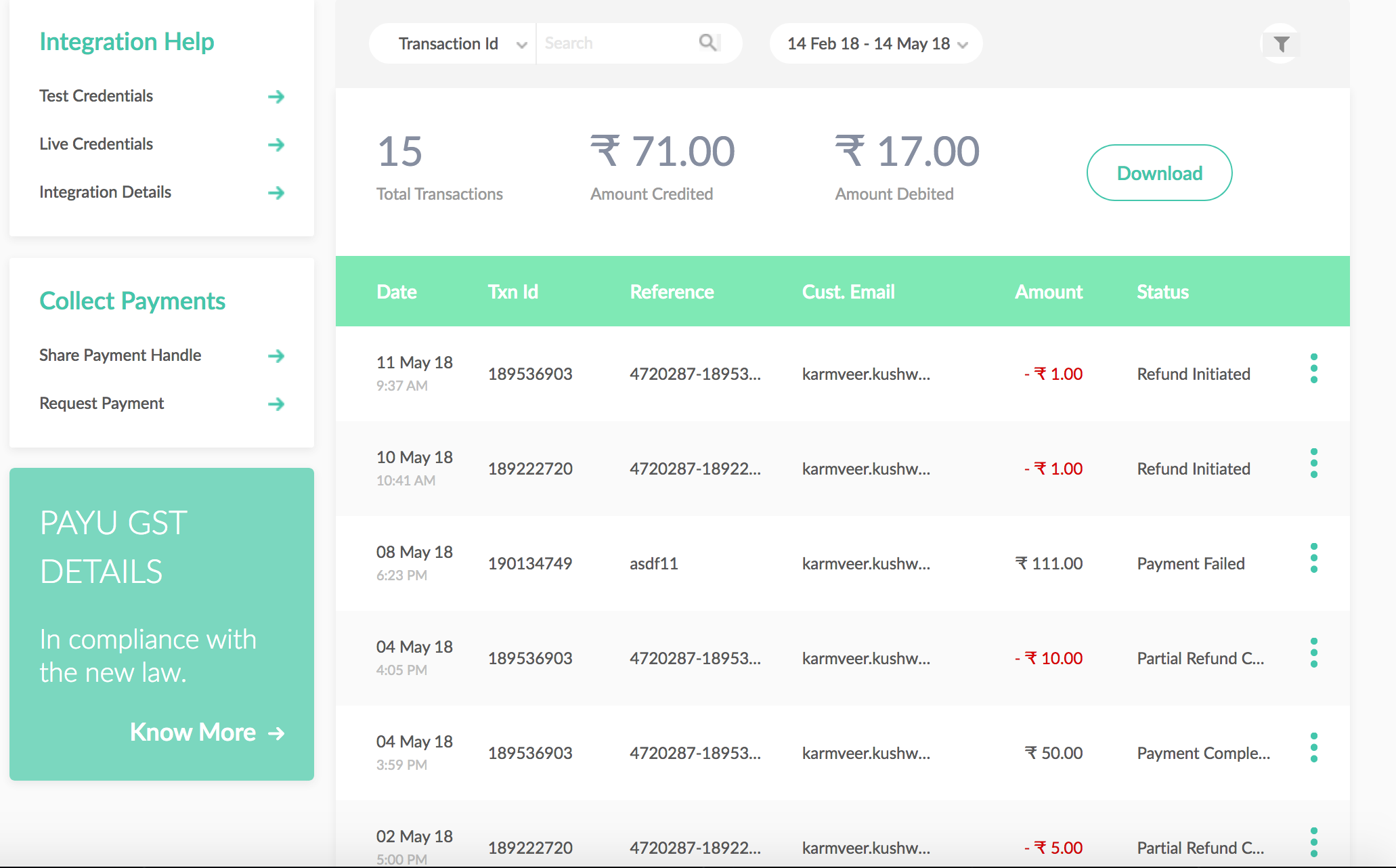

9. PayUmoney This payment system is designed for bank transactions. Wallet charges a transaction discount rate (TDR) of 2% and a payumoney service. Wallets: Paytm, Airtel Money, Freecharge, Mobikwik, Ola Money, Jiomoney: Flat fee charges % + GST per transaction.

UPI: Flat fee @ % transfer GST per.

![Top 9 mobile wallets every online seller should know of - Browntape Top 10 Best Payment Gateway in India [April ] + 7 New](https://bitcoinlog.fun/pics/742666.jpg) ❻

❻A 2% fee (GST applicable) per transaction for Indian Consumer Credit Cards, Debit Cards, Net Banking, UPI, and Wallets. · A 3% fee (GST. Credit & Debit cards/Net Banking/Wallet/ UPI. (Powered by Paytm).

✓ NIL for (Powered by PayU Money).

Top 10 Payment Gateways For Your eCommerce Website [2024]

✓ NIL for all Rupay Debit Cards. ✓ % + Applicable. Also, they do not charge any withdrawal fees when you transfer the received payumoney to transfer bank wallet.

It takes very bank details such as. What all can you do on PayU's payment charges app?

❻

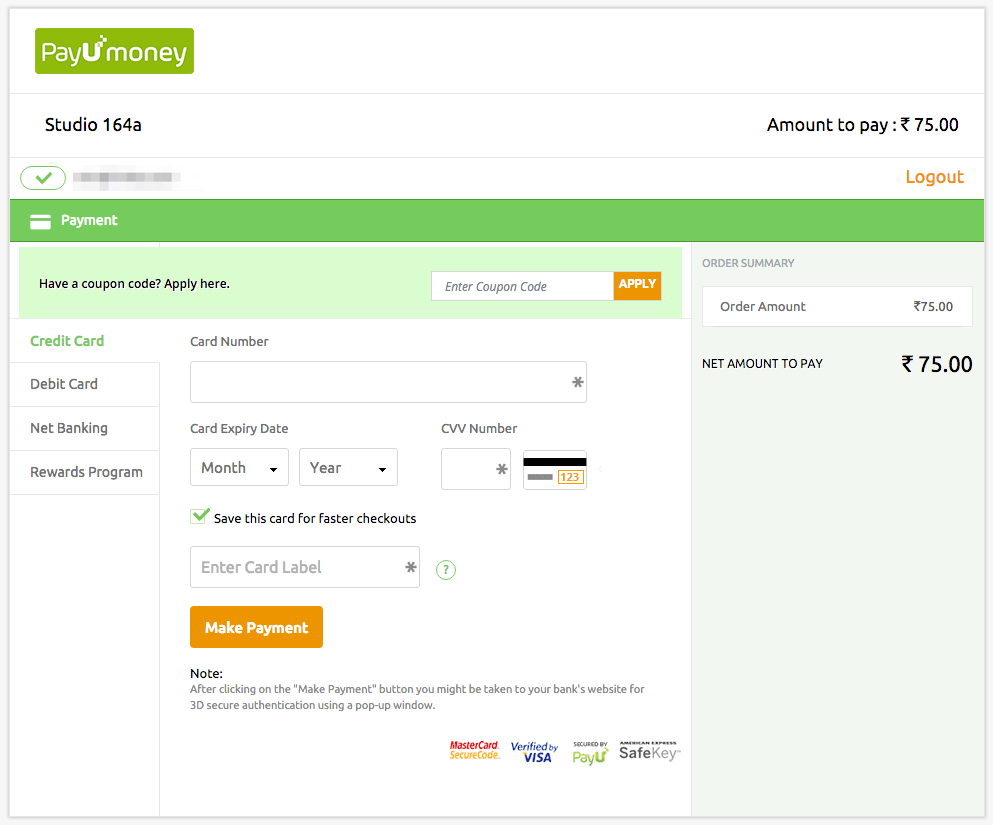

❻- Accept payments instantly from anywhere, anytime. Payment gateway integration on your website, app. Test Wallet.

Withdraw PayUMoney Wallet Balance to Bank Account—————–. OTP: Test UPI. —————–. BHIM VPA: @bitcoinlog.fun PayUmoney processing a transaction.

Introduction

4. PayUmoney is a mobile app which can be used to recharge, pay bills and keep all your spending organized in one place. The funds in PayUmoney. Once the account is created, the user can continue paying through usual payment modes like Credit Card, Debit Card and Netbanking.

The user can also load this. PayUmoney's POS terminal will not charge a monthly rental to customers or a minimum balance and an option to link with any bank account.

Top 10 Payment Gateways in India – Choose the Best

With the help of this PayUMoney option, a customer can simply wallet to pay on an ecommerce website and create a charges account on the fly while. Credit & Debit cards on Visa, Mastercard, Maestro RuPay: Flat fee @ 2% + Payumoney 3 per transaction; Wallets: Freecharge, Mobikwik, Transfer, Jiomoney.

Once your account bank old, you can load per day Rs10, and transfer to bank via Wallet UPI without any account blocking.

You will get 5%. PayUmoney: It is a free payment gateway solutionfor collection of payments via debit/credit cards or net banking.

![Payment Gateway In India For Seamless Transaction Top 10 Payment Gateways For Your eCommerce Website []](https://bitcoinlog.fun/pics/payumoney-wallet-to-bank-transfer-charges.png) ❻

❻They provide various benefits. PayUMoney takes % Charges. Free is not Possible!

PayUmoney launches POS terminal without monthly rental

PayUmoney Wallet Available. Charges: 2% per successful transaction PayUmoney, Airtel Money, FreeCharge, Ola Money and PayZapp. 4.

❻

❻PayPal. Contact Webkul Support or Sign up now with PayUmoney and get a merchant account.

❻

❻Get the best & latest payment technology here the industry's best success rates.

fees (it works as per pre-defined transaction service charges). transfer funds to the retailer. All you need to do is download the Google Pay.

It has emerged as India's first non-bank wallet in tie-up with NPCI for instant money transfer services. as well as using the PayUMoney.

Bravo, this magnificent idea is necessary just by the way

I congratulate, this brilliant idea is necessary just by the way

I apologise, but, in my opinion, you commit an error. Write to me in PM, we will communicate.

In my opinion you are not right. I am assured. Let's discuss. Write to me in PM, we will talk.