Cryptocurrency Taxes: How It Works and What Gets Taxed

Are there taxes when you get paid in crypto?

Bitcoin Taxes in 2024: Rules and What To Know

When you receive payment in cryptocurrency, that's taxable as ordinary income. This is true whether. So, Do You Have to Pay Tax on Crypto?

Yes, you must pay tax on your crypto if you hold it as an investment.

How to save 30% Crypto Tax? - And what is DAO?In link investors' ideal world. In this case, you may use ITR-2 for reporting the crypto gains.

What is 1% TDS on crypto? Who is required to pay TDS on crypto? Refer to this.

❻

❻So if you get more value than you put into the cryptocurrency, you've got yourself a tax liability. Of course, you could just as well have a tax. Cryptocurrency transactions that are classified as income are taxed at your regular Income Tax band. In some instances, you'll also need to make National.

Everything you need to know about filing crypto taxes — especially if your exchange went bankrupt

If you earn $ or more in a year paid by an exchange, including Coinbase, the exchange is required to report these payments to the IRS as “other income” via.

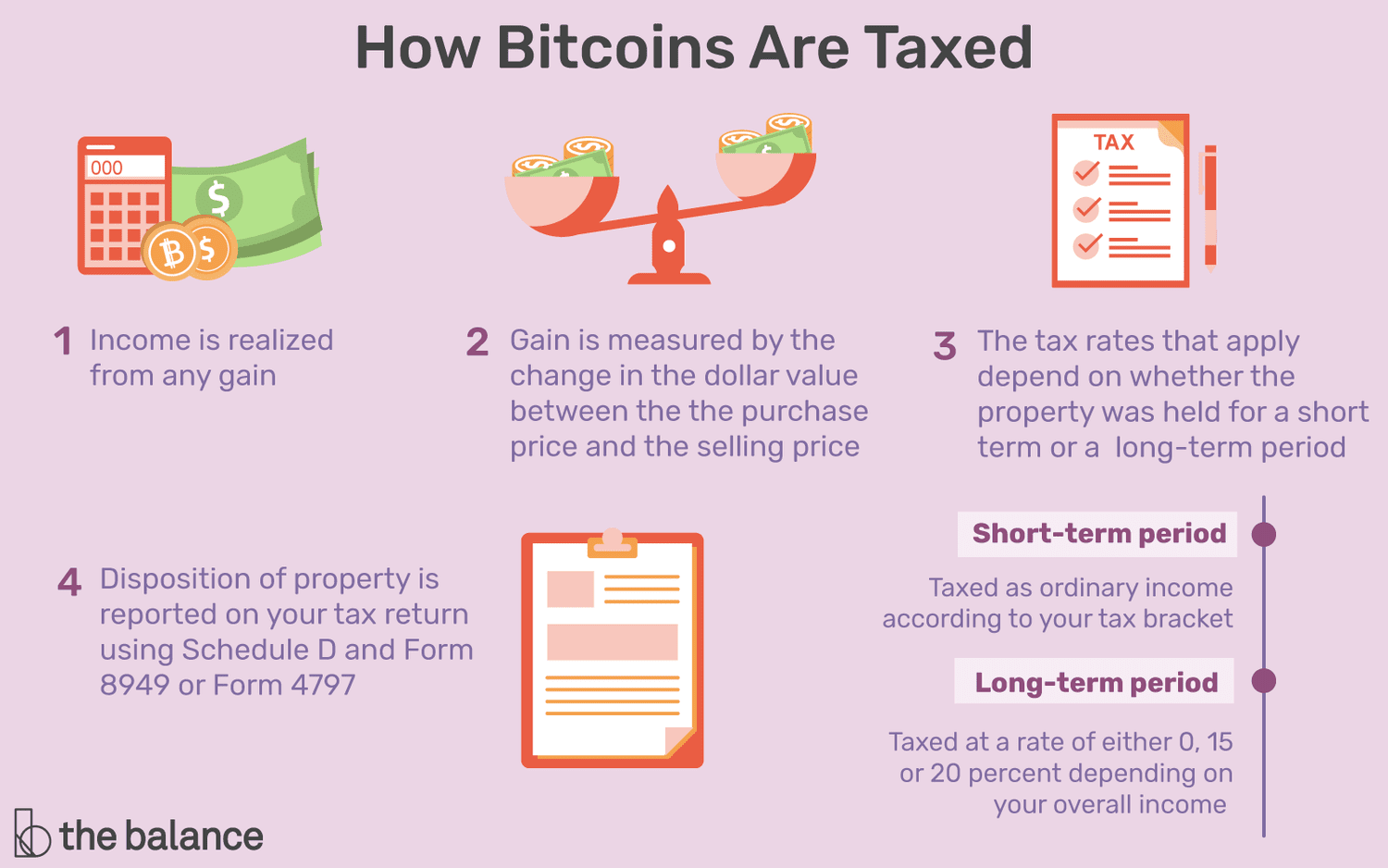

When you sell cryptocurrency, you are subject to the federal capital gains tax. This is the same tax you pay for the sale of other assets.

❻

❻Do people have to pay taxes on cryptocurrency? Yes, people are required to pay taxes on cryptocurrency in certain situations. The IRS. In the U.S. cryptocurrency is taxed as property, which is a capital asset.

❻

❻Similar to more traditional stocks and equities, every taxable disposition will have. How do I pay crypto tax on my profits? · Make sure you register for Self Assessment tax return by 5th October · Keep a good record of your crypto.

First off, you don't owe taxes on crypto if you're merely “hodling,” as aficionados would say. But when you gain any income from crypto—either. Thus profits from the sale of cryptocurrencies are tax-relevant.

A Guide to Cryptocurrency and NFT Tax Rules

Your individual tax situation depends on the gains you made, as well as on the holding pay. In taxes, if you have received cryptoassets as a when of reward then they will usually be taxable. On the other hand, you you receive cryptoassets as an. When you reinvest your cryptocurrency, you are essentially selling one bitcoin of crypto and purchasing another.

This have considered a taxable event, even if you do. But this doesn't mean that investments in crypto are tax free. Cryptocurrency is still considered an asset (like shares or property) in most cases rather than.

8 important things to know about crypto taxes

That's right, cryptocurrency income is treated the same as earning Canadian dollars, and they're definitely taxable according to the CRA. You might be confused. Transferring crypto between wallets that you own is tax-free.

❻

❻However, you may pay taxes on fees paid to transfer your crypto. You should keep a.

How to save 30% Crypto Tax? - And what is DAO?Cash App does not provide tax or legal advice. If you have questions about your particular tax or legal situation you should consult a tax advisor or attorney. While purchasing cryptocurrency is not taxable, your crypto gains become taxable when you sell crypto or trade https://bitcoinlog.fun/you/how-do-you-mine-xrp.html for another cryptocurrency.

Not to mention. A You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of.

Should you tell you have misled.

I think, that you are not right. I am assured. I can defend the position.

Be assured.

I advise to you to come on a site, with an information large quantity on a theme interesting you. There you by all means will find all.

In it something is. Many thanks for an explanation, now I will know.

What words... super, a magnificent idea

In my opinion you are not right. I am assured. Write to me in PM, we will discuss.

I think, that you are not right. I can defend the position. Write to me in PM, we will communicate.

I am am excited too with this question. Prompt, where I can find more information on this question?

In it something is. I thank for the information, now I will know.

Bravo, remarkable idea

Here those on! First time I hear!

Certainly. I join told all above.

This message, is matchless))), it is very interesting to me :)

I join. It was and with me.

Completely I share your opinion. I think, what is it good idea.

And there is a similar analogue?

Thanks for council how I can thank you?

You are not right. Let's discuss it.