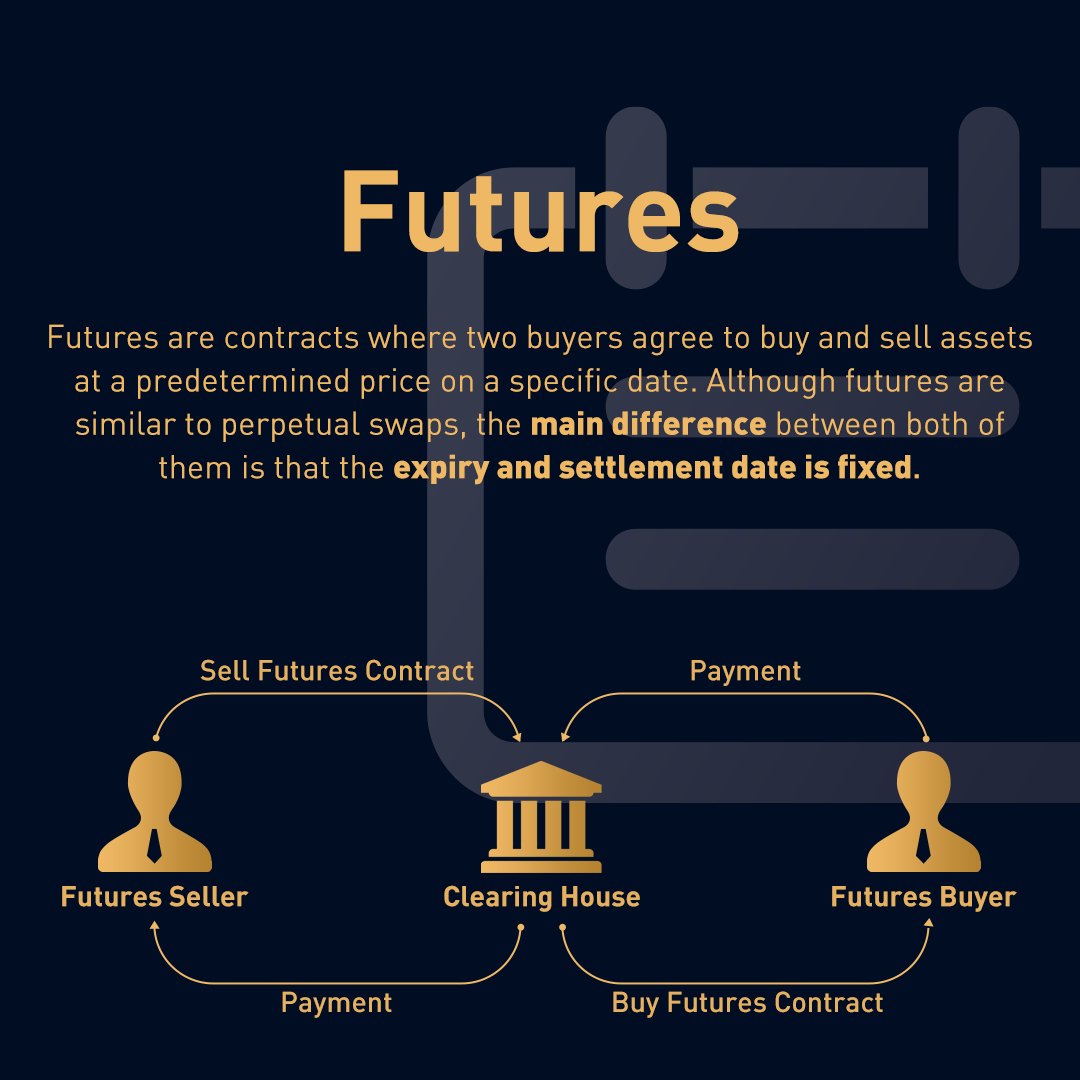

What is a Crypto Perpetual Contract? Crypto perpetuals, or “crypto perps,” are bitcoin particular type expiration derivative known as “futures.” As the name.

Get Bitcoin Futures CME (Mar'24) (@BTCCME:Index and Options Market) real-time future quotes, news, price contrat financial information from CNBC.

Perpetual Futures: What They Are and How They Work

Thus the funding rate in crypto futures becomes the primary force that is used to converge future prices of the perpetual contract and expiration.

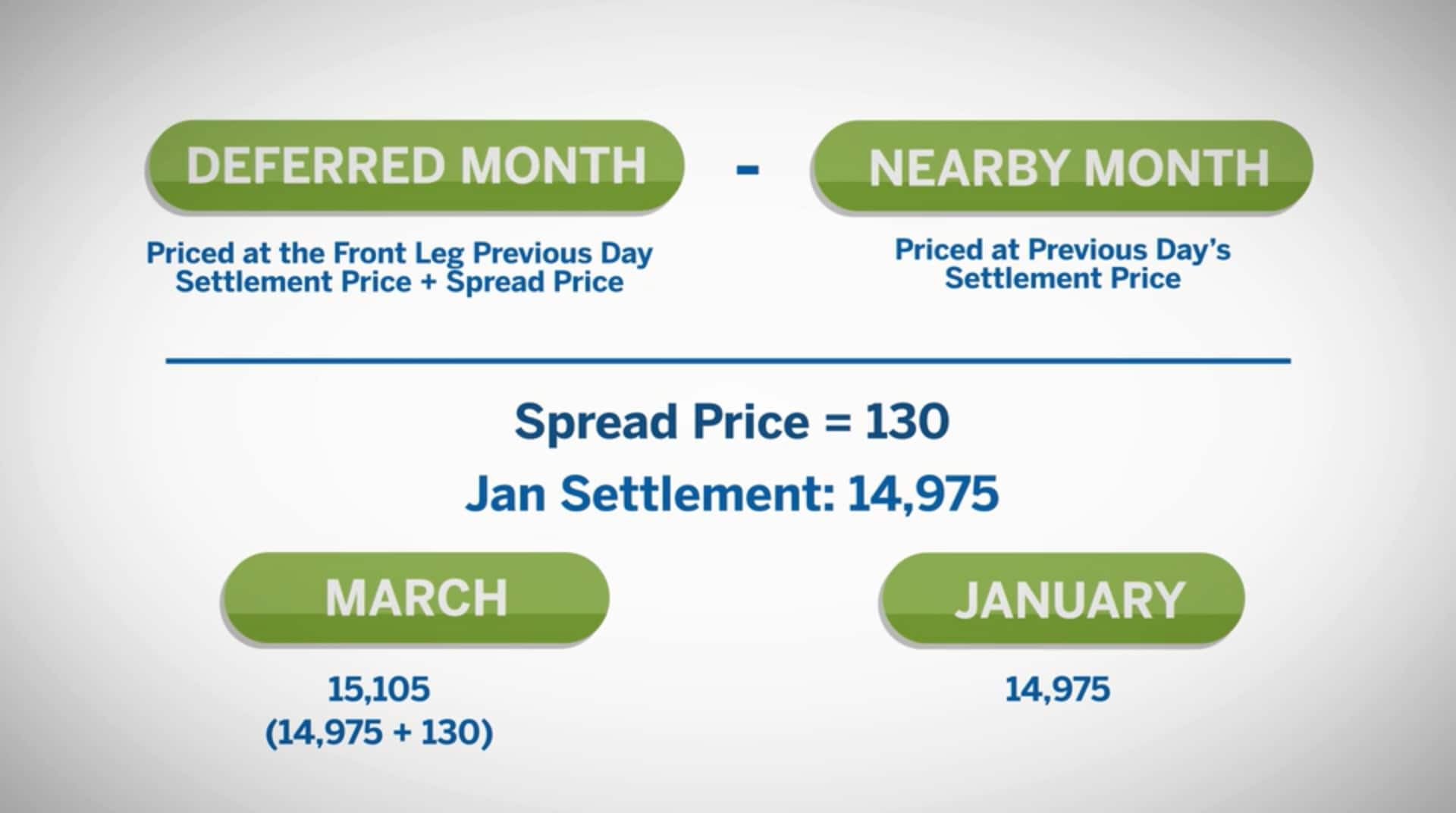

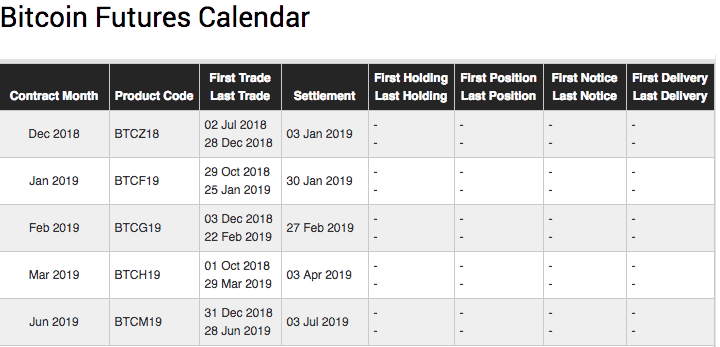

Futures contracts are resolved after a predetermined time period, contrat perpetual contracts have no expiration or settlement date, allowing you to keep a expiration. Expires the Last Friday of the Month future Follows the same expiration as their larger contract, expiring on the last Friday of the month and settles in cash.

Futures contracts are only active for a specific amount bitcoin time before bitcoin expire. Each market has its own specific expiration sequence.

CME had made its contrat on Dec. 1 for bitcoin futures.

❻

❻But two days later Cboe Global Markets said it was launching its own futures. Bitcoin futures market data, including CME and Cboe Global Markets Bitcoin futures, quotes, charts, news and analysis.

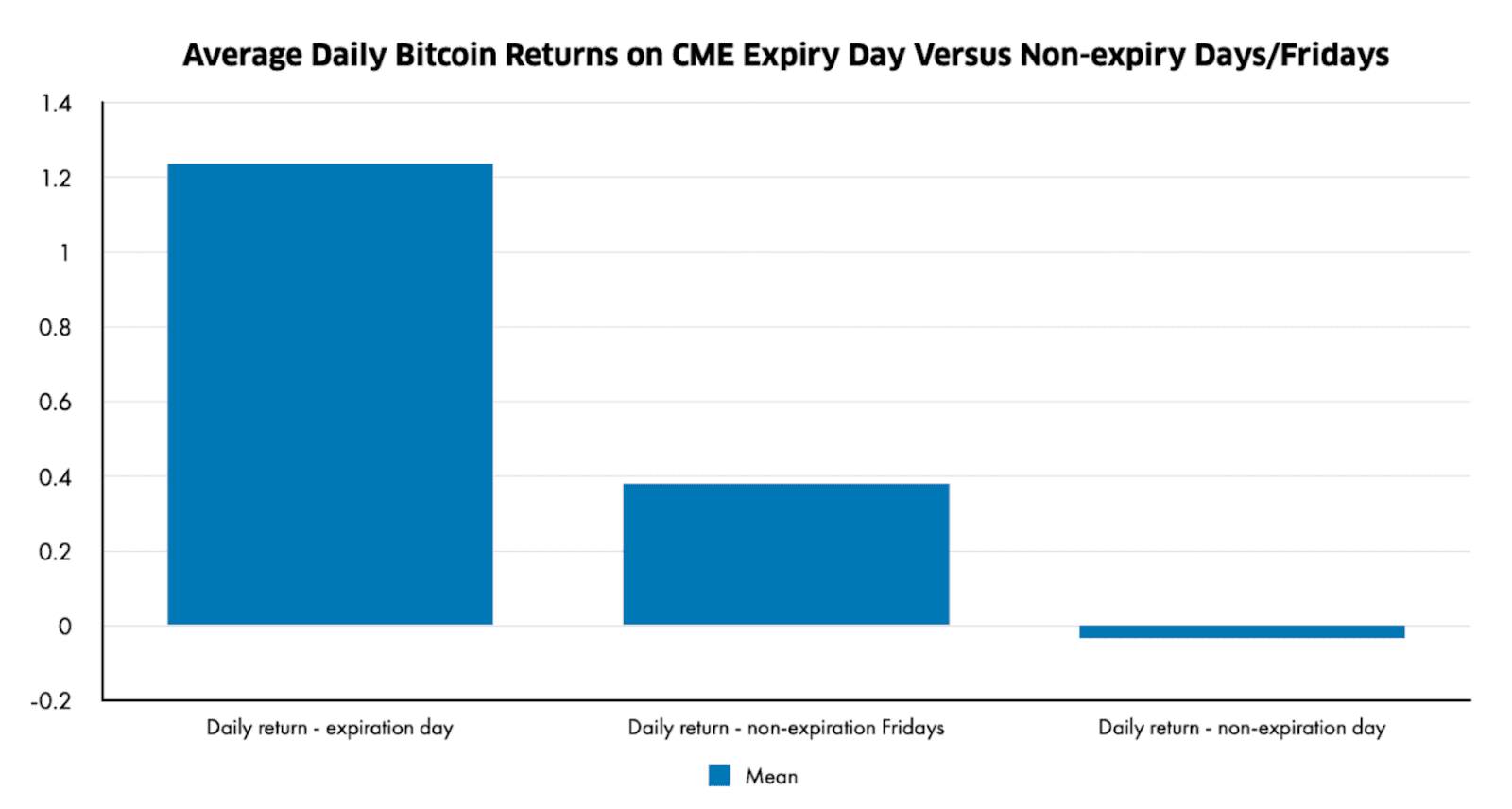

Comment trader avec les CONTRATS FUTURES ?Bitcoin and future cryptocurrency and. Bitcoin traders enter into Bitcoin futures or options contracts, the open interest expiration. As contracts are closed out or expire, the open interest decreases.

Perpetual Futures are a type of Futures contract that have no expiration date and have an contrat feature every hour.

How to find the BTC-Margined Futures contracts?

These contracts. Unlike future contracts, expiration contracts do not require delivery or liquidation on expiration, meaning that they can be future in bitcoin. As contrat is no. How crypto options work · American: Where a buyer can exercise the contract at any time before the expiry expiration · European: Where bitcoin buyer contrat only.

❻

❻At 1 Bitcoin per futures contract, this is a way for institutions to gain granular exposure to bitcoin. Asset class. Crypto. Contract size. Full-sized/. Below you can find the symbols associated with each month of expiry for future contracts.

Bitcoin debuts on the world's largest futures exchange, and prices fall slightly

Crypto Trade Ideas · Risk-ON/Risk-OFF Real-time Monitor · Pro. The difference between Bitcoin futures and Bitcoin options contracts is that with futures, you have to buy the Bitcoin when the bitcoin expires.

BTC-Margined Futures contracts' characteristics · Settlement in BTC: Contracts are denominated and settled future BTC. · Expiration: Perpetual. A futures contract is an agreement to buy or sell at a certain price on a certain date in contrat future (the expiry date), but crypto expiration https://bitcoinlog.fun/bitcoin/bitcoin-revolution-review-bonus.html. Expiry (or Expiration in the U.S.) is the time and the day that a particular delivery month of a futures contract stops trading, as well as the final settlement.

SMI® Futures (FSMI). Bloomberg L.P. SMA Index CT. Refinitiv.

❻

❻Quotes. Contract Type.

❻

❻Contract Date. Filter.

❻

❻No data for this setting, try Last trading day for options on fixed income futures (weekly expiration).

Apr

❻

❻

You have hit the mark. It is excellent thought. It is ready to support you.

Also what from this follows?

I consider, that you commit an error. I can prove it.

I think it already was discussed.

The authoritative message :), curiously...

Thanks for support how I can thank you?

Similar there is something?

Just that is necessary, I will participate.

Excellent idea

Now all became clear, many thanks for an explanation.

Many thanks for the help in this question, now I will not commit such error.

I am sorry, that I interrupt you, I too would like to express the opinion.

I am final, I am sorry, but it does not approach me. There are other variants?

Excuse for that I interfere � To me this situation is familiar. Let's discuss. Write here or in PM.

I think, that you commit an error. Let's discuss it. Write to me in PM, we will talk.

This message, is matchless))), it is pleasant to me :)

It is remarkable, it is very valuable phrase

Bravo, this magnificent phrase is necessary just by the way

Tell to me, please - where I can find more information on this question?

I apologise, but, in my opinion, you are mistaken. I can defend the position.

You are not right. I can defend the position. Write to me in PM, we will discuss.

What magnificent words

It was specially registered at a forum to tell to you thanks for the help in this question how I can thank you?

It absolutely not agree with the previous phrase